Question: Mr. Brian Krzanich was preparing for his new role as Intel's CEO that would start in May 2013.Impressed with your growing knowledge of strategic management,

Mr. Brian Krzanich was preparing for his new role as Intel's CEO that would start in May 2013.Impressed with your growing knowledge of strategic management, Mr. Krzanich had asked you to assist him in assessing the microprocessor industry, Intel's resources, capabilities, and strategy, and the firm's options for future success. With this in mind, you had been requested to complete the following tasks in your presentation by applying what you have learned in this course. Considering that Mr. Krzanich was Intel's COO before being promoted to the CEO, he did not expect to hear background information about the company.

- Analysis of External Environment. First, analyze the structure of the microprocessor industry from the industry's perspective using the Five Forces Model. Make sure you conclude the average profitability of microprocessor manufacturers based on your assessment of the magnitude of the threats (e.g., strong, medium, weak) from the five forces. Second, identify the greatest threat and opportunity that you believe microprocessor manufacturers may face from their external environment going forward.

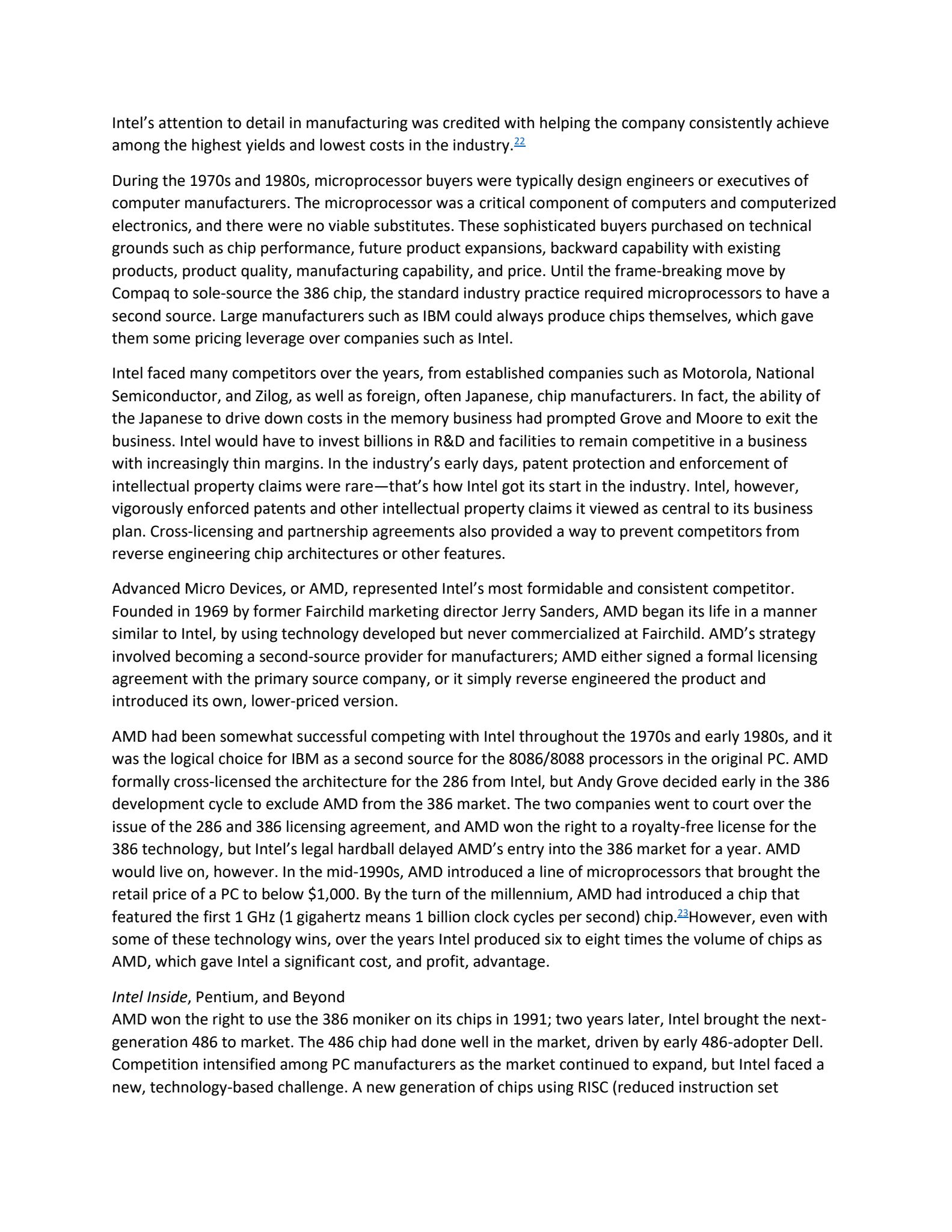

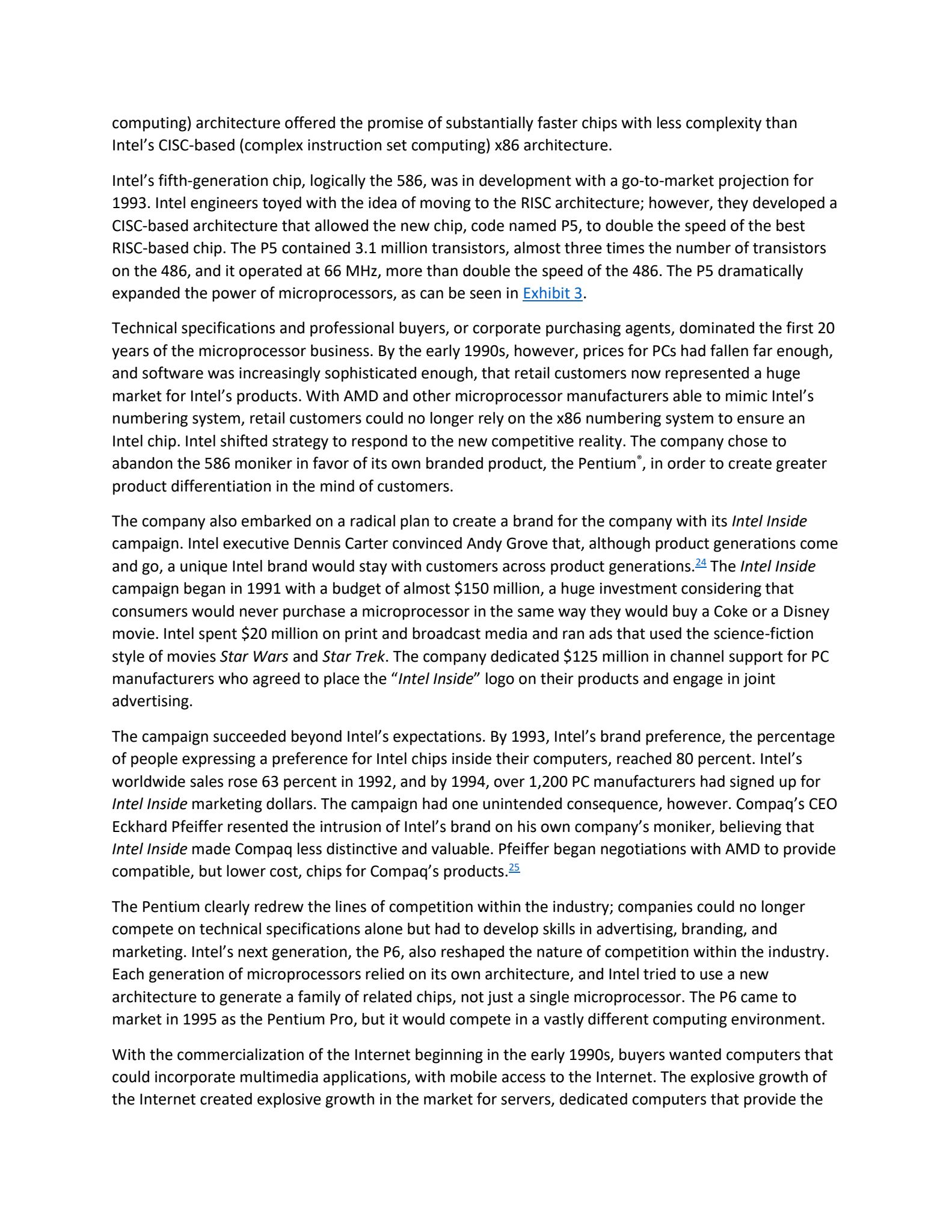

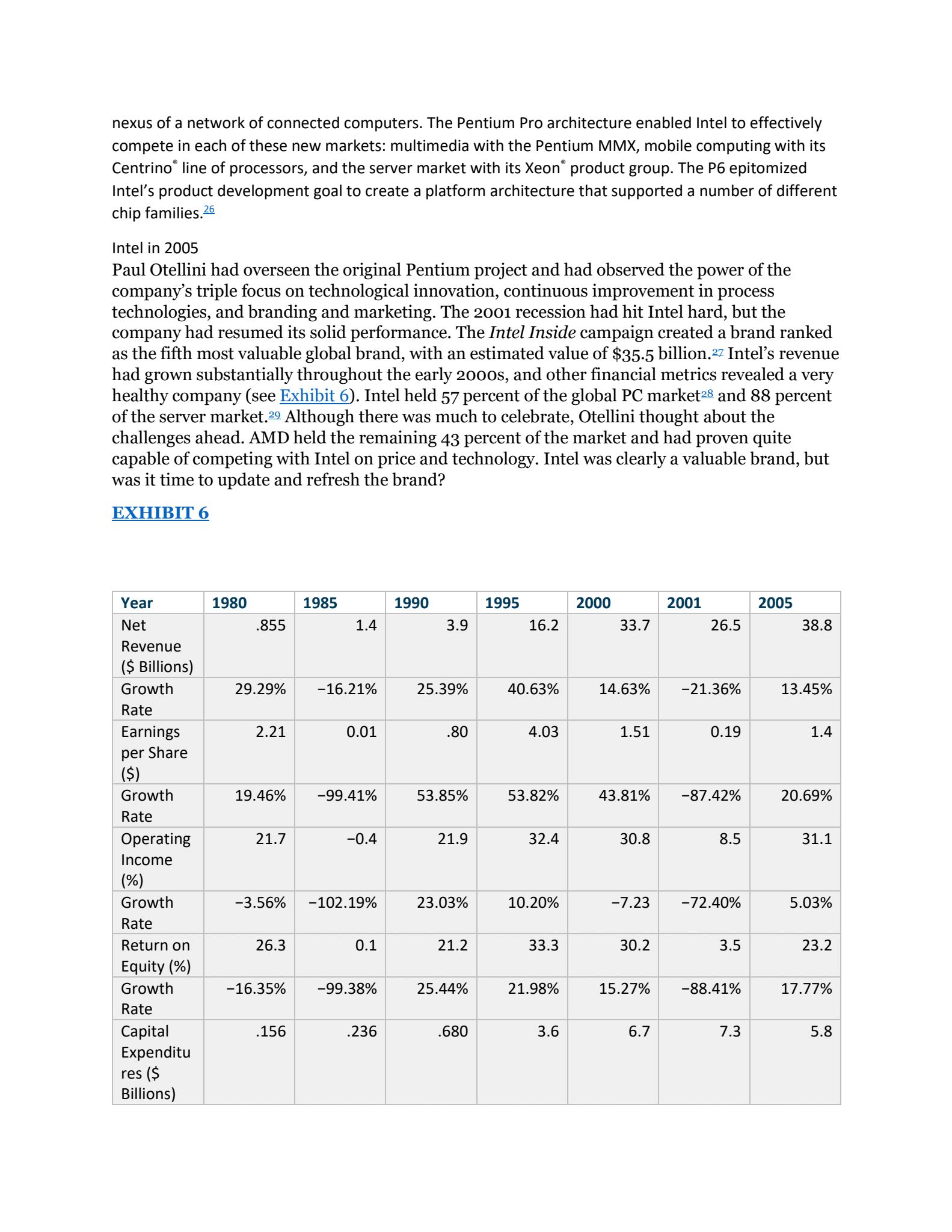

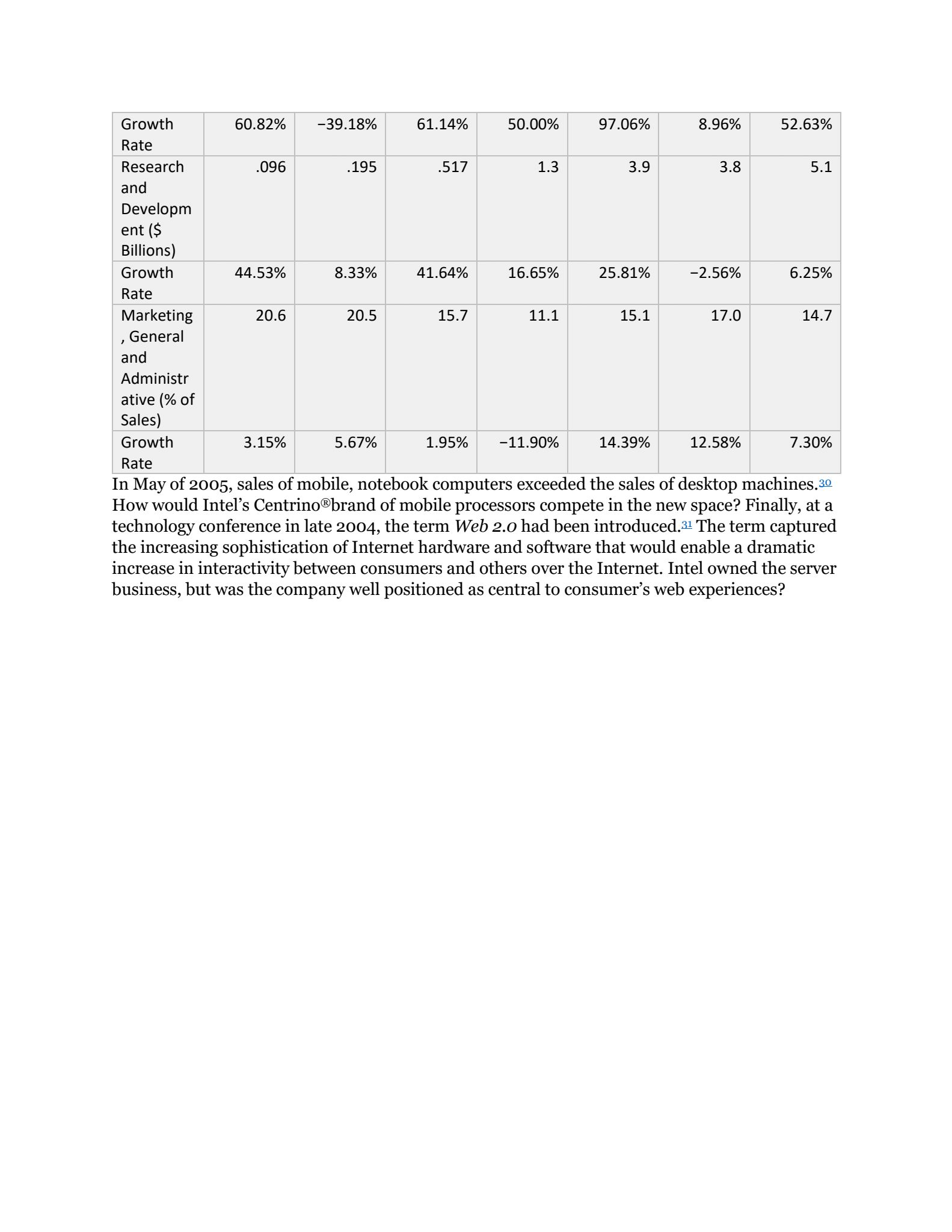

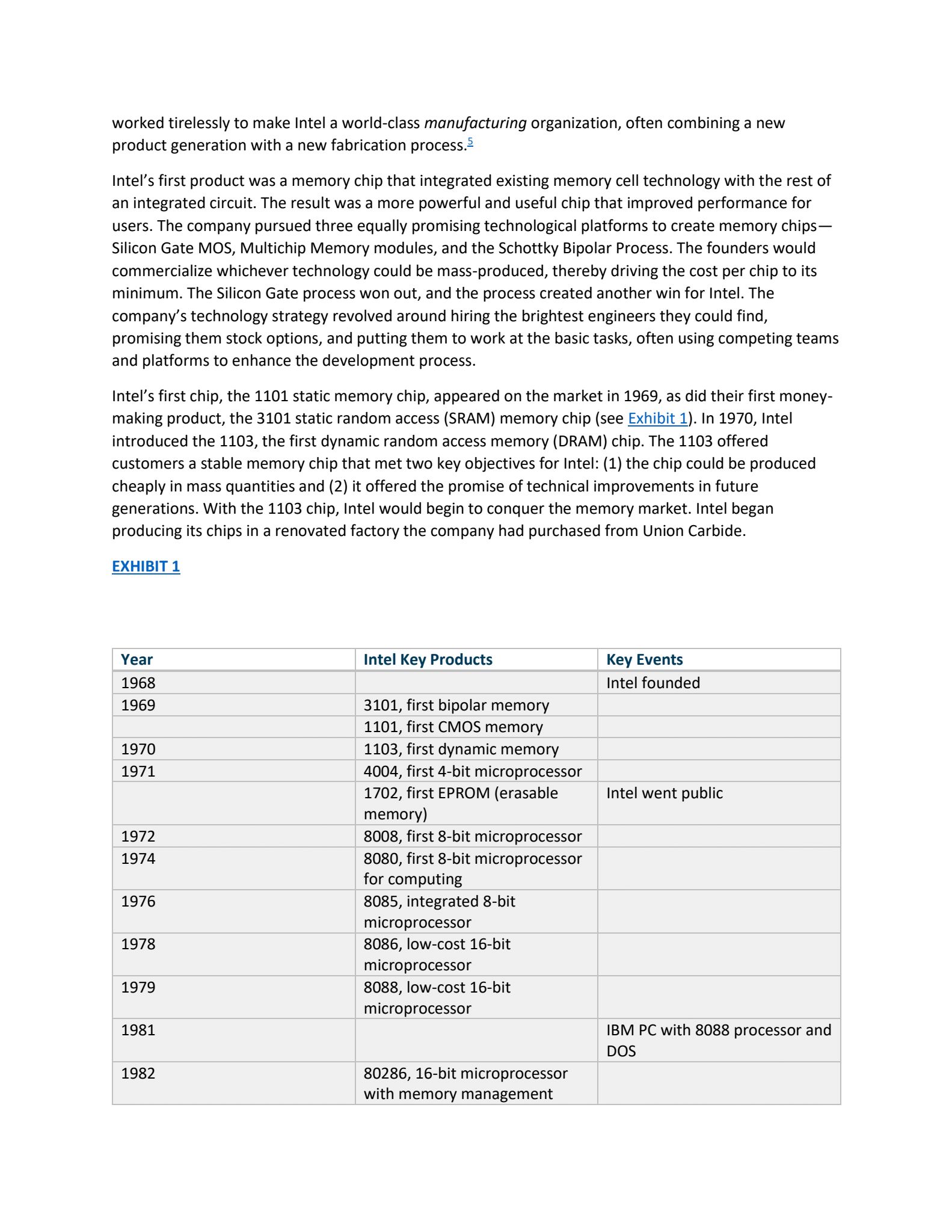

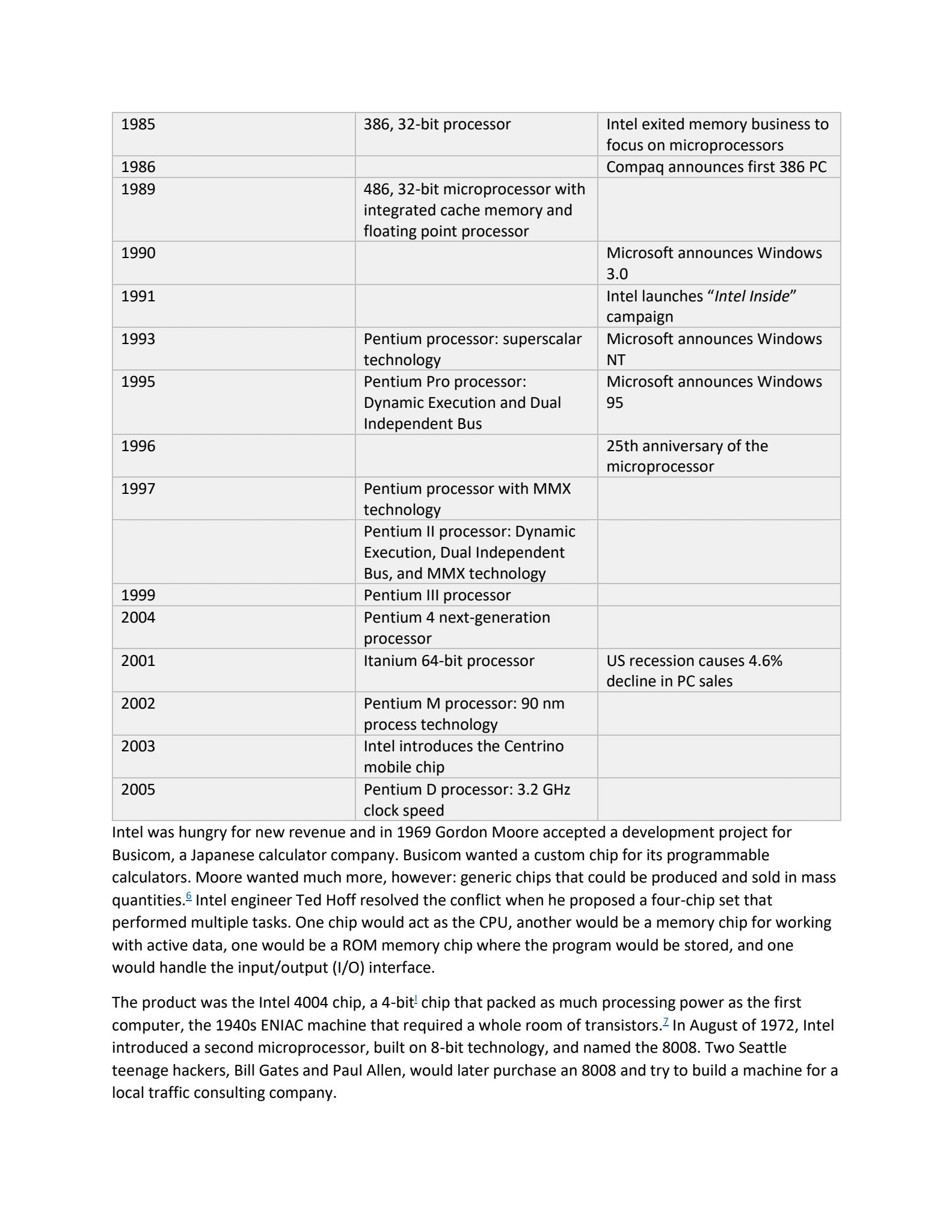

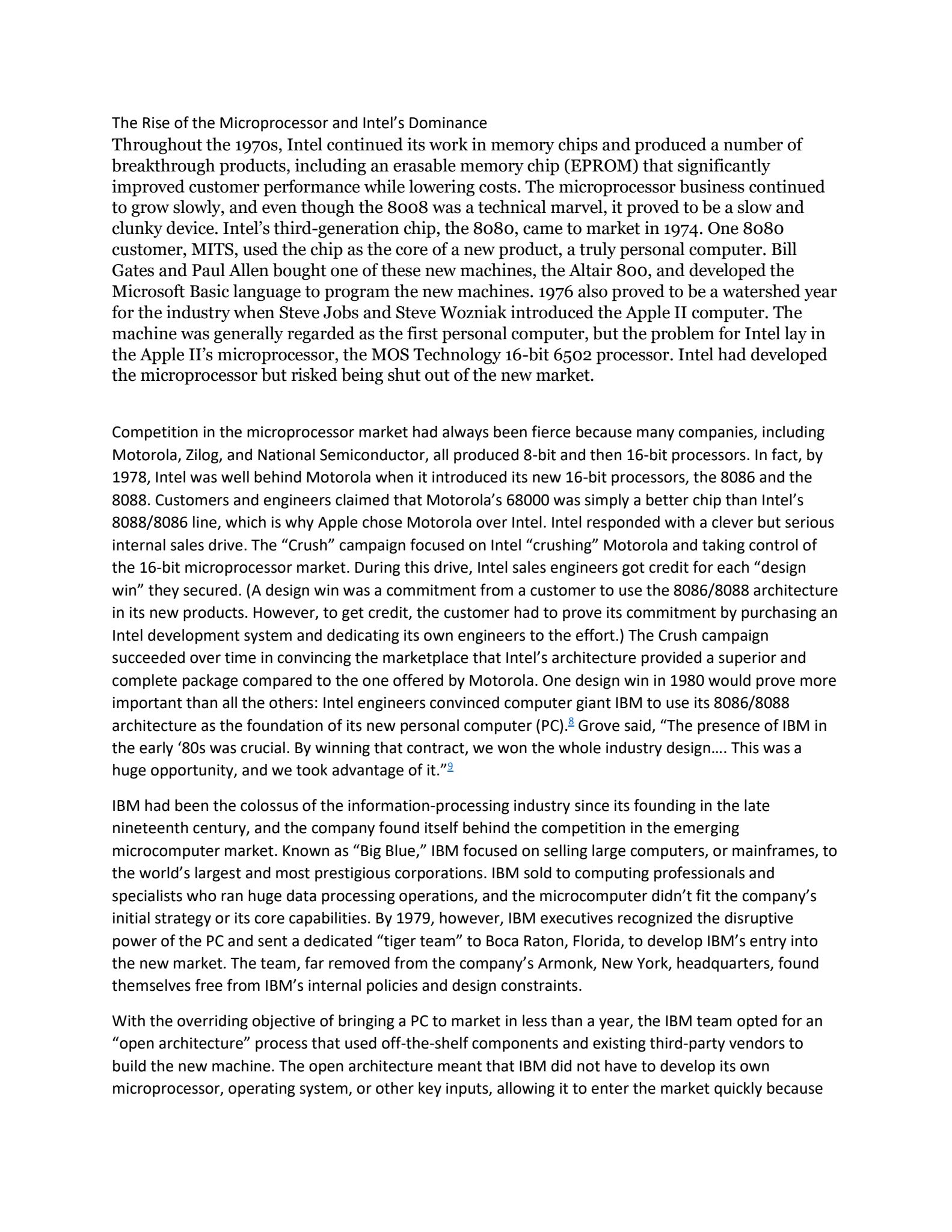

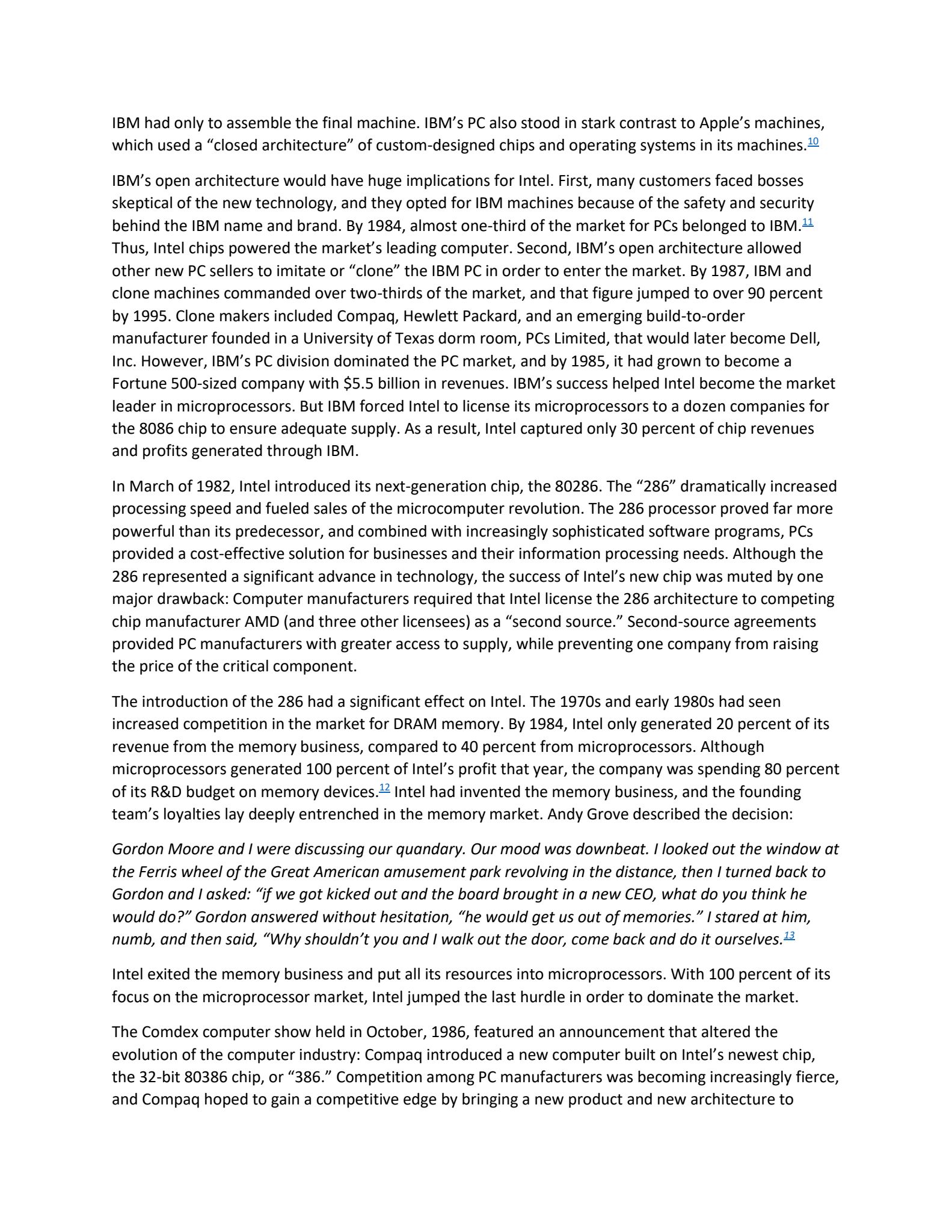

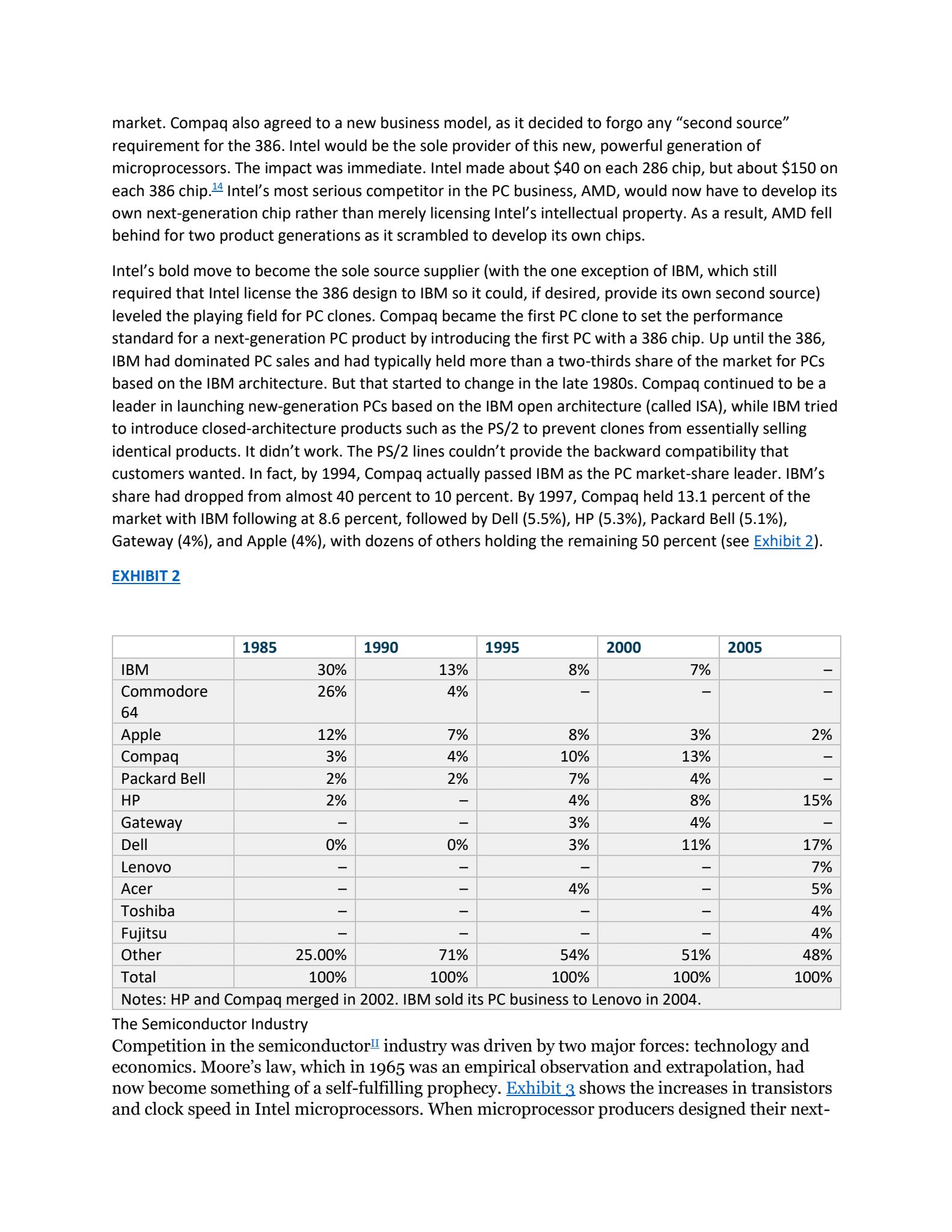

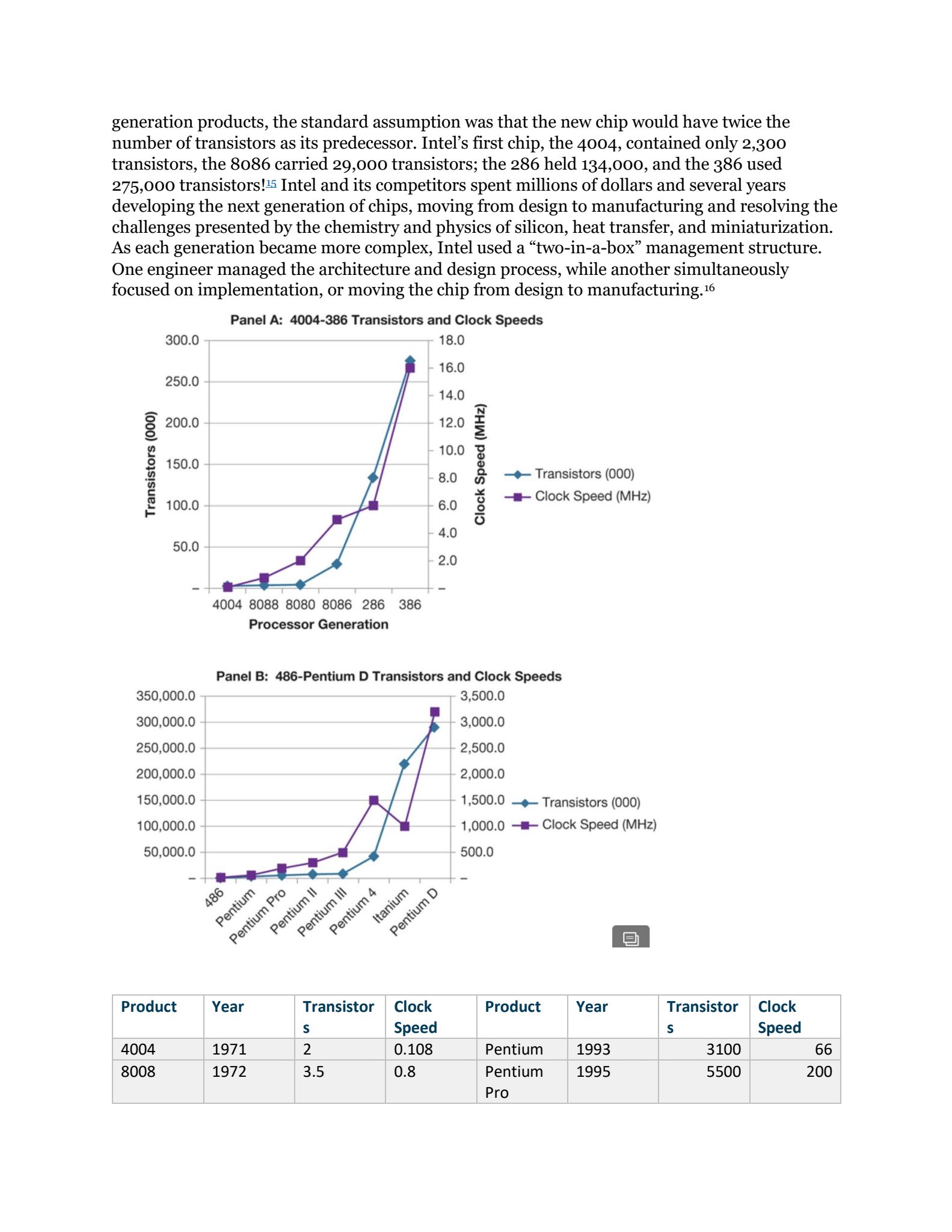

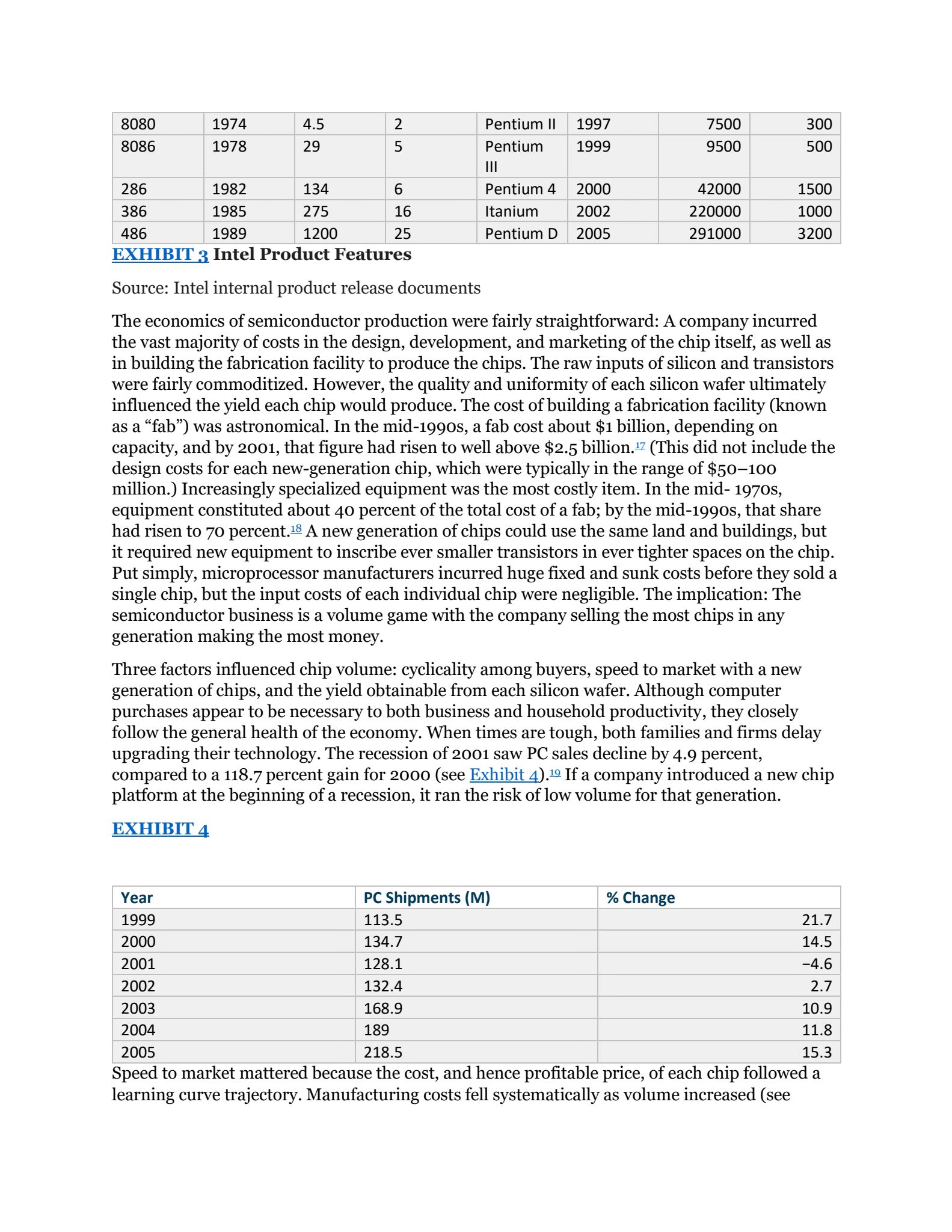

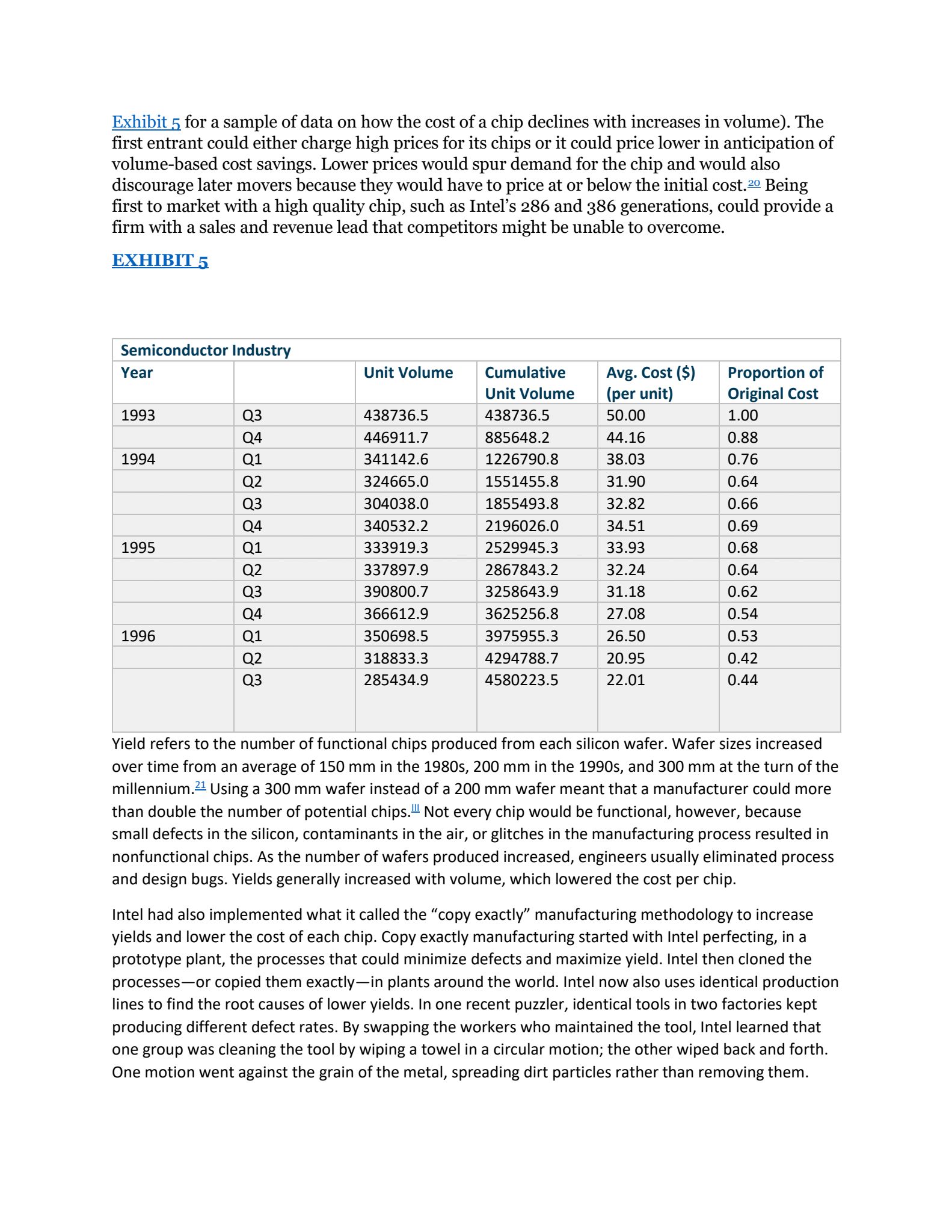

ONLINE CASE Intel (A): Dominance in Microprocessors Paul Otellini gazed out the window of his new office at Intel's headquarters and was struck by how much Silicon Valley, Intel Corporation, and he had changed. San Jose and the surrounding communities were no longer the sleepy towns of orchards they had been when he began at Intel in 1974. Intel had evolved from a cutting-edge memory company into a dominant player in the computer industry value chain. Otellini also had moved from a functional staff position in finance through a number of operating and marketing roles to become the first nonengineer to serve as Intel's CEO. His tenure included roles as the general manager of Intel's Architecture Group and Microprocessor Products Group, where he led the introduction of the Pentium chip that redefined the company in the early 1990s.- As Otellini pondered those significant changes since 1974, he wondered what Intel would need to make to maintain its position of industry leadership in microprocessors and how should he respond. Intel: The Early Days The beginning of Intel Corporation (NASDAQ symbol: INTC), arguably one of Silicon Valley's dominant and most successful companies in the mid-2000s, differed from the mythical founding of Hewlett Packard in a garage or the youthful exuberance of Apple's Steve Jobs and Steve Wozniak. When Robert Noyce and Gordon Moore formed Intel, they were already in middle age, were considered experts in their field, and raised over $2 million in start-up capital in one afternoon.- Noyce had been one of the inventors of the integrated circuit, and Moore was a talented, visionary engineer and problem solver. It was Moore who noted in 1965 that every 18-24 months the number of transistors placed on an integrated circuit would double. Dubbed "Moore's Law," this prediction had driven competition and strategy in the industry since its inception. In fact, experts predicted the rate of doubling would continue well into the 2020s.3 Intel was not the first entrepreneurial venture for Noyce or Moore; the two had helped found Schockley Labs in 1956, and they had bolted Shockley a year later as members of the "traitorous eight" that founded Fairchild Semiconductors. Fairchild had operated for over a decade as a subsidiary of the Fairchild Camera and Instrument Corporation, an East Coast manufacturing company. The corporate parent never truly understood the semiconductor business, and corporate policies meant that emerging and lucrative technological advances, often designed by Moore and his team, were not exploited. Noyce and Moore founded Intel with two goals: to work with and commercialize high quality, exciting new technologies and to make money. On Moore's office wall hung a plaque that said, "this