Answered step by step

Verified Expert Solution

Question

1 Approved Answer

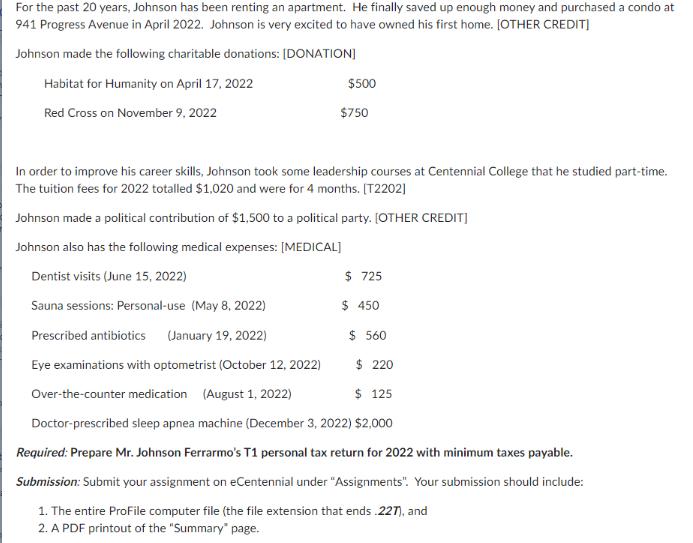

Mr. Johnson Ferrarmo is a supervisor at Retail Box Co. He received the following T4 slip: [T4] Employer's name Year Retail Box Co. 2022

![Mr. Johnson Ferrarmo is a supervisor at Retail Box Co. He received the following T4 slip: [T4] Employer's](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/09/651269ec431fc_1695705530465.jpg)

Mr. Johnson Ferrarmo is a supervisor at Retail Box Co. He received the following T4 slip: [T4] Employer's name Year Retail Box Co. 2022 Employment income [14] Employee's CPP contribution [16] Employee's El premiums [18] His personal information are as follows: [INFO] Marital Status: Single Address: 941 Progress Avenue, Toronto, ON, M1G 3T8 Phone Number: 416-289-5000 Date of Birth: October 14, 1976 75,000.00 3,499.80 952.74 Social insurance number Income tax deducted [22] El insurable earnings [24] CPP pensionable earnings [26] 527 000 145 12,800.00 60,300.00 64,900.00 For the past 20 years, Johnson has been renting an apartment. He finally saved up enough money and purchased a condo at 941 Progress Avenue in April 2022. Johnson is very excited to have owned his first home. [OTHER CREDIT] Johnson made the following charitable donations: [DONATION] Habitat for Humanity on April 17, 2022 Red Cross on November 9, 2022 $500 $750 In order to improve his career skills, Johnson took some leadership courses at Centennial College that he studied part-time. The tuition fees for 2022 totalled $1,020 and were for 4 months. [T2202] Johnson made a political contribution of $1,500 to a political party. [OTHER CREDIT] Johnson also has the following medical expenses: [MEDICAL] Dentist visits (June 15, 2022) Sauna sessions: Personal-use (May 8, 2022) Prescribed antibiotics (January 19, 2022) Eye examinations with optometrist (October 12, 2022) $220 Over-the-counter medication (August 1, 2022) $ 125 Doctor-prescribed sleep apnea machine (December 3, 2022) $2,000 Required: Prepare Mr. Johnson Ferrarmo's T1 personal tax return for 2022 with minimum taxes payable. Submission: Submit your assignment on eCentennial under "Assignments". Your submission should include: 1. The entire ProFile computer file (the file extension that ends.227), and 2. A PDF printout of the "Summary" page. $725 $ 450 $ 560

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare Mr Johnson Ferrarmos T1 personal tax return for 2022 with minimum taxes payable we will follow these steps and calculate the relevant value...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started