Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Howard owned an estate and some timber in Antrim in Northem Ireland. He agreed to sell all the timber on the estate in

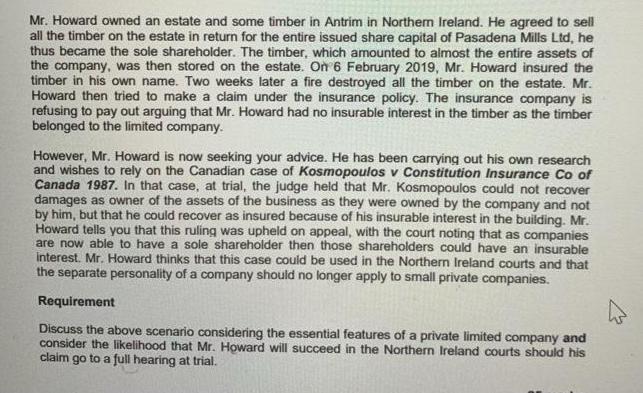

Mr. Howard owned an estate and some timber in Antrim in Northem Ireland. He agreed to sell all the timber on the estate in return for the entire issued share capital of Pasadena Mills Ltd, he thus became the sole shareholder. The timber, which amounted to almost the entire assets of the company, was then stored on the estate. On 6 February 2019, Mr. Howard insured the timber in his own name. Two weeks later a fire destroyed all the timber on the estate. Mr. Howard then tried to make a claim under the insurance policy. The insurance company is refusing to pay out arguing that Mr. Howard had no insurable interest in the timber as the timber belonged to the limited company. However, Mr. Howard is now seeking your advice. He has been carrying out his own research and wishes to rely on the Canadian case of Kosmopoulos v Constitution Insurance Co of Canada 1987. In that case, at trial, the judge held that Mr. Kosmopoulos could not recover damages as owner of the assets of the business as they were owned by the company and not by him, but that he could recover as insured because of his insurable interest in the building. Mr. Howard tells you that this ruling was upheld on appeal, with the court noting that as companies are now able to have a sole shareholder then those shareholders could have an insurable interest. Mr. Howard thinks that this case could be used in the Northern Ireland courts and that the separate personality of a company should no longer apply to small private companies. Requirement Discuss the above scenario considering the essential features of a private limited company and consider the likelihood that Mr. Howard will succeed in the Northern Ireland courts should his claim go to a full hearing at trial.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started