is a profit making organization. That's the way we intended it ... and that's the way it is." Intel's culture, operating policies, and competitive position built on Moore and Noyce's fascination with great semiconductor technology. However, their first hire, Andy Grove, would have equal, if not greater, influence on Intel's culture and capabilities. Grove was born in Hungary as Andras Grof, but he Americanized his name shortly after arriving in the United States in 1957. He earned a PhD in chemical engineering from UC Berkley in 1963 and worked with Noyce and Moore at Fairchild. Grove joined the company as Director of Operations; he became the COO shortly thereafter and CEO upon Moore's retirement in 1987. Grove's fanatical attention to detail, his penchant for disciplined, data-driven action and conduct, and his style of constructive conformation soon permeated the company, its operations, and its processes. Despite the company's technological prowess in engineering and innovation, GroveIntel's attention to detail in manufacturing was credited with helping the company consistently achieve among the highest yields and lowest costs in the industry.2 During the 19709 and 19805, microprocessor buyers were typically design engineers or executives of computer manufacturers. The microprocessor was a critical component of computers and computerized electronics, and there were no viable substitutes. These sophisticated buyers purchased on technical grounds such as chip performance, future product expansions, backward capability with existing products, product quality, manufacturing capability, and price. Until the framebreaking move by Compaq to sole-source the 386 chip, the standard industry practice required microprocessors to have a second source. Large manufacturers such as IBM could always produce chips themselves, which gave them some pricing leverage over companies such as Intel. Intel faced many competitors over the years, from established companies such as Motorola, National Semiconductor, and Ziiog, as well as foreign, often Japanese, chip manufacturers. In fact, the ability of the Japanese to drive down costs in the memory business had prompted Grove and Moore to exit the business. Intel would have to invest billions in R&D and facilities to remain competitive in a business with increasingly thin margins. In the industry's early days, patent protection and enforcement of intellectual property claims were rarethat's how Intel got its start in the industry. Intel, however, vigorously enforced patents and other intellectual property claims It viewed as central to its business plan. Cross-licensing and partnership agreements also provided a way to prevent competitors from reverse engineering chip architectures or other features. Advanced Micro Devices, or AMD, represented intel's most formidable and consistent competitor. Founded in 1969 by former Fairchild marketing director Jerry Sanders, AMD began its life in a manner similar to Intel, by using technology developed but never commercialized at Fairchild. AMD's strategy involved becoming a second-source provider for manufacturers; AMD either signed a formal licensing agreement with the primary source company, or it simply reverse engineered the product and introduced its own, lowerpriced version. AMD had been somewhat successful competing with Intel throughout the 19705 and early 19805, and it was the logical choice for IBM as a second source for the 8086/8088 processors in the original PC. AMD formally cross-licensed the architecture for the 286 from Intel, but Andy Grove decided early in the 386 development cycle to exclude AMD from the 386 market. The two companies went to court over the issue of the 286 and 386 licensing agreement, and AMD won the right to a royalty-free license for the 386 technology, but Intel's legal hardball delayed AMD's entry into the 386 market for a year. AMD would live on, however. In the mid-19905, AMD introduced a line of microprocessors that brought the retail price of a PC to below $1,000. By the turn ofthe millennium, AMD had introduced a chip that featured the first 1 GHz (1 gigahertz means 1 billion clock cycles per second) chipHowever, even with some of these technology wins, over the years Intel produced six to eight times the volume of chips as AMD, which gave Intel a significant cost, and profit, advantage. Intel Inside, Pentium, and Beyond AMD won the right to use the 386 moniker on its chips in 1991; two years later, Intel brought the next generation 486 to market. The 486 chip had done