Question

Mr John Bossis the CEO of JB to AB Mighty Moments Suppliers (Pty) Lty. He has been running a building material business since its formation

Mr John Bossis the CEO of JB to AB Mighty Moments Suppliers (Pty) Lty. He has been running a building material business since its formation on 28 February 2016. Unfortunately, his inexperienced accountant resigned at the end of the month without finalizing the accounts. Mr John Boss has requested you as an accounting student to help him meet this requirement by computerizing his business transactions. All payments and receipts are done electronically. The company uses a periodic inventory system and processes its transactions exclusive of VAT.Its records are based on an integrated method and it does not process the following documents; quotations, sales orders, purchase orders and goods received notes. Its financial year starts on 1 March, it banks with FNB Namibia and keeps a petty cash account with an imprest amount of N$7 000. It uses the balance forward processing method and prints its documents on plain single paper. PARTA (35 marks) Company name: Student number Draft list of possible opening balances as at 1 March 2017 Details Notes Amount N$000 Financial instruments 1 1 800 Warehouse and office 2 1 850 Forklift 3 250 Crane 3 700 Warehouse shelves 3 36 Heavy duty copying machine 2S 150 Profits/loss from previous years 22? Inventory @ selling price 4 55 Accounts Receivable 5 1 234 Bank (Cr balance as per bank statement) 330 Tiger Brand Ordinary Shares (JSE Listed) 105 Purchases 10 500 Sales 18 800 Power expenses 46.5 Unpaid Income tax 25 Unpaid-Medical Contributions 10.4 Accounts Payable 6 1 050 Discount allowed 0.48 10% Debentures Purchased 250 Discount received 0.53 NB. The average market interest in Namibia is 12%. Notes: 1. The financial instruments consist of authorized share capital of two million ordinary shares of N$0.75 par value with a market value of N$1.00 per share and seven hundred and fifty 12% Debentures of N$1 000 face value. . The property consists of a piece of land and a warehouse. The original cost of the land was one million Namibian dollars while the factory was built for N$850 000 and ready for use on 1% March 2016. The warehouse is subject to a depreciation charge of 10 percent per annum. The environmental regulations of the City of Windhoek require that the factory be dismantled, and the land restored to its natural condition after ten years. It is estimated that this will cost the company an amount of N$200 000. All other non-current assets are depreciated using 20% reducing balance method. All assets have a residual value which his equal to 10% of the cost and the useful life is five years. The assets were acquired at the business inception date. The company uses the cost model for its non-current assets. . The pricing policy of the company is to achieve a twenty percent profit margin. Inventory on hand Quantity Selling price per unit (N$) Cement — 50 kg bags 250 130.00 Door Frames 50 450.00 5. Accounts receivable balances Accountholder Account Amount number N$000 NUST N2016 750 DHP church D2000 350 IUM 13000 800 UNESCO U4000 250 Mr. Haufiku & Sons H2000 22? 6. Accounts payables Name Account number Amount N$000 Mega Build SA MB200 700 Ohorongo Cement Limited OC300 280 Build IT BIT100 22?

Part 2

Note: One of the heavy-duty photo copy machines was giving problems. The cost price was N$45 000

Update all batches before moving to the next question. No report is required at this stage.

Part C (40 Marks)

You are required to process the following yearend adjustments in period 12 Vi. Vii. viii.

i, The chief executive officer was given inventory with a sales value of N$25 000 as part of his remuneration.

ii), A concrete mixer with a life span of 5 years was bought from a company Chisung (Ch500), invoice number, INV1025 on 1 February 2018 on account and was delivered on the same date at the firm’s premises. Mighty Moments received an invoice from Chisung totalling N$113 830 which is made up of the following items:

(a) Actual Invoice amount for the machine N$80 000

(b) Installation cost of machine done atthe firm premises N$11 300

(c) Professional fees for architecture N$18 000

(d) Transport cost to deliver the machine to the client N$4 530

iii ,Expo 2018 launch includes a deposit of N$15 500.00 for a campaign which will begin in April 2018

iv Unpaid wages of N$34 534 as at 28 Feb 2018

v, Inventory with sales value of N$15 000.00 was donated to the old age home in Katutura.

vi, It was discovered that the amount of N$340 for settlement discount for customers was included as settlement discount from suppliers.

