Answered step by step

Verified Expert Solution

Question

1 Approved Answer

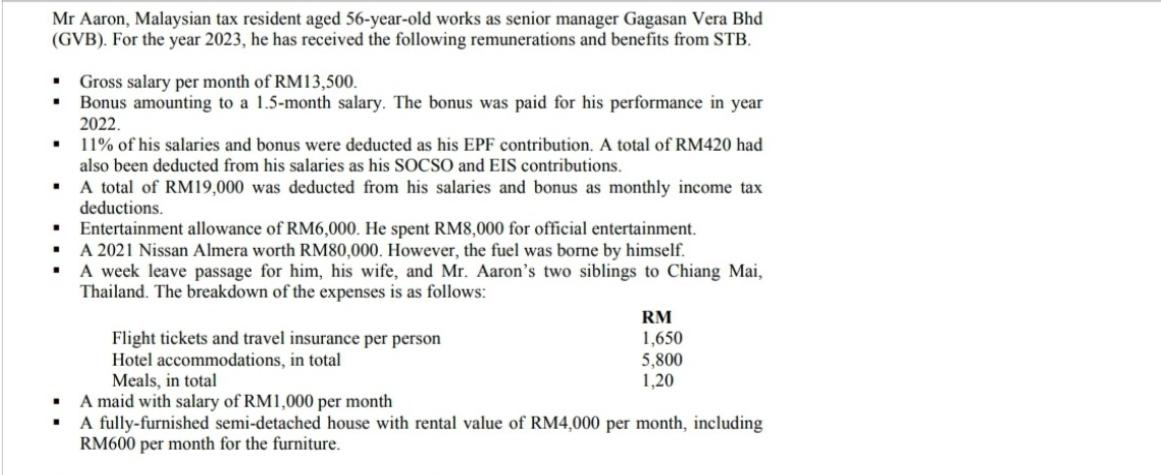

Mr Aaron, Malaysian tax resident aged 56-year-old works as senior manager Gagasan Vera Bhd (GVB). For the year 2023, he has received the following

Mr Aaron, Malaysian tax resident aged 56-year-old works as senior manager Gagasan Vera Bhd (GVB). For the year 2023, he has received the following remunerations and benefits from STB. . . . . . . Gross salary per month of RM13,500. Bonus amounting to a 1.5-month salary. The bonus was paid for his performance in year 2022. 11% of his salaries and bonus were deducted as his EPF contribution. A total of RM420 had also been deducted from his salaries as his SOCSO and EIS contributions. A total of RM19,000 was deducted from his salaries and bonus as monthly income tax deductions. Entertainment allowance of RM6,000. He spent RM8,000 for official entertainment. A 2021 Nissan Almera worth RM80,000. However, the fuel was borne by himself. A week leave passage for him, his wife, and Mr. Aaron's two siblings to Chiang Mai, Thailand. The breakdown of the expenses is as follows: Flight tickets and travel insurance per person Hotel accommodations, in total Meals, in total RM 1,650 5,800 1,20 A maid with salary of RM1,000 per month A fully-furnished semi-detached house with rental value of RM4,000 per month, including RM600 per month for the furniture. He is a member of IT professional body, a membership relevant to his current job. In year 2023, he paid RM250, the yearly membership fee. Required: Compute statutory income for Mr. Aaron for YA 2023 Please wait...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute Mr Aarons statutory income for Year of Assessment YA 2023 well take into account the remuneration and benefits he received as well as his v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started