well in the market, driven by early 486-adopter Dell. Competition intensified among PC manufacturers as the market continued to expand, but intel faced a new, technology-based challenge. A new generation of chips using RISC {reduced instruction set computing) architecture offered the promise of substantially faster chips with less complexity than Intel's CISC-based (complex instruction set computing) x86 architecture. Intel's fifth-generation chip, logically the 586, was in development with a go-to-market projection for 1993. Intel engineers toyed with the idea of moving to the RISC architecture; however, they developed a CISCbased architecture that allowed the new chip, code named P5, to double the speed of the best RISC-based chip. The P5 contained 3.1 million transistors, almost three times the number of transistors on the 486, and it operated at 66 MHz, more than double the speed of the 486. The P5 dramatically expanded the power of microprocessors, as can be seen in Exhibit 3. Technical specifications and professional buyers, or corporate purchasing agents, dominated the first 20 years of the microprocessor business. By the early 19903, however, prices for PCs had fallen far enough, and software was increasingly sophisticated enough, that retail customers now represented a huge market for Intel's products. With AMD and other microprocessor manufacturers able to mimic Intel's numbering system, retail customers could no longer rely on the x86 numbering system to ensure an Intel chip. Intel shifted strategy to respond to the new competitive reality. The company chose to abandon the 586 moniker in favor of its own branded product, the Pentium', in order to create greater product differentiation in the mind of customers. The company also embarked on a radical plan to create a brand for the company with its Intel Inside campaign. Intel executive Dennis Carter convinced Andy Grove that, although product generations come and go, a unique Intel brand would stay with customers across product generations?4 The Intel Inside campaign began in 1991 with a budget of almost $150 million, a huge investment considering that consumers would never purchase a microprocessor in the same way they would buy a Coke or a Disney movie. Intel spent $20 million on print and broadcast media and ran ads that used the sciencefiction style of movies Star Wars and Star Trek. The company dedicated $125 million in channel support for PC manufacturers who agreed to place the \"lntei inside" logo on their products and engage in joint advertising. The campaign succeeded beyond Intel's expectations. By 1993, Intel's brand preference, the percentage of people expressing a preference for Intel chips inside their computers, reached 80 percent. Intel's worldwide sales rose 63 percent in 1992, and by 1994, over 1,200 PC manufacturers had signed up for intel inside marketing dollars. The campaign had one unintended consequence, however. Compaq's CEO Eckhard Pfeiffer resented the intrusion of Intel's brand on his own company's moniker, believing that intei inside made Compaq less distinctive and valuable. Pfeiffer began negotiations with AMD to provide compatible, but lower cost, chips for Compaq's products?5 The Pentium clearly redrew the lines of competition within the industry; companies could no longer compete on technical specifications alone but had to develop skills in advertising, branding, and marketing. Intel's next generation, the P6, also reshaped the nature of competition within the industry. Each generation of microprocessors relied on its own architecture, and Intel tried to use a new architecture to generate a family of related chips, not just a single microprocessor. The P6 came to market in 1995 as the Pentium Pro, but it would compete in a vastly different computing environment. With the commercialization of the Internet beginning in the early 19905, buyers wanted computers that could incorporate multimedia applications, with mobile access to the Internet. The explosive growth of the Internet created explosive growth in the market for servers, dedicated computers that provide the nexus of a network of connected computers. The Pentium Pro architecture ena bEed Intel to effectively compete in each of these new markets: multimedia with the Pentium MMX, mobile computing with its Centrino' line of processors, and the server market with its Xeon' product group. The P6 epitomized Intel's product development goal to create a platform architecture that supported a number of different chip families Intel in 2005 