vii, A filing cabinet was purchased on 1 May 2017 for an amount of N$7 000 from Game Stores. This transaction had not been considered in the above balances.

viii, Mr John Boss decided to refund the amount owed to Mr. Haufiku & Sons.

ix , A special resolution was passed to declare dividends of N$0.10 per share on all outstanding shares.

x The allowance for irrecoverable debt was pegged at N$134 430.

xi, An inventory countat financial year-end indicated inventory with a sales value of N$35 000 wasin good condition and physically available in the entity’s warehouse.

xi The company auditors discovered an amount of N$ 12 300 for audit fees incorrectly entered on the debit side of the discount received account

xii ,Insurance expense for the year amounts to N$3 500.

xiii, Provide depreciation on all assets for the financial year ending 28 Feb 2018

xv ,Interest expense and interest income had not been accounted for in the company’s records.

Required:

Process the above transactions, update and print out the following reports.

1. A detailed ledger for JB to AB Mighty Moments Suppliers (Pty) Ltd. (View — General ledger — Transaction — Detailed ledger)

Period 1 — period 12

2, Suppliers and customers' detailed ledgers.

Customers: View — Customers — Detailed ledger — By customers

Suppliers: View — Suppliers — Detailed ledger — By suppliers

Period: 1 — Period 12

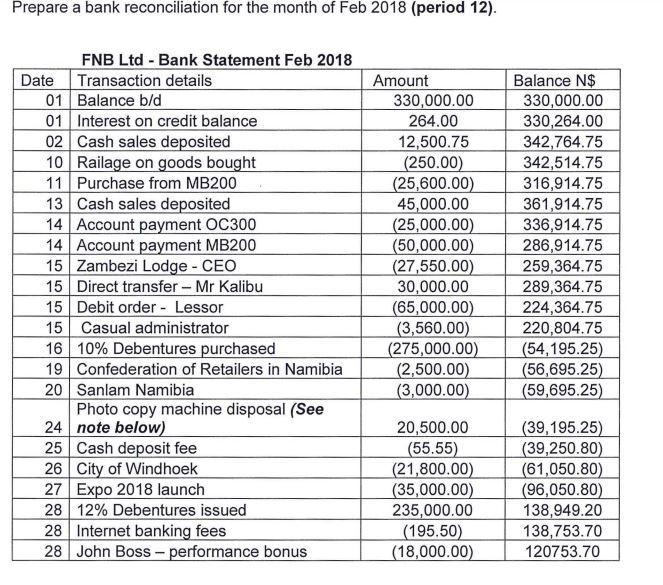

Prepare a bank reconciliation for the month of Feb 2018 (period 12). FNB Ltd - Bank Statement Feb 2018 Date Transaction details 01 Balance b/d 01 Interest on credit balance 02 Cash sales deposited 10 Railage on goods bought 11 Purchase from MB200 13 Cash sales deposited 14 Account payment OC300 14 Account payment MB200 15 Zambezi Lodge - CEO 15 Direct transfer - Mr Kalibu 15 Debit order - Lessor 15 Casual administrator 16 10% Debentures purchased 19 Confederation of Retailers in Namibia 20 Sanlam Namibia Photo copy machine disposal (See 24 note below) 25 Cash deposit fee 26 City of Windhoek 27 Expo 2018 launch 28 12% Debentures issued 28 Internet banking fees 28 John Boss - performance bonus Amount 330,000.00 264.00 12,500.75 (250.00) (25,600.00) 45,000.00 (25,000.00) (50,000.00) (27,550.00) 30,000.00 (65,000.00) (3,560.00) (275,000.00) (2,500.00) (3,000.00) 20,500.00 (55.55) (21,800.00) (35,000.00) 235,000.00 (195.50) (18,000.00) Balance N$ 330,000.00 330,264.00 342,764.75 342,514.75 316,914.75 361,914.75 336,914.75 286,914.75 259,364.75 289,364.75 224,364.75 220,804.75 (54,195.25) (56,695.25) (59,695.25) (39,195.25) (39,250.80) (61,050.80) (96,050.80) 138,949.20 138,753.70 120753.70

Step by Step Solution

3.46 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Lets analyze the given model for quantity demanded Dn and quantity supplied Pn Well use the provided ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started