Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROJECT A PROJECT B Mr. Decision is torn between two independent projects A and B. The data below each project are given and the

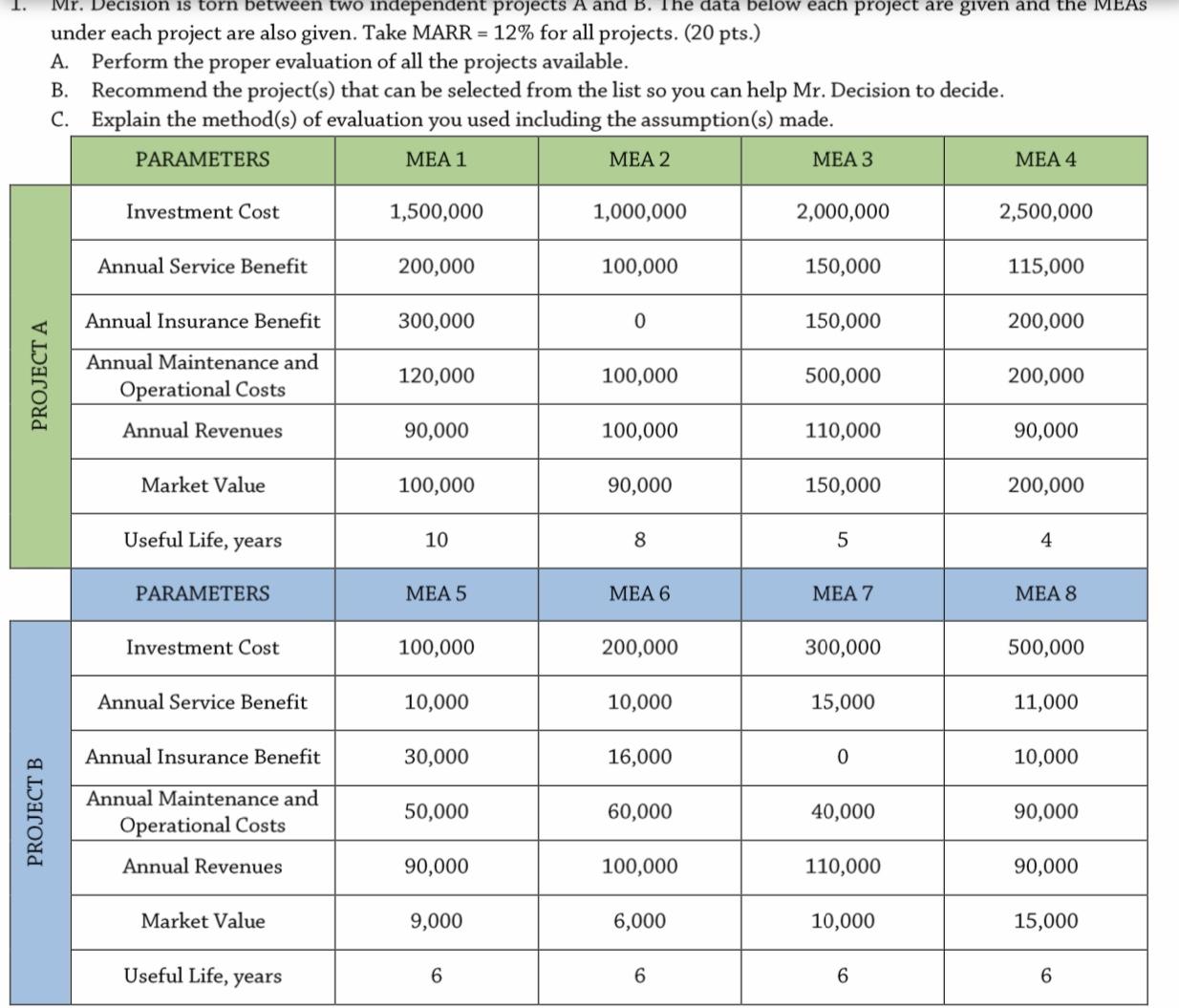

PROJECT A PROJECT B Mr. Decision is torn between two independent projects A and B. The data below each project are given and the MEAS under each project are also given. Take MARR = 12% for all projects. (20 pts.) A. Perform the proper evaluation of all the projects available. B. Recommend the project(s) that can be selected from the list so you can help Mr. Decision to decide. C. Explain the method(s) of evaluation you used including the assumption(s) made. PARAMETERS MEA 1 MEA 2 MEA 3 MEA 4 Investment Cost 1,500,000 1,000,000 2,000,000 2,500,000 Annual Service Benefit 200,000 100,000 150,000 115,000 Annual Insurance Benefit 300,000 0 150,000 200,000 Annual Maintenance and Operational Costs 120,000 100,000 500,000 200,000 Annual Revenues 90,000 100,000 110,000 90,000 Market Value 100,000 90,000 150,000 200,000 Useful Life, years 10 8 5 4 PARAMETERS MEA 5 MEA 6 MEA 7 MEA 8 Investment Cost 100,000 200,000 300,000 500,000 Annual Service Benefit 10,000 10,000 15,000 11,000 Annual Insurance Benefit 30,000 16,000 0 10,000 Annual Maintenance and Operational Costs 50,000 60,000 40,000 90,000 Annual Revenues 90,000 100,000 110,000 90,000 Market Value 9,000 6,000 10,000 15,000 Useful Life, years 6 6 6 6

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

A To properly evaluate the projects available we must first calculate the Net Present Value NPV of e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started