Paul Otellini had overseen the original Pentium project and had observed the power of the companfs triple focus on technological innovation, continuous improvement in process technologies, and branding and marketing. The 2001 recession had hit Intel hard, but the company had resumed its solid performance. The Intel Inside campaign created a brand ranked as the fth most valuable global brand, with an estimated value of $35.5 billion.g2 Intel's revenue had grown substantially throughout the early 2000s, and other nancial metrics revealed a very healthy company (see Exhibit 6). Intel held 57 percent of the global PC market28 and 88 percent of the server market.g9 Although there was much to celebrate, Otellini thought about the challenges ahead. AMD held the remaining 43 percent of the market and had proven quite capable of competing with Intel on price and technology. Intel was clearly a valuable brand, but was it time to update and refresh the brand? EXHIBIT 6 1995 2000 __m_m_ Revenue (S Billions) .- Rate Earnings . . . 1.4 per Share (5) G rowth Rate Operating Income (96) Growth . 402.19% Rate Return on Equity (96) Growth Rate Capital . . . . .7 7.3 Expenditu res (5 Billions) 60.82% 39.18% 6114% 50 00% 97.06% 8.96% 52 53% Rate Research .195 .517 1.3 3.8 and Developm ent (S Billions) Growth 44.53% 8.33% 41.64% Rate Marketing 20.6 20.5 , General and Administr ative (% of Sales) Growth 3.15% 5.67% Rate 5.1 16.65% 25.81% -2.56% 6.25% - 170 12.58% In May of 2005, sales of mobile, notebook computers exceeded the sales of desktop machines How would Intel's Centrin0brand of mobile processors compete in the new space? Finally, at a technology conference in late 2004, the term Web 2.0 had been introduced.1L1 The term captured the increasing sophistication of Internet hardware and software that would enable a dramatic increase in interactivity between consumers and others over the Internet. Intel owned the server business, but was the company well positioned as central to consumer's web experiences? worked tirelessly to make Intel a worldclass manufacturing organization, often combining a new product generation with a new fabrication process. Intel's rst product was a memory chip that integrated existing memory cell technology with the rest of an integrated circuit. The result was a more powerful and useful chip that improved performance for users. The company pursued three equally promising technological platforms to create memory chips Silicon Gate MOS, Multichip Memory modules, and the Schottky Bipolar Process. The founders would commercialize whichever technology could be massproduced, thereby driving the cost per chip to its minimum. The Silicon Gate process won out, and the process created another win for Intel. The com pany's technology strategy revolved around hiring the brightest engineers they could find, promising them stock options, and putting them to work at the basic tasks, often using competing teams and platforms to enhance the development process. Intel's rst chip, the 1101 static memory chip, appeared on the market in 1969, as did their first money making product, the 3101 static random access (SRAM) memory chip (see Exhibit 1). In 1970, Intel introduced the 1103, the first dynamic random access memory (DRAM) chip. The 1103 offered customers a stable memory chip that met two key objectives for Intel: (1) the chip could be produced cheaply in mass quantities and (2) it offered the promise of technical improvements in future generations. With the 1103 chip, Intel would begin to conquer the memory market. Intel began producing its chips in a renovated factory the company had purchased from Union Carbide. EXHIBIT 1 m 1702, first EPROM (erasable Intel went public memory) 1972 8008, first 8-bit microprocessor 1974 8080, first 8-bit microprocessor for computing 1976 8085, integrated 8-bit microprocessor _ 1978 8086, low-cost 16bit microprocessor 1979 8088, low-cost 16-bit microprocessor 1981 IBM PC with 8088 processor and D05 1982 80286, 16bit microprocessor with memory management 1985 386, 32-bit processor Intel exited memory business to focus on microprocessors 1986 Compaq announces first 386 PC 1989 486, 32-bit microprocessor with integrated cache memory and floating point processor 1990 Microsoft announces Windows 3.0 1991 Intel launches "Intel Inside" campaign 1993 Pentium processor: superscalar Microsoft announces Windows technology NT 1995 Pentium Pro processor: Microsoft announces Windows Dynamic Execution and Dual 95 Independent Bus 1996 25th anniversary of the microprocessor 