Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr and Ms Adams files a joint return, and both 67 years old. They have two children, one lives with the bio dad 60%

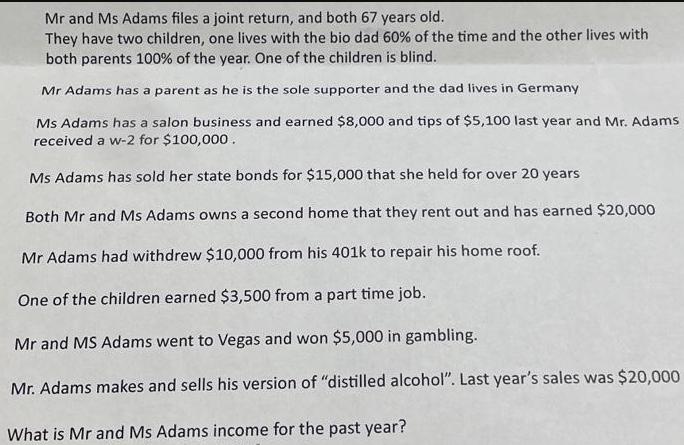

Mr and Ms Adams files a joint return, and both 67 years old. They have two children, one lives with the bio dad 60% of the time and the other lives with both parents 100% of the year. One of the children is blind. Mr Adams has a parent as he is the sole supporter and the dad lives in Germany Ms Adams has a salon business and earned $8,000 and tips of $5,100 last year and Mr. Adams received a w-2 for $100,000. Ms Adams has sold her state bonds for $15,000 that she held for over 20 years Both Mr and Ms Adams owns a second home that they rent out and has earned $20,000 Mr Adams had withdrew $10,000 from his 401k to repair his home roof. One of the children earned $3,500 from a part time job. Mr and MS Adams went to Vegas and won $5,000 in gambling. Mr. Adams makes and sells his version of "distilled alcohol". Last year's sales was $20,000 What is Mr and Ms Adams income for the past year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Mr and Ms Adams income for the past year we need to consider various sources of income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started