Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Miser, who is 35 years old, has just inherited R11 000 and decides to use the windfall towards his retirement. He places the

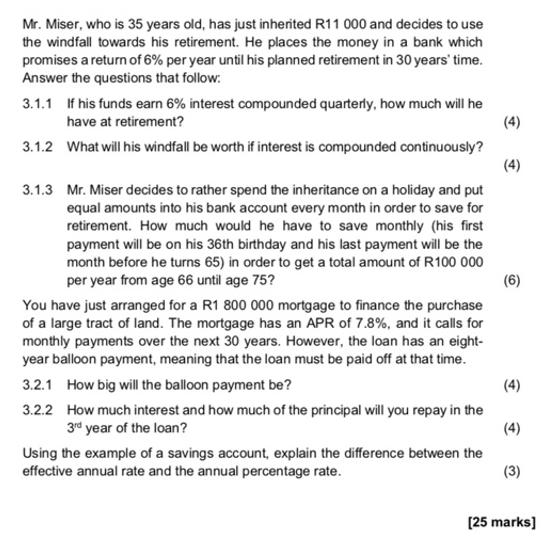

Mr. Miser, who is 35 years old, has just inherited R11 000 and decides to use the windfall towards his retirement. He places the money in a bank which promises a return of 6% per year until his planned retirement in 30 years' time. Answer the questions that follow: 3.1.1 If his funds earn 6% interest compounded quarterly, how much will he have at retirement? (4) 3.1.2 What will his windfall be worth if interest is compounded continuously? (4) 3.1.3 Mr. Miser decides to rather spend the inheritance on a holiday and put equal amounts into his bank account every month in order to save for retirement. How much would he have to save monthly (his first payment will be on his 36th birthday and his last payment will be the month before he turns 65) in order to get a total amount of R100 000 (6) per year from age 66 until age 75? You have just arranged for a R1 800 000 mortgage to finance the purchase of a large tract of land. The mortgage has an APR of 7.8%, and it calls for monthly payments over the next 30 years. However, the loan has an eight- year balloon payment, meaning that the loan must be paid off at that time. 3.2.1 How big will the balloon payment be? (4) 3.2.2 How much interest and how much of the principal will you repay in the (4) 3rd year of the loan? Using the example of a savings account, explain the difference between the effective annual rate and the annual percentage rate. [25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started