Answered step by step

Verified Expert Solution

Question

1 Approved Answer

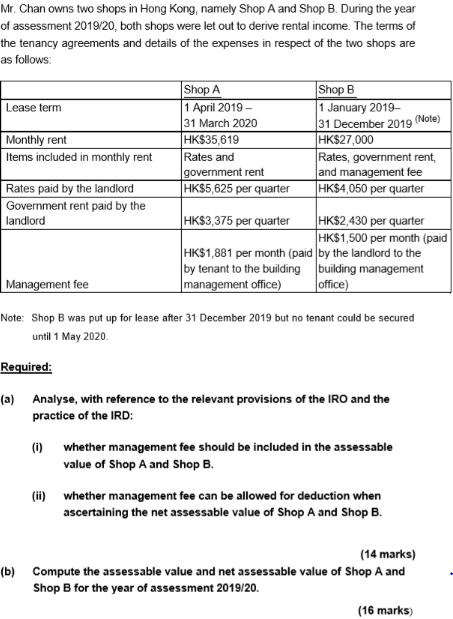

Mr. Chan owns two shops in Hong Kong, namely Shop A and Shop B. During the year of assessment 2019/20, both shops were let

Mr. Chan owns two shops in Hong Kong, namely Shop A and Shop B. During the year of assessment 2019/20, both shops were let out to derive rental income. The terms of the tenancy agreements and details of the expenses in respect of the two shops are as follows: Lease term Monthly rent Items included in monthly rent Rates paid by the landlord Government rent paid by the landlord Management fee Shop A 1 April 2019- 31 March 2020 HK$35,619 Rates and government rent HK$5,625 per quarter HK$3,375 per quarter HK$1,881 per month (paid by tenant to the building management office) (1) Shop B 1 January 2019- 31 December 2019 (Note) HK$27,000 Rates, government rent, and management fee HK$4,050 per quarter HK$2,430 per quarter HK$1,500 per month (paid by the landlord to the building management office) Note: Shop B was put up for lease after 31 December 2019 but no tenant could be secured until 1 May 2020. Required: (a) Analyse, with reference to the relevant provisions of the IRO and the practice of the IRD: whether management fee should be included in the assessable value of Shop A and Shop B. (ii) whether management fee can be allowed for deduction when ascertaining the net assessable value of Shop A and Shop B. (14 marks) (b) Compute the assessable value and net assessable value of Shop A and Shop B for the year of assessment 2019/20. (16 marks)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a i According to section 141 of the Inland Revenue Ordinance IRO the assessable value of property in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started