Answered step by step

Verified Expert Solution

Question

1 Approved Answer

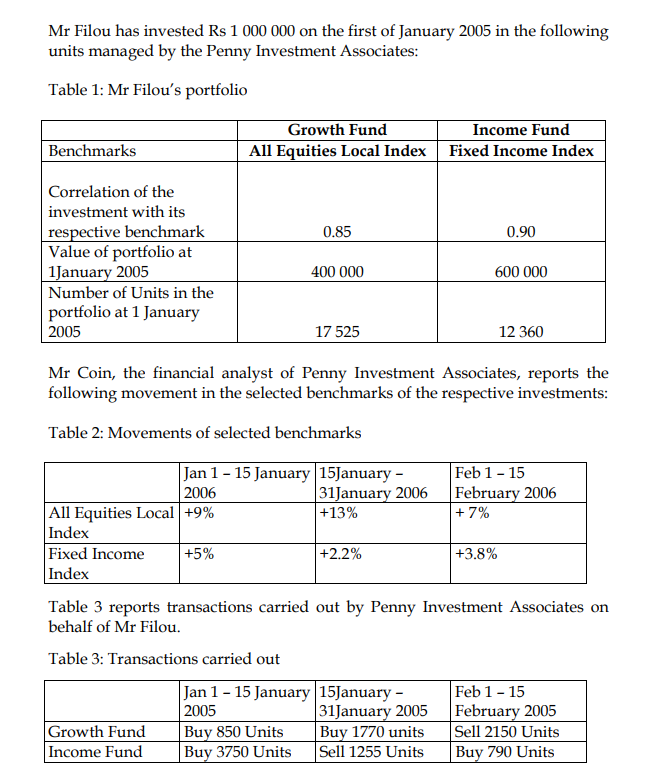

Mr Filou has invested Rs 1 000 000 on the first of January 2005 in the following units managed by the Penny Investment Associates:

![2.1 Calculate the value of each unit as at 15 February 2005. [10 marks] Hence, calculate the value of Mr](https://dsd5zvtm8ll6.cloudfront.net/questions/2023/10/65365b7f4f240_18365365b7f49db4.jpg)

Mr Filou has invested Rs 1 000 000 on the first of January 2005 in the following units managed by the Penny Investment Associates: Table 1: Mr Filou's portfolio Benchmarks Correlation of the investment with its respective benchmark Value of portfolio at 1January 2005 Number of Units in the portfolio at 1 January 2005 All Equities Local +9% Index Fixed Income Index Growth Fund All Equities Local Index Growth Fund Income Fund +5% 0.85 Jan 1-15 January 15January - 2006 31January 2006 +13% 400 000 Mr Coin, the financial analyst of Penny Investment Associates, reports the following movement in the selected benchmarks of the respective investments: Table 2: Movements of selected benchmarks Jan 1 - 15 January 2005 17 525 Buy 850 Units Buy 3750 Units +2.2% Income Fund Fixed Income Index 15January - 31January 2005 Buy 1770 units Sell 1255 Units 0.90 600 000 Table 3 reports transactions carried out by Penny Investment Associates on behalf of Mr Filou. Table 3: Transactions carried out 12 360 +3.8% Feb 1-15 February 2006 +7% Feb 1-15 February 2005 Sell 2150 Units Buy 790 Units 2.1 Calculate the value of each unit as at 15 February 2005. [10 marks] Hence, calculate the value of Mr Filou's portfolio as at that date, clearly indicating the proportion of each investment in his global portfolio. Comment on the reported proportion. [5 marks] Calculate the global rate of return of Mr Filou's investment. [2 marks] Write down the equations to calculate the internal rate of return of each investment (Growth Fund and Income Fund). [3 marks] 2.2 2.3 2.4 2.5 Open-ended mutual funds are highly beneficial to individual investors. Discuss. [10 marks]

Step by Step Solution

★★★★★

3.55 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Answer 21 The value of each unit as at 15 February 2005 can be calculated using the formula Value of unit Portfolio value Number of units For Growth Fund Value of unit 400000 17525 2293 For Income Fun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started