Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Joab is a director of Fofo Limited. During the year 2013, the company allowed him to purchase 40,000 shares based on his enormous

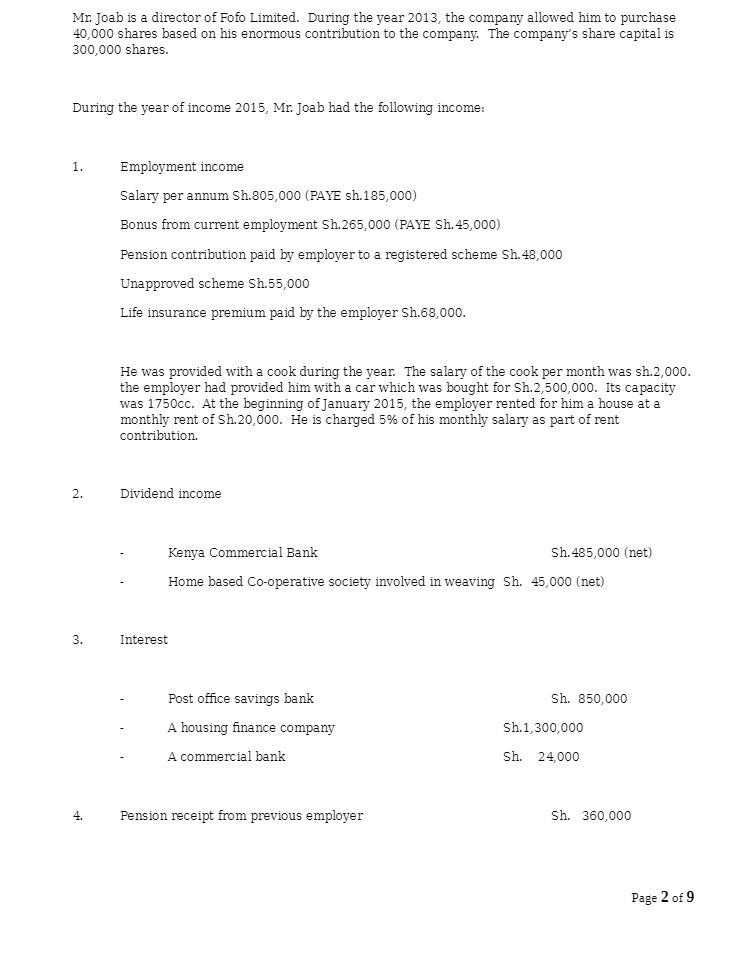

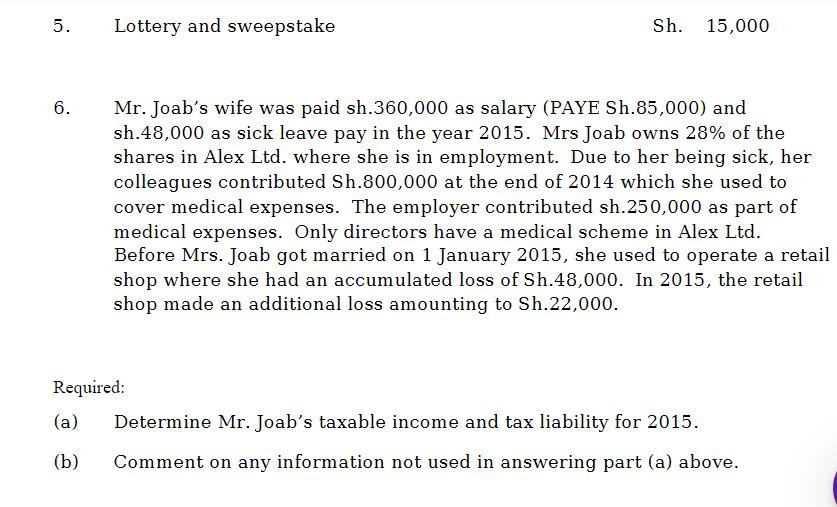

Mr. Joab is a director of Fofo Limited. During the year 2013, the company allowed him to purchase 40,000 shares based on his enormous contribution to the company. The company's share capital is 300,000 shares. During the year of income 2015, Mr. Joab had the following income: 1. 2. 3. 4. Employment income Salary per annum Sh.805,000 (PAYE sh.185,000) Bonus from current employment Sh.265,000 (PAYE Sh.45,000) Pension contribution paid by employer to a registered scheme Sh. 48,000 Unapproved scheme Sh.55,000 Life insurance premium paid by the employer Sh.68,000. He was provided with a cook during the year. The salary of the cook per month was sh.2,000. the employer had provided him with a car which was bought for Sh.2,500,000. Its capacity was 1750cc. At the beginning of January 2015, the employer rented for him a house at a monthly rent of Sh.20,000. He is charged 5% of his monthly salary as part of rent contribution. Dividend income Kenya Commercial Bank Home based Co-operative society involved in weaving Sh. 45,000 (net) Interest Post office savings bank A housing finance company A commercial bank Pension receipt from previous employer Sh. 485,000 (net) Sh. 850,000 Sh.1,300,000 Sh. 24,000 Sh. 360,000 Page 2 of 9 5. 6. Lottery and sweepstake Sh. Required: (a) (b) 15,000 Mr. Joab's wife was paid sh.360,000 as salary (PAYE Sh.85,000) and sh.48,000 as sick leave pay in the year 2015. Mrs Joab owns 28% of the shares in Alex Ltd. where she is in employment. Due to her being sick, her colleagues contributed Sh.800,000 at the end of 2014 which she used to cover medical expenses. The employer contributed sh.250,000 as part of medical expenses. Only directors have a medical scheme in Alex Ltd. Before Mrs. Joab got married on 1 January 2015, she used to operate a retail shop where she had an accumulated loss of Sh.48,000. In 2015, the retail shop made an additional loss amounting to Sh.22,000. Determine Mr. Joab's taxable income and tax liability for 2015. Comment on any information not used in answering part (a) above.

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A 3854931805727 B The loss on the retail shop amounting to 70000 2200048000 will be carried forward to be offset against the income from the sa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started