Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Ghafar signed an agreement on 15 June 2017 to buy a piece of land for RM328,835. He settled the full payment on 26

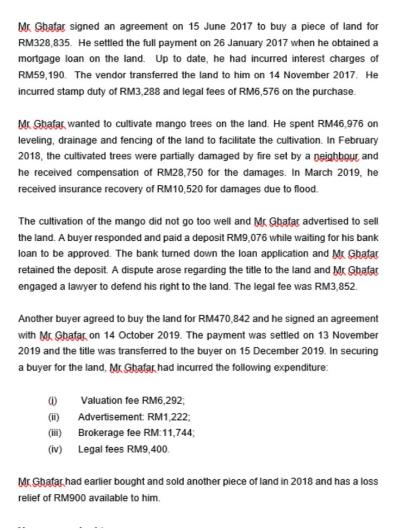

Mr. Ghafar signed an agreement on 15 June 2017 to buy a piece of land for RM328,835. He settled the full payment on 26 January 2017 when he obtained a mortgage loan on the land. Up to date, he had incurred interest charges of RM59,190 The vendor transferred the land to him on 14 November 2017. He incurred stamp duty of RM3,288 and legal fees of RM6,576 on the purchase. Mr Ghafar, wanted to cultivate mango trees on the land. He spent RM46,976 on leveling, drainage and fencing of the land to facilitate the cultivation. In February 2018, the cultivated trees were partially damaged by fire set by a neighbour and he received compensation of RM28,750 for the damages. In March 2019, he received insurance recovery of RM10,520 for damages due to flood. The cultivation of the mango did not go too well and Mr Ghafar advertised to sell the land. A buyer responded and paid a deposit RM9,076 while waiting for his bank loan to be approved. The bank turned down the loan application and Mr Ghatar retained the deposit. A dispute arose regarding the title to the land and Mr Ghafar engaged a lawyer to defend his right to the land. The legal fee was RM3,852. Another buyer agreed to buy the land for RM470,842 and he signed an agreement with Mr. Ghafar, on 14 October 2019. The payment was settled on 13 November 2019 and the title was transferred to the buyer on 15 December 2019. In securing a buyer for the land, Mr Ghafar had incurred the following expenditure: (0) (1) (iii) (iv) Legal fees RM9,400. Valuation fee RM6,292; Advertisement: RM1,222, Brokerage fee RM:11,744; Mr. Ghatar had earlier bought and sold another piece of land in 2018 and has a loss relief of RM900 available to him. You are required to: (a) Determine, with reason, the date of acquisition and disposal of the land, give a reason for the choice you made. (3 marks) (b) Compute the chargeable gain or loss for Mr Ghafar in respect of the disposed of property. (22 marks)

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Date of Acquisition and Disposal Date of Acquisition Mr Ghatar acquired the land on 14 November 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started