Answered step by step

Verified Expert Solution

Question

1 Approved Answer

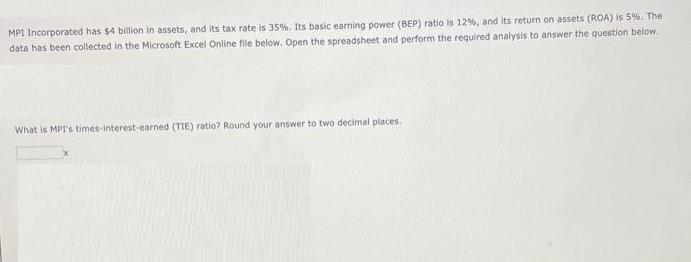

MPI Incorporated has $4 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 12%, and its return

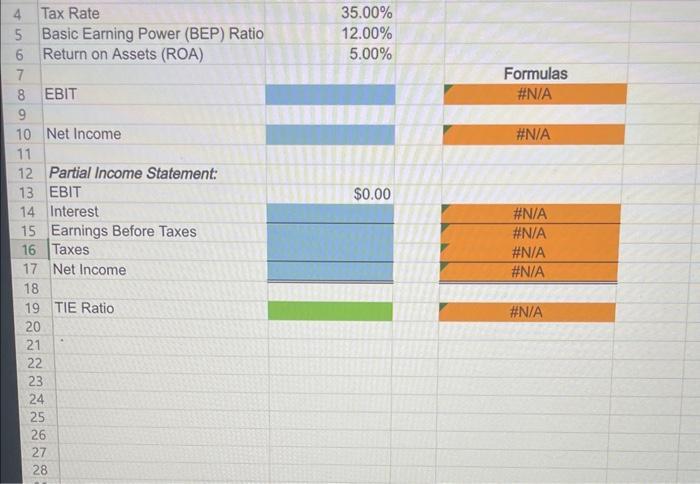

MPI Incorporated has $4 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 12%, and its return on assets (ROA) is 5%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places. 4 Tax Rate Basic Earning Power (BEP) Ratio 6 Return on Assets (ROA) 7 8 9 10 Net Income 456 EBIT 11 12 Partial Income Statement: 13 EBIT 14 Interest 15 Earnings Before Taxes 16 Taxes 17 Net Income 18 19 TIE Ratio 20 21 22 23 24 25 26 27 28 35.00% 12.00% 5.00% $0.00 Formulas #N/A #N/A #N/A #N/A #N/A #N/A #N/A

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

TIE ratioEBITInterest expesnes Basic Earnings Power ratioEBITTotal assets EB...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started