Question

Mr. Cauzone decided to wind-up his Company on 12/31/21. After selling all assets and settling all liabilities, there's $122,000 of Cash left in the

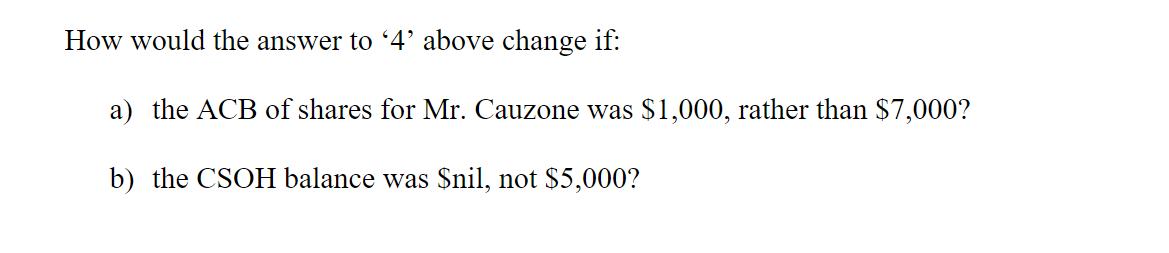

Mr. Cauzone decided to wind-up his Company on 12/31/21. After selling all assets and settling all liabilities, there's $122,000 of Cash left in the Company. Mr. Cauzone owns all the shares of the Company with ACB of $7,000. He has come to you for advice and provided the following balances: PUC CSOH CDA GRIP $2,000 $5,000 $48,000 $24,000 Assuming Mr. Cauzone has no other income, calculate his Federal taxes payable / refundable for 2021, based on above. How would the answer to '4' above change if: a) the ACB of shares for Mr. Cauzone was $1,000, rather than $7,000? b) the CSOH balance was $nil, not $5,000?

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a The answer would be the same if the ACB of shares for Mr C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume II

Authors: Larson Kermit, Jensen Tilly

14th Canadian Edition

71051570, 0-07-105150-3, 978-0071051576, 978-0-07-10515, 978-1259066511

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App