1997 Pentium processor with MMX technology Pentium II processor: Dynamic Execution, Dual Independent Bus, and MMX technology 1999 Pentium III processor 2004 Pentium 4 next-generation processor 2001 Itanium 64-bit processor US recession causes 4.6% decline in PC sales 2002 Pentium M processor: 90 nm process technology 2003 Intel introduces the Centrino mobile chip 2005 Pentium D processor: 3.2 GHz clock speed Intel was hungry for new revenue and in 1969 Gordon Moore accepted a development project for Busicom, a Japanese calculator company. Busicom wanted a custom chip for its programmable calculators. Moore wanted much more, however: generic chips that could be produced and sold in mass quantities." Intel engineer Ted Hoff resolved the conflict when he proposed a four-chip set that performed multiple tasks. One chip would act as the CPU, another would be a memory chip for working with active data, one would be a ROM memory chip where the program would be stored, and one would handle the input/output (1/O) interface. The product was the Intel 4004 chip, a 4-bit- chip that packed as much processing power as the first computer, the 1940s ENIAC machine that required a whole room of transistors. In August of 1972, Intel introduced a second microprocessor, built on 8-bit technology, and named the 8008. Two Seattle teenage hackers, Bill Gates and Paul Allen, would later purchase an 8008 and try to build a machine for a local traffic consulting company.The Rise of the Microprocessor and Intel's Dominance Throughout the 19705, Intel continued its work in memory chips and produced a number of breakthrough products, including an erasable memory chip (EPROM) that signicantly improved customer performance while lowering costs. The microprocessor business continued to grow slowly, and even though the 8008 was a technical marvel, it proved to be a slow and clunky device. Intel's third-generation chip, the 8080, came to market in 1974. One 8080 customer, MITS, used the chip as the core of a new product, a truly personal computer. Bill Gates and Paul Allen bought one of these new machines, the Altair 800, and developed the Microsoft Basic language to program the new machines. 1976 also proved to be a watershed year for the industry when Steve Jobs and Steve Wozniak introduced the Apple II computer. The machine was generally regarded as the rst personal computer, but the problem for Intel lay in the Apple II's microprocessor, the MOS Technology 16-bit 6502 processor. Intel had developed the microprocessor but risked being shut out of the new market. Competition in the microprocessor market had always been fierce because many companies, including Motorola, Zilog, and National Semiconductor, all produced 8-bit and then 16-bit processors. in fact, by 1978, Intel was well behind Motorola when it introduced its new 16-bit processors, the 8086 and the 8088. Customers and engineers claimed that Motorola's 68000 was simply a better chip than Intel's 8088/8086 line, which is why Apple chose Motorola over Intel. Intel responded with a clever but serious internal sales drive. The \"Crush" campaign focused on Intel \"crushing" Motorola and taking control of the 16-bit microprocessor market. During this drive, Intel sales engineers got credit for each "design win" they secured. (A design win was a commitment from a customer to use the 8086/8088 architecture in its new products. However, to get credit, the customer had to prove its commitment by purchasing an Intel development system and dedicating its own engineers to the effort.) The Crush campaign succeeded over time in convincing the marketplace that Intel's architecture provided a superior and complete package compared to the one offered by Motorola. One design win in 1980 would prove more important than all the others: Intel engineers convinced computer giant IBM to use its 8086/8088 architecture as the foundation of its new personal computer (PC). Grove said, "The presence of IBM in the early '805 was crucial. By winning that contract, we won the whole industry design... This was a huge opportunity, and we took advantage of it."3 IBM had been the colossus of the information-processing industry since its founding in the late nineteenth century, and the company found itself behind the competition in the emerging microcomputer market. Known as "Big Blue," IBM focused on selling large computers, or mainframes, to the world's largest and most prestigious corporations. IBM sold to computing professionals and specialists who ran huge data processing