Question

Mr Len Philander (otherwise known as Len) is 64 years of age. He is married and has two children, a son, and a daughter, both

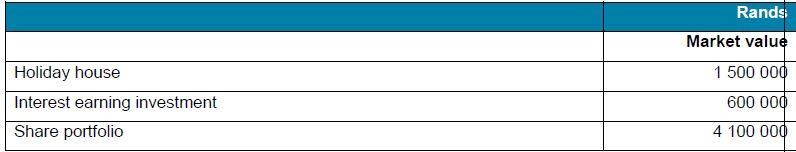

Mr Len Philander (otherwise known as Len) is 64 years of age. He is married and has two children, a son, and a daughter, both of whom are over 25 years of age. His son is a South African resident, but his daughter is a non-resident. Details of Len’s assets at 29 February 2020 are as follows:

For some time, Len has been considering creating an inter vivos trust, to which he would transfer (by

donation) the holiday home, interest-earning investment, and the share portfolio. The trust will be

discretionary with regards to both capital and income and have two independent trustees, other than

Len himself.

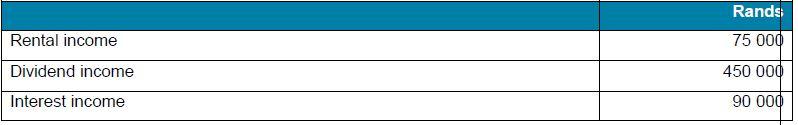

The following information in respect of income is relevant

Len made the following donations during the 2020 year of assessment:

1. On 1 March 2019, he donated his ‘three-year-old’ motor car to his mother. On this date it had a

book value of R122 880, a tax value of R96 000, and a market value of R80 000. It had originally

cost him R180 000. He took delivery of his new motor car on the same day.

2. On 1 May 2019, he waived a debt owed to him by his youngest brother, Glen, a full-time university

student, to whom he had, on 1 February 2018, lent R60 000 at an interest rate of 9% a year. The

capital together with the interest due was repayable by Glen to him on 1 May 2019.

3. On 1 July 2019, he gave his now-retired housekeeper, Pattie (who had attained the age of 60 years

on 30 June 2019), an annuity of R12 000 for the rest of her life. It is being awarded to her at a rate

of R1 000 a month. This donation was made to Pattie in recognition of 15 years of loyal and

efficient service to him. Pattie had retired from the position of his housekeeper on her sixtieth

birthday, on 30 June 2019, the day before the first R1 000 was awarded to her.

4. On 1 September 2019, he gave Simon, a younger brother (who was then 25 years old), one-third of

the profits of his (Len’s) publishing business for the remainder of Simon’s life. The average annual

profit of this business, before tax, over the past three years was R150 000. The business was

valued by an independent third party on 31 August 2019 at R500 000.

5. A day later, on 2 September 2019, he donated to David, a nephew (who was then 15 years old),

the one-third share in the business (that is subject to usufruct held by Simon), subject to Simon’s

entitlement to the profits from it.

6. On 1 November 2019, he donated R25 000 to a university (a ‘qualifying’ public-benefit

organisation). It used the proceeds of this donation to subsidise the salary it was paying to one of

its professors in its School of Medicine.

7. In December 2019, Len distributed Christmas gifts valued at R45 000 in total to his relatives. He

also gave his father a Cartier Custom Diamond Roadster Leather Band Watch valued at R200 000

and donated a stunning Harry Winston necklace for R900 000 for his wife’s birthday present.

8. On 1 January 2020, he donated R10 000 to his golf club. Recent floods had destroyed a bridge

over a river flowing through the golf course. The proceeds of this donation were used to help

finance the cost of building a new bridge. Under section 30A (2), the Commissioner has approved

the golf club as a ‘recreational club’. And under paragraph 9 of Part 1 of the Ninth Schedule it

carries on a public benefit activity.

9. On 20 February 2020 Len cancelled a donation of R450 000 he had made on 1 September 2019 to

the Baroda family trust. This was after he learnt that the family was involved in tender fraud with the

local government officials.

You are required to:

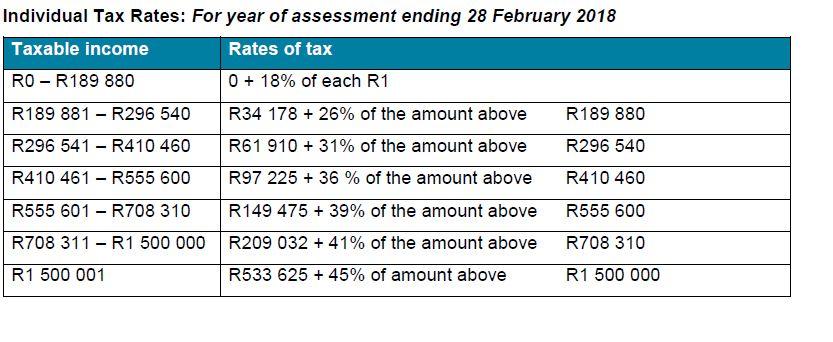

2.1 Assume that Len goes ahead and creates the inter-vivos trust on 31 July 2019 to which he donates the holiday home, interest earning investment, and the share portfolio. Draft a letter as a tax consultant to Len advising him on the tax implications of the creation of the trust,

including in whose hands the trust income will be taxed.

Support your advice with relevant calculations of the position if the trust were to pay a distribution to Len’s two major children on 29 February 2020 of R100 000 each out of all the income in the trust. (28 Marks)

Appropriateness of the format and presentation of the letter and the effectiveness with which the information is communicated. (2 Marks)

Holiday house Interest earning investment Share portfolio Rands Market value 1 500 000 600 000 4 100 000

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Dear Mr Len Philander RE Tax Implications of Creating an InterVivos Trust I hope this letter finds you well As your tax consultant I am writing to advise you on the tax implications of creating the in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started