Answered step by step

Verified Expert Solution

Question

1 Approved Answer

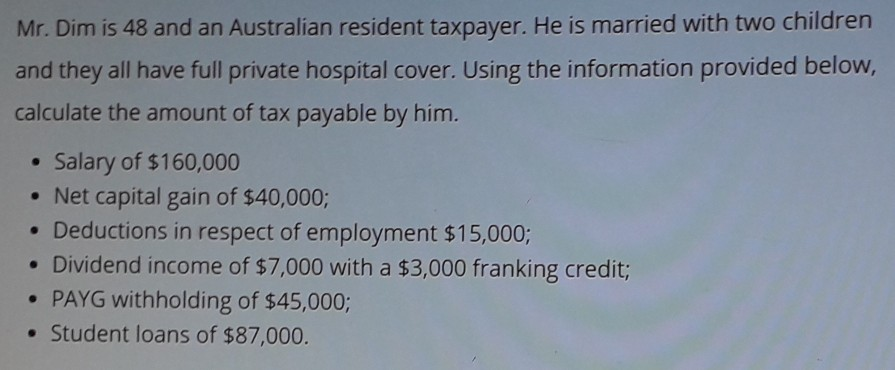

Mr. Dim is 48 and an Australian resident taxpayer. He is married with two children and they all have full private hospital cover. Using the

Mr. Dim is 48 and an Australian resident taxpayer. He is married with two children and they all have full private hospital cover. Using the information provided below, calculate the amount of tax payable by him. Salary of $160,000 Net capital gain of $40,000; Deductions in respect of employment $15,000; Dividend income of $7,000 with a $3,000 franking credit; PAYG withholding of $45,000; Student loans of $87,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started