Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Mark Vargo has been a resident of Canada all of his life. He was recently offered a lucrative job with a reputable firm

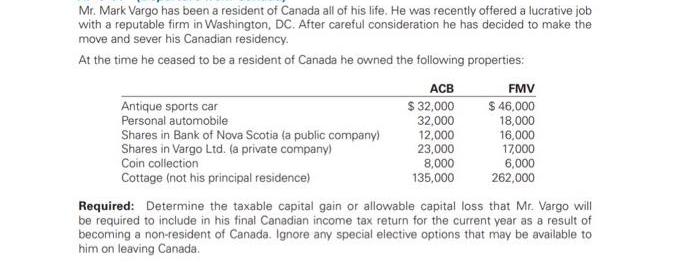

Mr. Mark Vargo has been a resident of Canada all of his life. He was recently offered a lucrative job with a reputable firm in Washington, DC. After careful consideration he has decided to make the move and sever his Canadian residency. At the time he ceased to be a resident of Canada he owned the following properties: Antique sports car Personal automobile Shares in Bank of Nova Scotia (a public company) Shares in Vargo Ltd. (a private company) Coin collection Cottage (not his principal residence) ACB $ 32,000 32,000 12,000 23,000 8,000 135,000 FMV $ 46,000 18,000 16,000 17,000 6,000 262,000 Required: Determine the taxable capital gain or allowable capital loss that Mr. Vargo will be required to include in his final Canadian income tax return for the current year as a result of becoming a non-resident of Canada. Ignore any special elective options that may be available to him on leaving Canada.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION When an individual ceases to be a resident of Canada they are deemed to have disposed of al...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started