Mr Leong aged 53, is the factory manager of Best Electronics Sdn Bhd which manufactures electronic components for export to its holding company in

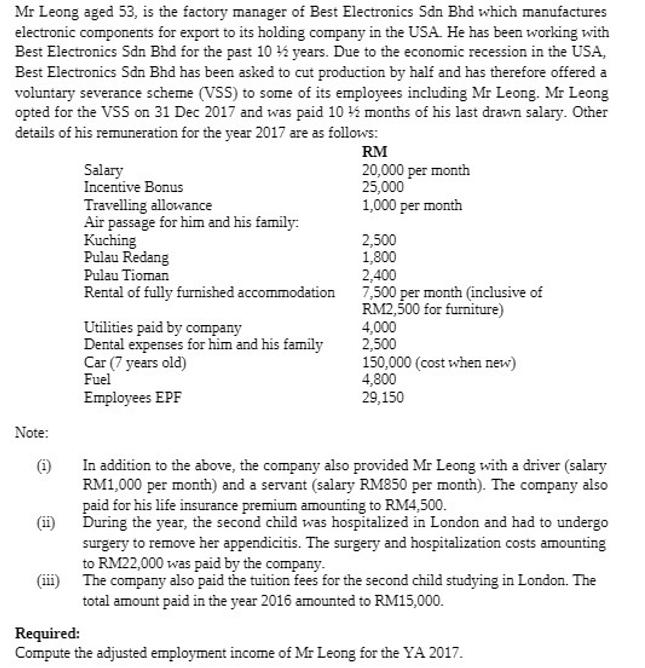

Mr Leong aged 53, is the factory manager of Best Electronics Sdn Bhd which manufactures electronic components for export to its holding company in the USA. He has been working with Best Electronics Sdn Bhd for the past 10 years. Due to the economic recession in the USA, Best Electronics Sdn Bhd has been asked to cut production by half and has therefore offered a voluntary severance scheme (VSS) to some of its employees including Mr Leong. Mr Leong opted for the VSS on 31 Dec 2017 and was paid 10 months of his last drawn salary. Other details of his remuneration for the year 2017 are as follows: Note: (1) Salary Incentive Bonus Travelling allowance Air passage for him and his family: Kuching Pulau Redang Pulau Tioman Rental of fully furnished accommodation (ii) Utilities paid by company Dental expenses for him and his family Car (7 years old) Fuel Employees EPF RM 20,000 per month 25,000 1,000 per month 2,500 1,800 2,400 7,500 per month (inclusive of RM2,500 for furniture) 4,000 2,500 150,000 (cost when new) 4,800 29,150 In addition to the above, the company also provided Mr Leong with a driver (salary RM1,000 per month) and a servant (salary RM850 per month). The company also paid for his life insurance premium amounting to RM4,500. During the year, the second child was hospitalized in London and had to undergo surgery to remove her appendicitis. The surgery and hospitalization costs amounting to RM22,000 was paid by the company. (iii) The company also paid the tuition fees for the second child studying in London. The total amount paid in the year 2016 amounted to RM15,000. Required: Compute the adjusted employment income of Mr Leong for the YA 2017.

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started