Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Jose wants to invest in bonds a sum of Ksh.100000. Three bonds are being examined by him with a holding period of three

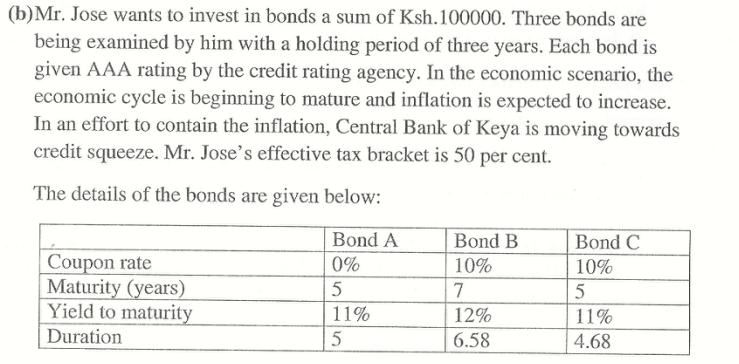

Mr. Jose wants to invest in bonds a sum of Ksh.100000. Three bonds are being examined by him with a holding period of three years. Each bond is given AAA rating by the credit rating agency. In the economic scenario, the economic cycle is beginning to mature and inflation is expected to increase. In an effort to contain the inflation, Central Bank of Keya is moving towards credit squeeze. Mr. Jose's effective tax bracket is 50 per cent. The details of the bonds are given below: Coupon rate Maturity (years) Yield to maturity Duration Bond A 0% 5 11% 5 Bond B 10% 7 12% 6.58 Bond C 10% 5 11% 4.68 If Mr. Jose has to pick up ay two of the bonds what would be his choice? What are the reasons you cite for picking up that particular bond? (10 marks)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Mr Jose should pick up Bond B and Bo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started