operations, and the microcomputer didn't fit the company's initial strategy or its core capabilities. By 1979, however, IBM executives recognized the disruptive power of the PC and sent a dedicated "tiger team\" to Boca Raton, Florida, to develop IBM's entry into the new market. The team, far removed from the corn pany's Armonk, New York, headquarters, found themselves free from IBM's internal policies and design constraints. With the overriding objective of bringing a PC to market in less than a year, the IBM team opted for an "open architecture\" process that used offthe-shelf components and existing third-party vendors to build the new machine. The open architecture meant that IBM did not have to develop its own microprocessor, operating system, or other key inputs, allowing it to enter the market quickly because IBM had only to assemble the final machine. IBM's PC also stood in stark contrast to Apple's machines, which used a \"closed architecture" of customdesigned chips and operating systems in its machines.E IBM's open architecture would have huge implications for Intel. First, many customers faced bosses skeptical of the new technology, and they opted for IBM machines because of the safety and security behind the iBM name and brand. By 1984, almost onethird of the market for PCs belonged to IBM.Q Thus, Intel chips powered the market's leading computer. Second, IBM's open architecture allowed other new PC sellers to imitate or "clone" the IBM PC in order to enter the market. By 1987, IBM and clone machines commanded over two-thirds of the market, and that figurejumped to over 90 percent by 1995. Clone makers included Compaq, Hewlett Packard, and an emerging buildto-order manufacturer founded in a University of Texas dorm room, PCs Limited, that would later become Dell, Inc. However, IBM's PC division dominated the PC market, and by 1985, it had grown to become a Fortune SODsized company with $5.5 billion in revenues. IBM's success helped Intel become the market leader in microprocessors. But IBM forced Intel to license its microprocessors to a dozen companies for the 8086 chip to ensure adequate supply. As a result, Intel captured only 30 percent of chip revenues and profits generated through IBM. In March of 1982, Intel introduced its next-generation chip, the 80286. The \"286\" dramatically increased processing speed and fueled sales of the microcomputer revolution. The 286 processor proved far more powerful than its predecessor, and combined with increasingly sophisticated software programs, PCs provided a cost-effective solution for businesses and their information processing needs. Although the 286 represented a significant advance in technology, the success of Intel's new chip was muted by one major drawback: Computer manufacturers required that Intel license the 286 architecture to competing chip manufacturer AMD (and three other licensees) as a "second source.\" Second-source agreements provided PC manufacturers with greater access to supply, while preventing one company from raising the price of the critical component. The introduction of the 286 had a significant effect on Intel. The 19705 and early 19805 had seen increased competition in the market for DRAM memory. By 1984, Intel only generated 20 percent of its revenue from the memory business, compared to 40 percent from microprocessors. Although microprocessors generated 100 percent of Intel's profit that year, the company was spending 80 percent of its R&D budget on memory devicesF2 Intel had invented the memory business, and the founding team's loyalties lay deeply entrenched in the memory market. Andy Grove described the decision: Gordon Moore and i were discussing our quandary. Our mood was downbeat. Hooked out the window at the Ferris wheel of the Great American amusement park revolving in the distance, then I turned back to Gordon and i asked: \"if we got kicked out and the board brought in a new CEO, what do you think he would do ?\" Gordon answered without hesitation, \"he wouid get us out of memories.