Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Au, Mr Ho and Mr So have been carrying on a partnership (AHS Company) business in Hong Kong for many years. Before 1

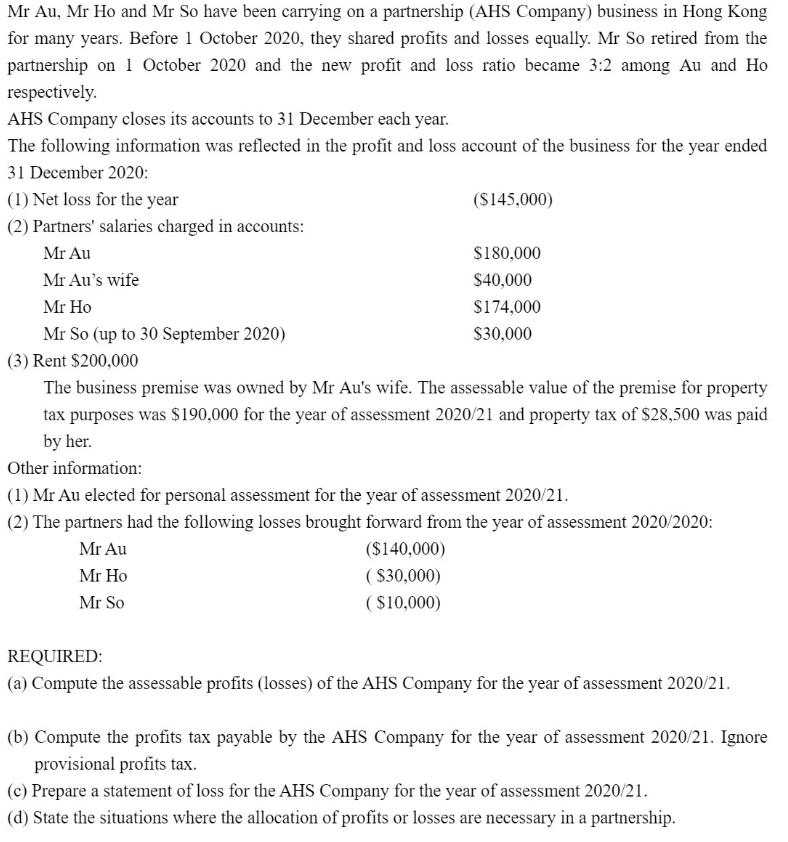

Mr Au, Mr Ho and Mr So have been carrying on a partnership (AHS Company) business in Hong Kong for many years. Before 1 October 2020, they shared profits and losses equally. Mr So retired from the partnership on 1 October 2020 and the new profit and loss ratio became 3:2 among Au and Ho respectively. AHS Company closes its accounts to 31 December each year. The following information was reflected in the profit and loss account of the business for the year ended 31 December 2020: (1) Net loss for the year (2) Partners' salaries charged in accounts: Mr Au Mr Au's wife Mr Ho Mr So (up to 30 September 2020) ($145,000) $180,000 $40,000 $174,000 $30,000 (3) Rent $200,000 The business premise was owned by Mr Au's wife. The assessable value of the premise for property tax purposes was $190,000 for the year of assessment 2020/21 and property tax of $28,500 was paid by her. Other information: (1) Mr Au elected for personal assessment for the year of assessment 2020/21. (2) The partners had the following losses brought forward from the year of assessment 2020/2020: Mr Au Mr Ho ($140,000) ($30,000) ($10,000) Mr So REQUIRED: (a) Compute the assessable profits (losses) of the AHS Company for the year of assessment 2020/21. (b) Compute the profits tax payable by the AHS Company for the year of assessment 2020/21. Ignore provisional profits tax. (c) Prepare a statement of loss for the AHS Company for the year of assessment 2020/21. (d) State the situations where the allocation of profits or losses are necessary in a partnership.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To compute the assessable profits losses of the AHS Company for the year of assessment 202021 we need to make the following adjustments to the net l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started