Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Joko, CFA and Mrs. Shinta, CFA, are senior analysts working in PT Kaya Raya. PT Kaya Raya specializes in fixed income and equity

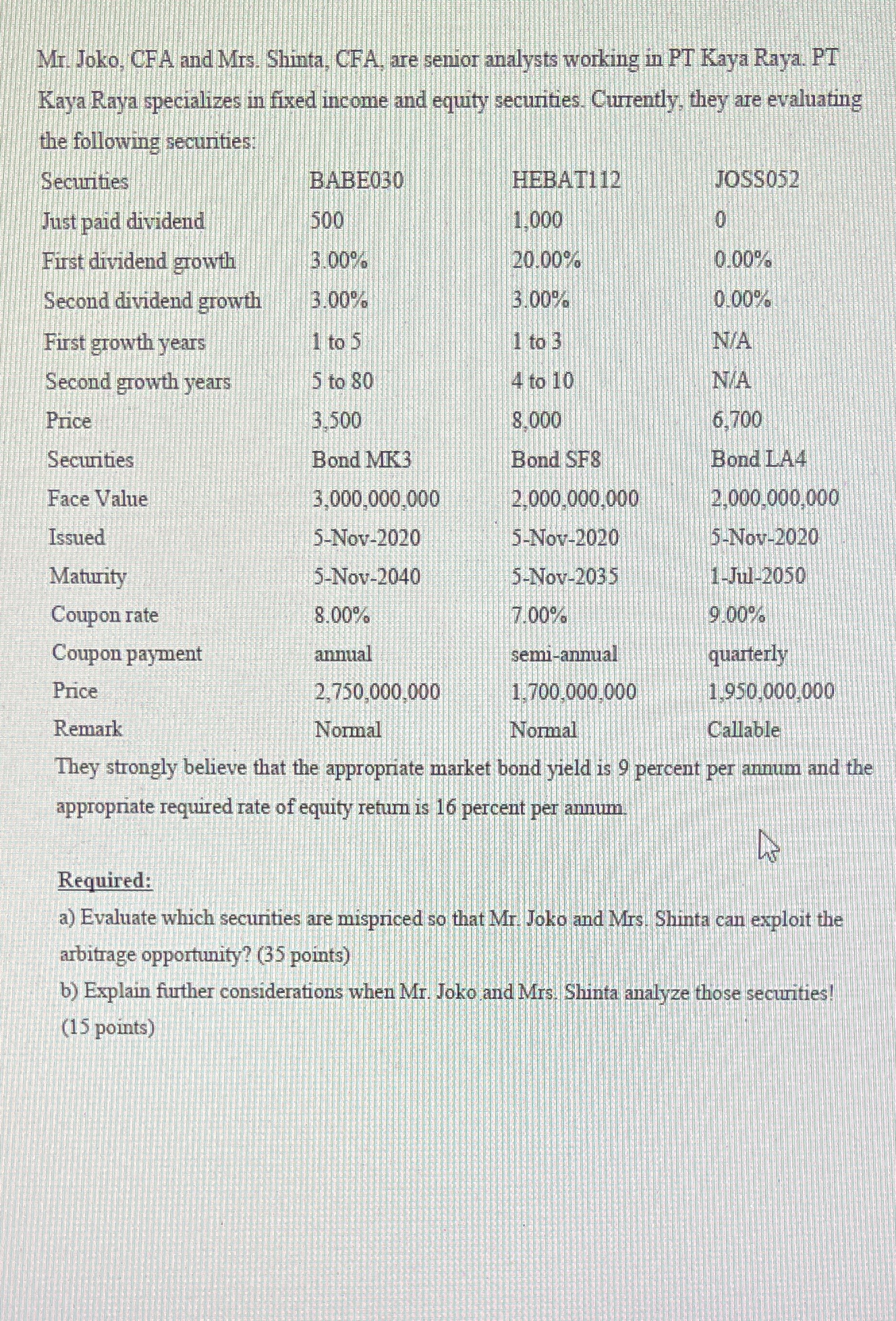

Mr. Joko, CFA and Mrs. Shinta, CFA, are senior analysts working in PT Kaya Raya. PT Kaya Raya specializes in fixed income and equity securities. Currently, they are evaluating the following securities: BABE030 500 3.00% 3.00% 1 to 5 5 to 80 3.500 Bond MK3 Securities Just paid dividend First dividend growth Second dividend growth First growth years Second growth years Price Securities Face Value Issued Maturity Coupon rate 9.00% Coupon payment quarterly Price 1,950,000,000 Remark Normal Normal Callable They strongly believe that the appropriate market bond yield is 9 percent per annum and the appropriate required rate of equity return is 16 percent per annum. 4 Required: a) Evaluate which securities are mispriced so that Mr. Joko and Mrs. Shinta can exploit the arbitrage opportunity? (35 points) b) Explain further considerations when Mr. Joko and Mrs. Shinta analyze those securities! (15 points) 3,000,000,000 5-Nov-2020 5-Nov-2040 8.00% annual HEBAT112 1.000 20.00% 3.00% 1 to 3 4 to 10 8.000 Bond SF3 2,000,000,000 5-Nov-2020 5-Nov-2035 7.00% 2,750,000,000 JOSS052 semi-annual 1,700,000,000 0 0.00% 0.00% N/A N/A 6,700 Bond LA4 2,000,000,000 5-Nov-2020 1-Jul-2050

Step by Step Solution

★★★★★

3.39 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate which securities are mispriced and identify potential arbitrage opportunities Mr Joko and Mrs Shinta need to compare the actual prices of the securities with their intrinsic values Intrins...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started