Question

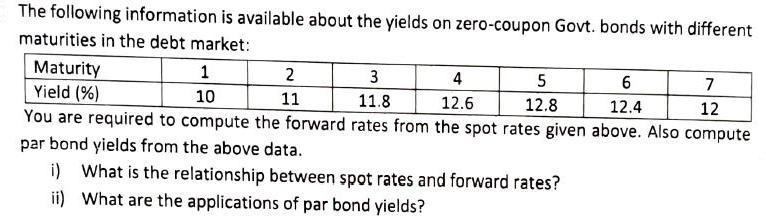

The following information is available about the yields on zero-coupon Govt. bonds with different maturities in the debt market: 4 6 Maturity Yield (%)

The following information is available about the yields on zero-coupon Govt. bonds with different maturities in the debt market: 4 6 Maturity Yield (%) 7 3 11.8 12.6 12.4 12 You are required to compute the forward rates from the spot rates given above. Also compute par bond yields from the above data. i) What is the relationship between spot rates and forward rates? What are the applications of par bond yields? ii) 1 10 2 11 5 12.8

Step by Step Solution

3.31 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

i Relationship between spot rates and forward rates The spot rate is the interest rate for a loan or investment that is paid immediately The forward r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Data Analysis And Decision Making

Authors: Christian Albright, Wayne Winston, Christopher Zappe

4th Edition

538476125, 978-0538476126

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App