Question

Mr. Neville owns 100% of First Gear Ltd, a CCPC, and 33% of Second Gear Ltd, another CCPC. His wife, Mrs. Neville, owns 33% of

Mr. Neville owns 100% of First Gear Ltd, a CCPC, and 33% of Second Gear Ltd, another CCPC. His wife, Mrs. Neville, owns 33% of Second Gear Ltd. The last 33% of Second Gear Ltd. is owned by their adult son, Alex. Assume that all shares are common voting shares.

Second Gear Ltd.'s taxable capital employed in Canada is $15 million. Second Gear has no investment income. Their active business income and taxable income in 2022 is $10,000, and they have already claimed a Small Business Deduction on the entire amount ($1,900).

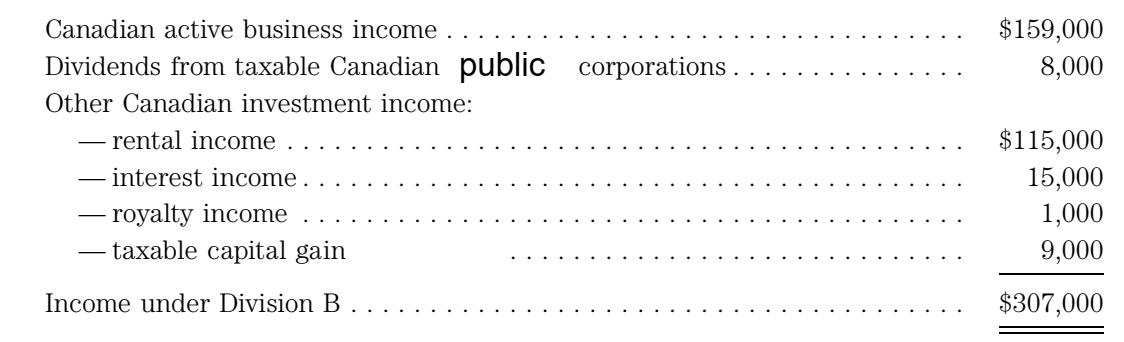

In 2022, First Gear Ltd. calculated their Division B income for tax purposes as follows:

First Gear Ltd.'s taxable capital gain includes $3,000 from the sale of investments, and $6,000 from the sale of a truck used in business.

The company donated $60,000 to registered charities during 2022. Their carry-forward balances include: $10,000 of donations carried forward from 2021, and $2,000 of net capital losses from 2016.

Assume investment income earned in the prior year is the same as the amount earned in the current year. First Gear Ltd. has $20 million of taxable capital in Canada.

Calculate the Small Business Deduction that First Gear Ltd. may claim for the 2022 tax year.

Canadian active business income. Dividends from taxable Canadian public corporations. Other Canadian investment income: rental income interest income. - royalty income - taxable capital gain Income under Division B $159,000 8,000 $115,000 15,000 1,000 9,000 $307,000

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer First Gear Ltd has a total of 300000 in income under Division B This includes 159000 in Canadian active business income 8000 in dividends from taxable Canadian public corporations 115000 in oth...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started