\" istared at him, numb, and then said, \"Why shouldn't you and! walk out the door, come back and do it ourselves.E Intel exited the memory business and put all its resources into microprocessors. With 100 percent of its focus on the microprocessor market, Intel jumped the last hurdle in order to dominate the market. The Comdex computer show held in October, 1986, featured an announcement that altered the evolution of the computer industry: Compaq introduced a new computer built on Intel's newest chip, the 32-bit 80386 chip, or "386." Competition among PC manufacturers was becoming increasingly fierce, and Compaq hoped to gain a competitive edge by bringing a new product and new architecture to market. Compaq also agreed to a new business model, as it decided to forgo any "second source" requirement for the 386. Intel would be the sole provider of this new, powerful generation of microprocessors. The impact was immediate. Intel made about $40 on each 286 chip, but about $150 on each 386 chip. Intel's most serious competitor in the PC business, AMD, would now have to develop its own next-generation chip rather than merely licensing Intel's intellectual property. As a result, AMD fell behind for two product generations as it scrambled to develop its own chips. Intel's bold move to become the sole source supplier (with the one exception of IBM, which still required that Intel license the 386 design to IBM so it could, if desired, provide its own second source) leveled the playing field for PC clones. Compaq became the first PC clone to set the performance standard for a next-generation PC product by introducing the first PC with a 386 chip. Up until the 386, IBM had dominated PC sales and had typically held more than a two-thirds share of the market for PCs based on the IBM architecture. But that started to change in the late 1980s. Compaq continued to be a leader in launching new-generation PCs based on the IBM open architecture (called ISA), while IBM tried to introduce closed-architecture products such as the PS/2 to prevent clones from essentially selling identical products. It didn't work. The PS/2 lines couldn't provide the backward compatibility that customers wanted. In fact, by 1994, Compaq actually passed IBM as the PC market-share leader. IBM's share had dropped from almost 40 percent to 10 percent. By 1997, Compaq held 13.1 percent of the market with IBM following at 8.6 percent, followed by Dell (5.5%), HP (5.3%), Packard Bell (5.1%), Gateway (4%), and Apple (4%), with dozens of others holding the remaining 50 percent (see Exhibit 2). EXHIBIT 2 1985 1990 1995 2000 2005 IBM 30% 13% 8% 7% Commodore 26% 4% 64 Apple 12% 7% 8% 3% 2% Compaq 3% 4% 10% 13% Packard Bell 2% 2% 7% 4% HP 2% 4% 8% 15% Gateway 3% 4% Dell 0% 0% 3% 1 1% 17% Lenovo 7% Acer 4% 5% Toshiba 4% Fujitsu 4% Other 25.00% 71% 4% 51% 48% Total 100% 100% 100% 100% 100% Notes: HP and Compaq merged in 2002. IBM sold its PC business to Lenovo in 2004. The Semiconductor Industry Competition in the semiconductor industry was driven by two major forces: technology and economics. Moore's law, which in 1965 was an empirical observation and extrapolation, had now become something of a self-fulfilling prophecy. Exhibit 3 shows the increases in transistors and clock speed in Intel microprocessors. When microprocessor producers designed their next-generation products, the standard assumption was that the new chip would have twice the number of transistors as its predecessor. Intel's rst chip, the 4004, contained only 2,300 transistors, the 8086 carried 29,000 transistors; the 286 held 134,000, and the 386 used 275,000 transistorsl Intel and its competitors spent millions of dollars and several years developing the next generation of chips, moving from design to manufacturing and resolving the challenges presented by the chemistry and physics of silicon, heat transfer, and miniaturization. As each generation became more complex, Intel used a \"two-ina-box\" management structure. One engineer managed the architecture and design process, while another simultaneously focused on implementation, or moving the chip from design to manufacturing.16 Panel A: 4004-386 Translators and Clock Speeds 300.0 - 18.0 16.0 250.0 14.0 " 2000 2 E g . r 1 .0 a 10.0 150.0 - _ 8.0 + Transistors (000) .. 1000 _60 4.5 +CIockSpeadlMH2) |_ - 2 o 4.0 50.0 k 2.0 4004 8088 8080 8086 286 386 Hooessor Generation Panel B: dae-Pentlum D Transistors and Clock Speeds 3.5000 3.0000 2.5000 2.0000 350.0000 300.0000 250.0000 200.0000 150.0000 100.0000 50.0000 1,500.0 + Transistors (000) 1,000.0 + Clock Speed (MHz) 500.0 Transistor s 3100 ___6 275 486 1989 1200 EXHIBIT 3 Intel Product Features Source: Intel internal product release documents The economics of semiconductor production were fairly straightforward: A company incurred the vast majority of costs in the design, development, and marketing of the chip itself, as well as in building the fabrication facility to produce the chips. The raw inputs of silicon and transistors were fairly commoditized. However, the quality