Mr. Anderson owns two rental buildings which had the following revenues and expenses in 2017 and the indicated U.C.C. at the beginning of the

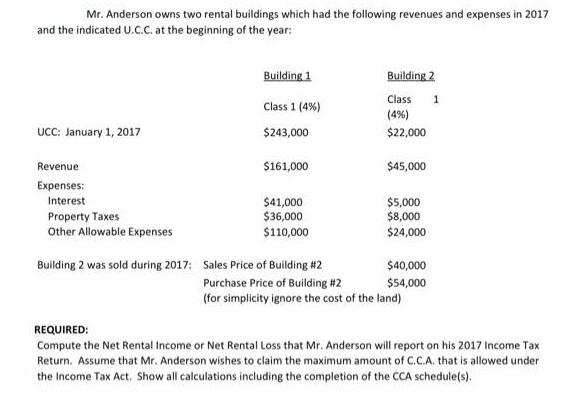

Mr. Anderson owns two rental buildings which had the following revenues and expenses in 2017 and the indicated U.C.C. at the beginning of the year: UCC: January 1, 2017 Revenue Expenses: Interest Property Taxes Other Allowable Expenses Building 2 was sold during 2017: Building 1 Class 1 (4%) $243,000 $161,000 $41,000 $36,000 $110,000 Building 2 Class 1 (4%) $22,000 $45,000 $5,000 $8,000 $24,000 Sales Price of Building #2 Purchase Price of Building #2 (for simplicity ignore the cost of the land) $40,000 $54,000 REQUIRED: Compute the Net Rental Income or Net Rental Loss that Mr. Anderson will report on his 2017 Income Tax Return. Assume that Mr. Anderson wishes to claim the maximum amount of C.C.A. that is allowed under the Income Tax Act. Show all calculations including the completion of the CCA schedule(s).

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

CALCULATION OF RENTAL INCOME OR LOSS OF BUILDING 1 Amount Reve...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started