Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Peter started his business QN3 Shirts on the 1st day of August 2022. Initially, Mr peter decided that he would be selling only

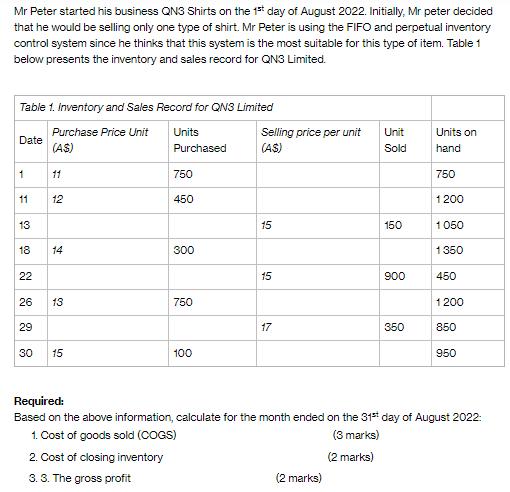

Mr Peter started his business QN3 Shirts on the 1st day of August 2022. Initially, Mr peter decided that he would be selling only one type of shirt. Mr Peter is using the FIFO and perpetual inventory control system since he thinks that this system is the most suitable for this type of item. Table 1 below presents the inventory and sales record for QNS Limited. Table 1. Inventory and Sales Record for QN3 Limited Purchase Price Unit (A$) Date 1 11 13 18 22 26 29 30 11 12 14 13 15 Units Purchased 2. Cost of closing inventory 3.3. The gross profit 750 450 300 750 100 Selling price per unit (A$) 15 15 17 (2 marks) Unit Sold (2 marks) 150 900 350 Units on hand 750 1200 1050 1350 450 1200 Required: Based on the above information, calculate for the month ended on the 31st day of August 2022: 1. Cost of goods sold (COGS) (3 marks) 850 950

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Cost of Goods Sold COGS Cost of Closing Inventory and Gross Profit for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started