and uniformity of each silicon wafer ultimately inuenced the yield each chip would produce. The cost of building a fabrication facility (known as a \"fab\") was astronomical. In the mid-1990s, a fab cost about $1 billion, depending on capacity, and by 2001, that gure had risen to well above $2.5 billion;Z (This did not include the design costs for each new-generation chip, which were typically in the range of $50100 million.) Increasingly specialized equipment was the most costly item. In the mid- 1970s, equipment constituted about 40 percent of the total cost of a fab; by the mid-1990s, that share had risen to 70 percent A new generation of chips could use the same land and buildings, but it required new equipment to inscribe ever smaller transistors in ever tighter spaces on the chip. Put simply, microprocessor manufacturers incurred huge xed and sunk costs before they sold a single chip, but the input costs of each individual chip were negligible. The implication: The semiconductor business is a volume game with the company selling the most chips in any generation making the most money. Three factors inuenced chip volume: cyclicality among buyers, speed to market with a new generation of chips, and the yield obtainable from each silicon wafer. Although computer purchases appear to be necessary to both business and household productivity, they closely follow the general health of the economy. When times are tough, both families and rms delay upgrading their technology. The recession of 2001 saw PC sales decline by 4.9 percent, compared to a 118.7 percent gain for 2000 (see Exhibit 41% If a company introduced a new chip platform at the beginning of a recession, it ran the risk of low volume for that generation. EXHIBIT 4 PC Shipments (M) | % Change ___ Speed to market mattered because the cost, and hence protable price, of each chip followed a learning curve trajectory. Manufacturing costs fell systematically as volume increased (see Exhibit 5 for a sample of data on how the cost of a chip declines with increases in volume). The rst entrant could either charge high prices for its chips or it could price lower in anticipation of volume-based cost savings. Lower prices would spur demand for the chip and would also discourage later movers because they would have to price at or below the initial cost Being rst to market with a high quality chip, such as Intel's 286 and 386 generations, could provide a rm with a sales and revenue lead that competitors might be unable to overcome. EXHIBIT 5 Semiconductor Industry Unit Volume Cumulative Unit Volume Avg. Cost (5) (per unit) W Original Cost 4387365 4387365 ' 50.00 1.00 _ 446911 7 8856482 4416 0-88 341142. 6 12267908 38.03 0.76 I_ 324665. 0 15514558 31.90 0.64 304038. 0 1855493.8 32.82 0.66 3405322 21960260 25299453 34.51 33.93 0.69 0.68 0.4 01 3339193 0.2 3378973 3908007 32586435 31.18 0.62 28678432 32.24 0.64 3666123 36252563 39759553 4294788.? 45802235 27.08 0.54 26.50 0.53 20.95 0.42 ' 22.01 0.44 Yield refers to the number of functional chips produced from each silicon wafer. Wafer sizes increased over time from an average of 150 mm in the 19805, 200 mm in the 19905, and 300 mm at the turn of the millennium Using a 300 mm wafer instead of a 200 mm wafer meant that a manufacturer could more than double the number of potential chips.m Not every chip would be functional, however, because small defects in the silicon, contaminants in the air, or glitches in the manufacturing process resulted in nonfunctional chips. As the number of wafers produced increased, engineers usually eliminated process and design bugs. Yields generally increased with volume, which lowered the cost per chip. Intel had also implemented what it called the "copy exactly" manufacturing methodology to increase yields and lower the cost of each chip. Copy exactly manufacturing started with Intel perfecting, in a prototype piant, the processes that could minimize defects and maximize yield. Intel then cloned the processesor copied them exactiyin plants around the world. Intel now also uses identical production lines to find the root causes of lower yields. In one recent puzzler, identical tools in two factories kept producing different defect rates. By swapping the workers who maintained the tool, Intel learned that one group was cleaning the tool by wiping a towel in a circular motion; the other wiped back and forth. One motion went against the grain ofthe metai, spreading dirt particles rather than removing them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts