Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Jackson is faced with a scenario and as a final year banking and finance student, you are required to provide a solution to

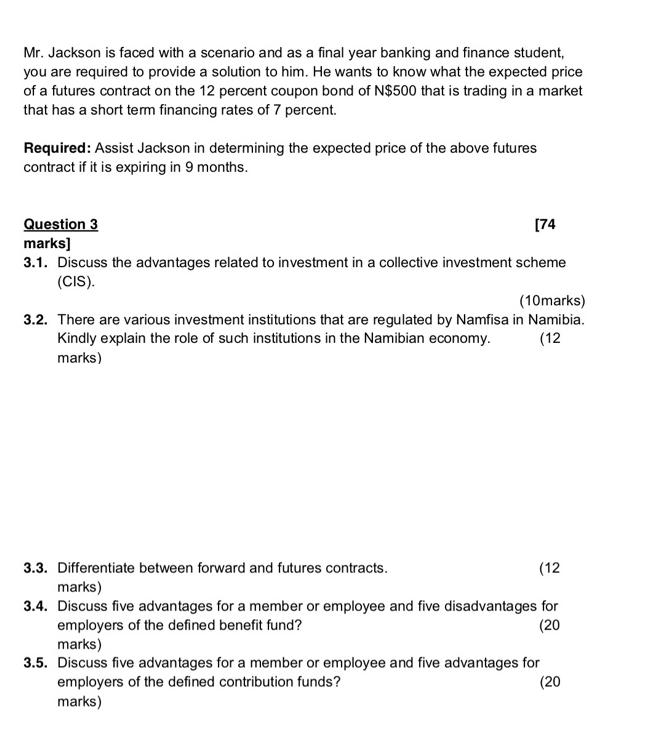

Mr. Jackson is faced with a scenario and as a final year banking and finance student, you are required to provide a solution to him. He wants to know what the expected price of a futures contract on the 12 percent coupon bond of N$500 that is trading in a market that has a short term financing rates of 7 percent. Required: Assist Jackson in determining the expected price of the above futures contract if it is expiring in 9 months. Question 3 marks] 3.1. Discuss the advantages related to investment in a collective investment scheme (CIS). [74 (10marks) 3.2. There are various investment institutions that are regulated by Namfisa in Namibia. Kindly explain the role of such institutions in the Namibian economy. marks) (12 3.3. Differentiate between forward and futures contracts. (12 marks) 3.4. Discuss five advantages for a member or employee and five disadvantages for employers of the defined benefit fund? (20 marks) 3.5. Discuss five advantages for a member or employee and five advantages for (20 employers of the defined contribution funds? marks)

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Mr Jackson is faced with a scenario and as a final year banking and finance student you are required to provide a solution to him He wants to know what the expected price of a futures contract on the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started