Question

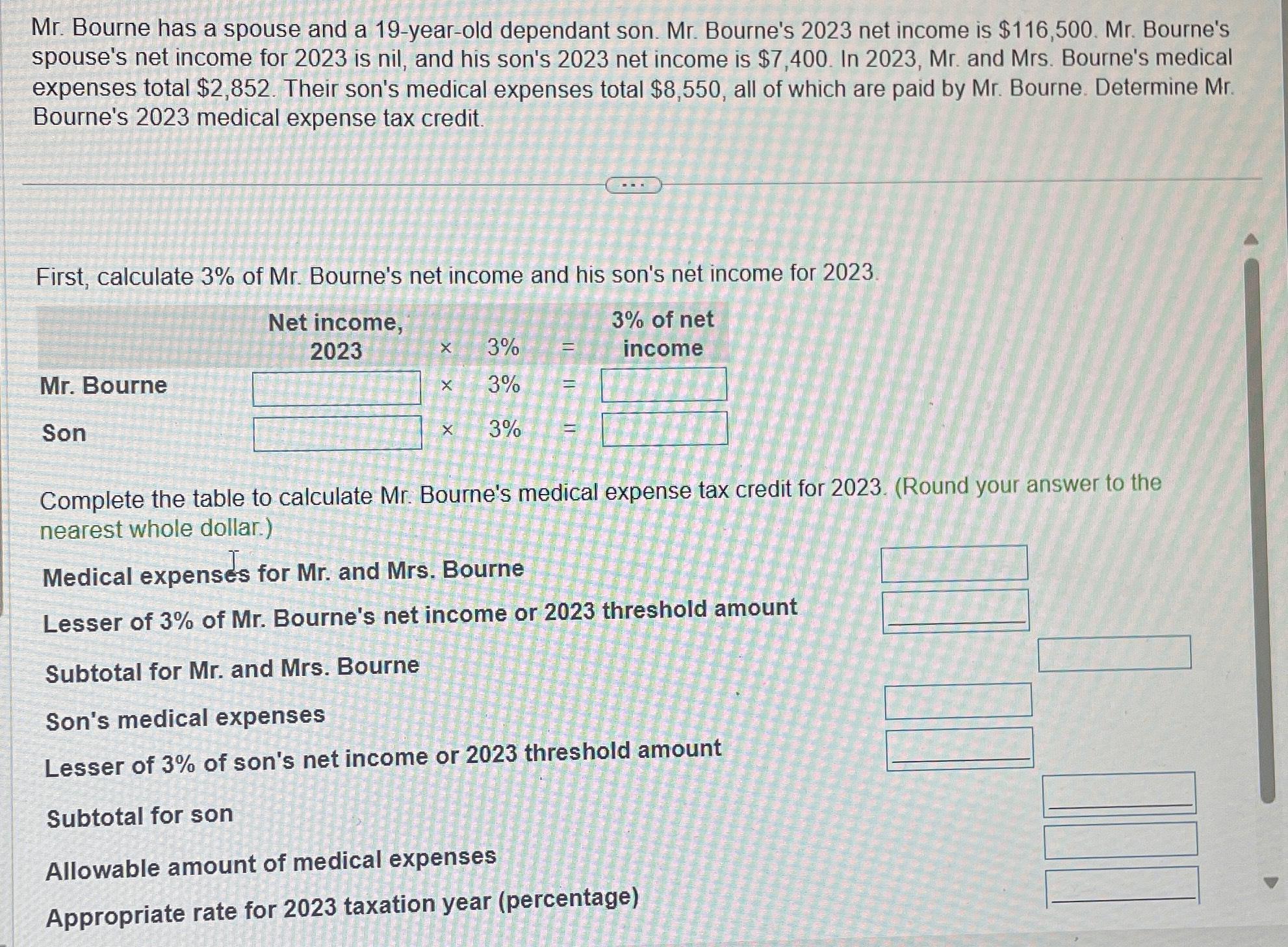

Mr. Bourne has a spouse and a 19-year-old dependant son. Mr. Bourne's 2023 net income is $116,500 . Mr. Bourne's spouse's net income for 2023

Mr. Bourne has a spouse and a 19-year-old dependant son. Mr. Bourne's 2023 net income is

$116,500. Mr. Bourne's spouse's net income for 2023 is nil, and his son's 2023 net income is $7,400. In 2023, Mr. and Mrs. Bourne's medical expenses total

$2,852. Their son's medical expenses total

$8,550, all of which are paid by Mr. Bourne. Determine Mr. Bourne's 2023 medical expense tax credit.\ First, calculate

3%of Mr. Bourne's net income and his son's net income for 2023\ Complete the table to calculate Mr. Bourne's medical expense tax credit for 2023. (Round your answer to the nearest whole dollar.)\ Medical expenses for Mr. and Mrs. Bourne\ Lesser of

3%of Mr. Bourne's net income or 2023 threshold amount\ Subtotal for Mr. and Mrs. Bourne\ Son's medical expenses\ Lesser of

3%of son's net income or 2023 threshold amount\ Subtotal for son\ Allowable amount of medical expenses\ Appropriate rate for 2023 taxation year (percentage)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started