Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Aldous is a big-time swindler. In one year he was able to earn P1 Million from his swindling activities. When the Commissioner of

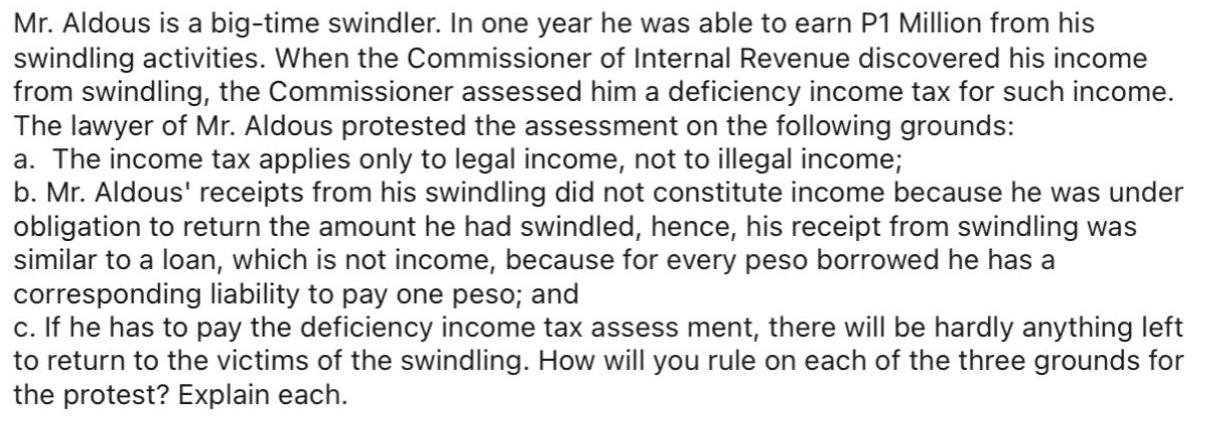

Mr. Aldous is a big-time swindler. In one year he was able to earn P1 Million from his swindling activities. When the Commissioner of Internal Revenue discovered his income from swindling, the Commissioner assessed him a deficiency income tax for such income. The lawyer of Mr. Aldous protested the assessment on the following grounds: a. The income tax applies only to legal income, not to illegal income; b. Mr. Aldous' receipts from his swindling did not constitute income because he was under obligation to return the amount he had swindled, hence, his receipt from swindling was similar to a loan, which is not income, because for every peso borrowed he has a corresponding liability to pay one peso; and c. If he has to pay the deficiency income tax assess ment, there will be hardly anything left to return to the victims of the swindling. How will you rule on each of the three grounds for the protest? Explain each.

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a The income tax law applies to all income whether it was earned legally or illegally There...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started