Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Good has reached his 67 birthday and is ready to retire. He has been a hard worker and had lived a provident life

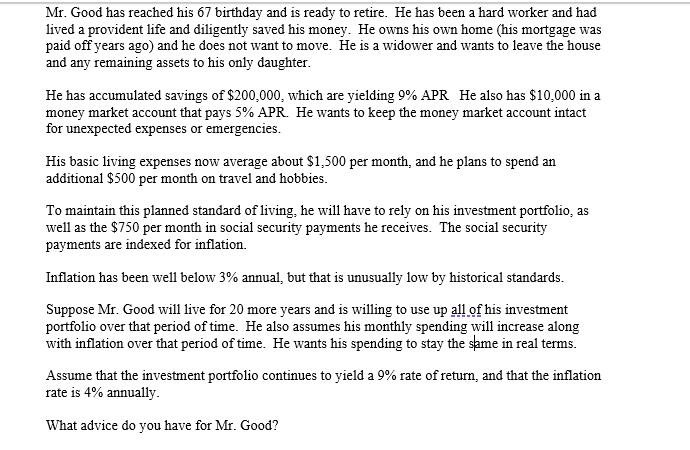

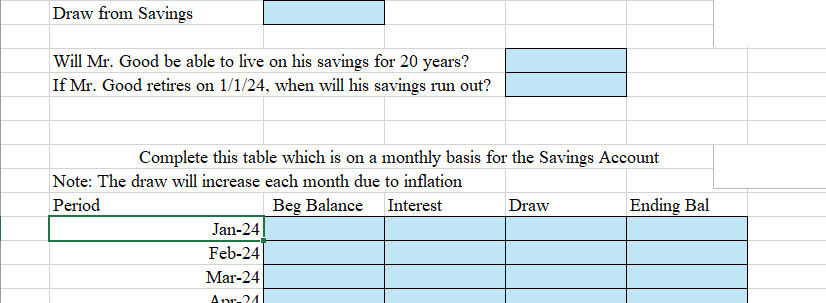

Mr. Good has reached his 67 birthday and is ready to retire. He has been a hard worker and had lived a provident life and diligently saved his money. He owns his own home (his mortgage was paid off years ago) and he does not want to move. He is a widower and wants to leave the house and any remaining assets to his only daughter. He has accumulated savings of $200,000, which are yielding 9% APR He also has $10,000 in a money market account that pays 5% APR. He wants to keep the money market account intact for unexpected expenses or emergencies. His basic living expenses now average about $1,500 per month, and he plans to spend an additional $500 per month on travel and hobbies. To maintain this planned standard of living, he will have to rely on his investment portfolio, as well as the $750 per month in social security payments he receives. The social security payments are indexed for inflation. Inflation has been well below 3% annual, but that is unusually low by historical standards. Suppose Mr. Good will live for 20 more years and is willing to use up all of his investment portfolio over that period of time. He also assumes his monthly spending will increase along with inflation over that period of time. He wants his spending to stay the same in real terms. Assume that the investment portfolio continues to yield a 9% rate of return, and that the inflation rate is 4% annually. What advice do you have for Mr. Good? Draw from Savings Will Mr. Good be able to live on his savings for 20 years? If Mr. Good retires on 1/1/24, when will his savings run out? Complete this table which is on a monthly basis for the Savings Account Note: The draw will increase each month due to inflation Period Beg Balance Jan-24 Feb-24 Mar-24 Apr-21 Interest Draw Ending Bal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether Mr Good will be able to live on his savings for 20 years and when his savings w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started