Answered step by step

Verified Expert Solution

Question

1 Approved Answer

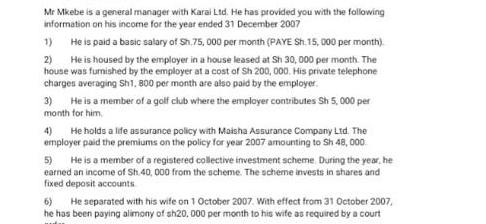

Mr Mkebe is a general manager with Karai Ltd. He has provided you with the following information on his income for the year ended

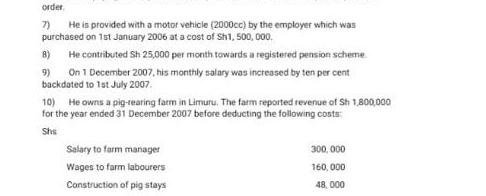

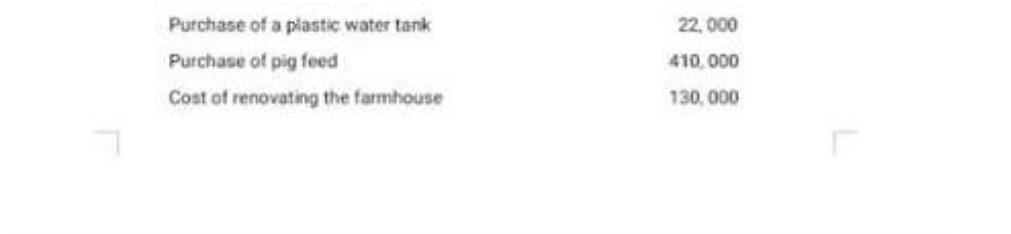

Mr Mkebe is a general manager with Karai Ltd. He has provided you with the following information on his income for the year ended 31 December 2007 1) He is paid a basic salary of Sh.75, 000 per month (PAYE Sh.15,000 per month) 2) He is housed by the employer in a house leased at Sh 30, 000 per month. The house was furnished by the employer at a cost of Sh 200, 000. His private telephone charges averaging Sh1, 800 per month are also paid by the employer 3) He is a member of a golf club where the employer contributes Sh 5,000 per month for him. 4) He holds a life assurance policy with Maisha Assurance Company Ltd. The employer paid the premiums on the policy for year 2007 amounting to Sh 48,000 5) He is a member of a registered collective investment scheme. During the year, he earned an income of Sh.40, 000 from the scheme. The scheme invests in shares and fixed deposit accounts 6) He separated with his wife on 1 October 2007. With effect from 31 October 2007, he has been paying alimony of sh20, 000 per month to his wife as required by a court order. 7) He is provided with a motor vehicle (2000cc) by the employer which was purchased on 1st January 2006 at a cost of Sh1, 500,000. 8) 9) He contributed Sh 25,000 per month towards a registered pension scheme On 1 December 2007, his monthly salary was increased by ten per cent backdated to 1st July 2007. 10) He owns a pig-rearing farm in Limuru. The farm reported revenue of Sh 1,800,000 for the year ended 31 December 2007 before deducting the following costs: Shs Salary to farm manager Wages to farm labourers Construction of pig stays 300,000 160,000 48,000 Purchase of a plastic water tank Purchase of pig feed Cost of renovating the farmhouse 22,000 410,000 130,000 Required: i Taxable income of Mr. Mkebe for the year ended 31 December 2007. ii. Tax liability from the income computed in (i)

Step by Step Solution

★★★★★

3.31 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

I To compute the taxable income of Mr Mkebe for the year ended 31 December 2007 Basic salary Sh 7500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started