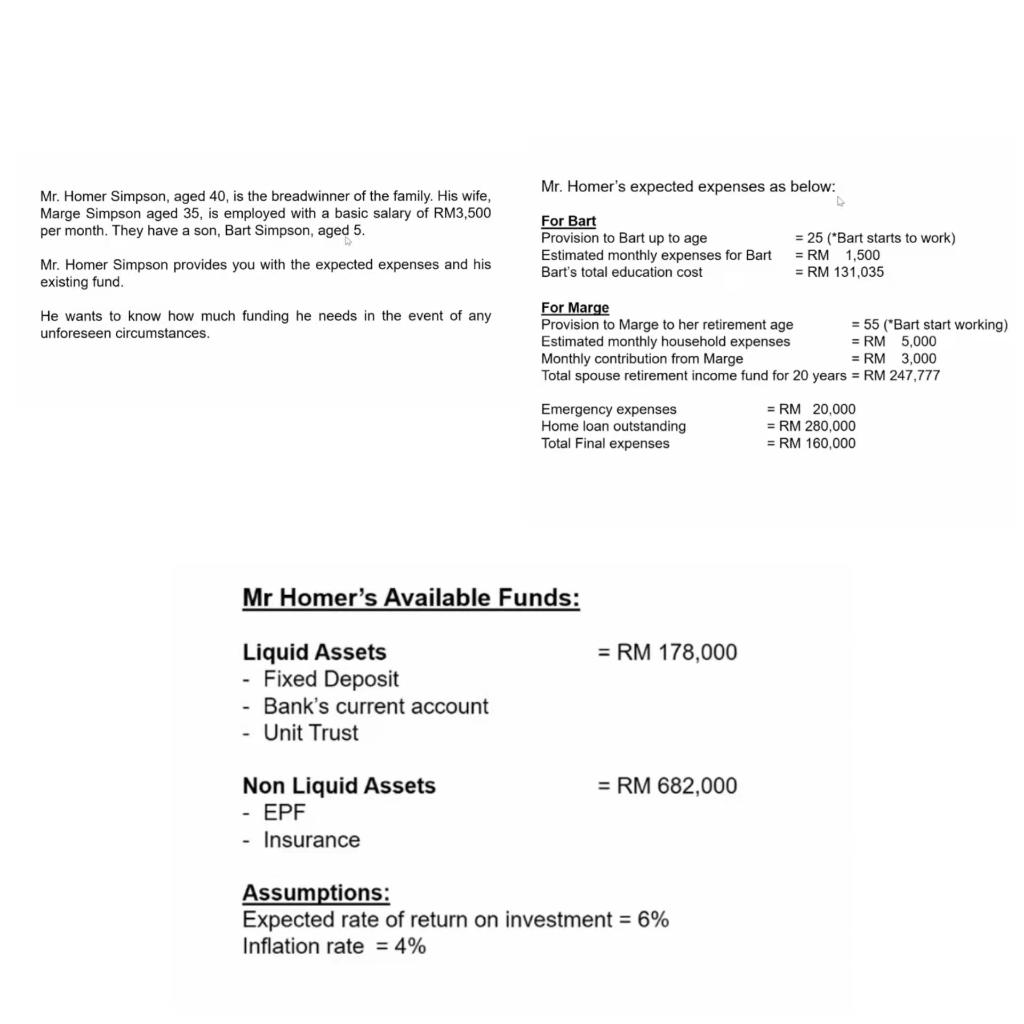

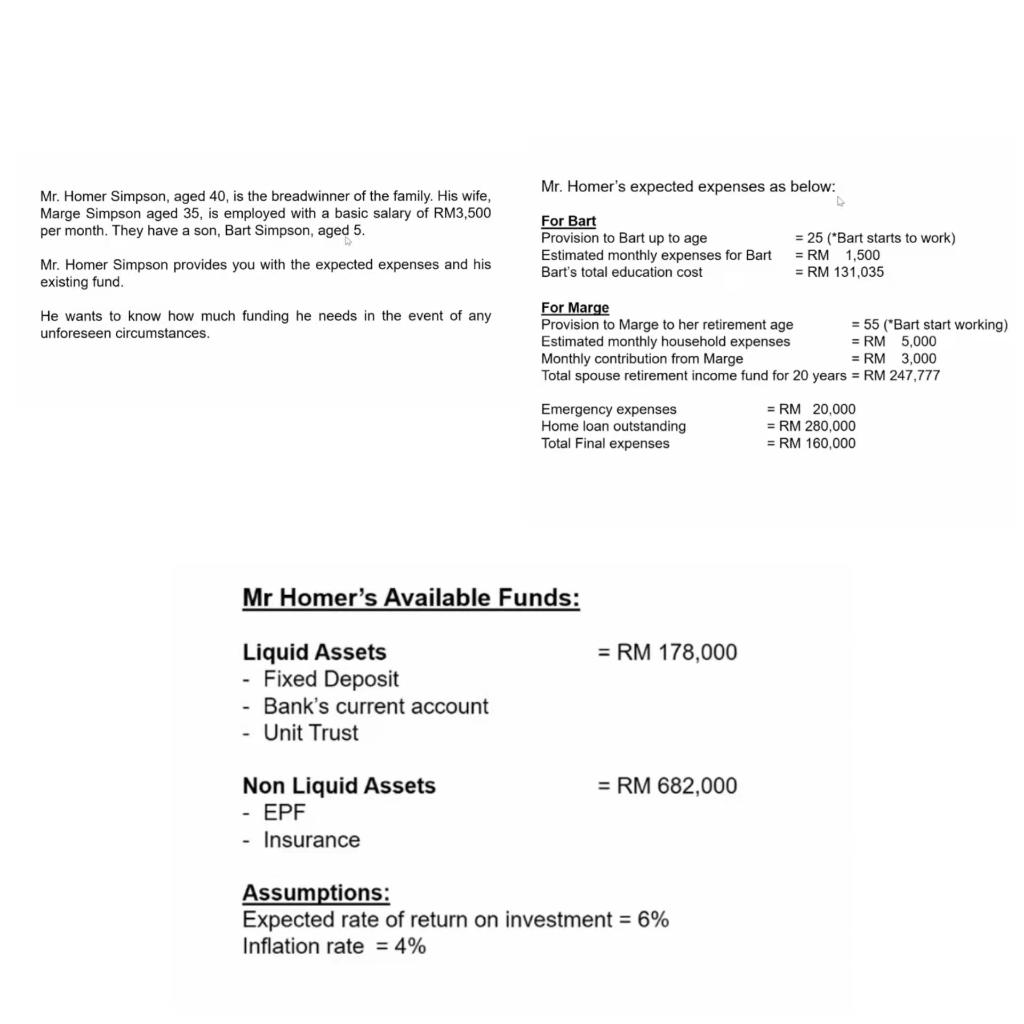

Mr. Homer's expected expenses as below: Mr. Homer Simpson, aged 40, is the breadwinner of the family. His wife, Marge Simpson aged 35, is employed with a basic salary of RM3,500 per month. They have a son, Bart Simpson, aged 5. Mr. Homer Simpson provides you with the expected expenses and his existing fund. For Bart Provision to Bart up to age Estimated monthly expenses for Bart Bart's total education cost = 25 ("Bart starts to work) = RM 1,500 = RM 131,035 He wants to know how much funding he needs in the event of any unforeseen circumstances. For Marge Provision to Marge to her retirement age = 55 ("Bart start working) Estimated monthly household expenses = RM 5,000 Monthly contribution from Marge = RM 3,000 Total spouse retirement income fund for 20 years = RM 247,777 Emergency expenses Home loan outstanding Total Final expenses = RM 20,000 = RM 280,000 = RM 160,000 Mr Homer's Available Funds: = RM 178,000 Liquid Assets - Fixed Deposit - Bank's current account Unit Trust = RM 682,000 Non Liquid Assets - EPF - Insurance Assumptions: Expected rate of return on investment = 6% Inflation rate = 4% Mr. Homer's expected expenses as below: Mr. Homer Simpson, aged 40, is the breadwinner of the family. His wife, Marge Simpson aged 35, is employed with a basic salary of RM3,500 per month. They have a son, Bart Simpson, aged 5. Mr. Homer Simpson provides you with the expected expenses and his existing fund. For Bart Provision to Bart up to age Estimated monthly expenses for Bart Bart's total education cost = 25 ("Bart starts to work) = RM 1,500 = RM 131,035 He wants to know how much funding he needs in the event of any unforeseen circumstances. For Marge Provision to Marge to her retirement age = 55 ("Bart start working) Estimated monthly household expenses = RM 5,000 Monthly contribution from Marge = RM 3,000 Total spouse retirement income fund for 20 years = RM 247,777 Emergency expenses Home loan outstanding Total Final expenses = RM 20,000 = RM 280,000 = RM 160,000 Mr Homer's Available Funds: = RM 178,000 Liquid Assets - Fixed Deposit - Bank's current account Unit Trust = RM 682,000 Non Liquid Assets - EPF - Insurance Assumptions: Expected rate of return on investment = 6% Inflation rate = 4%