Question

Mr. Peters is a fully paid up member of a Building Society and owns 20 000 shares. He receives a dividend of 95 cents

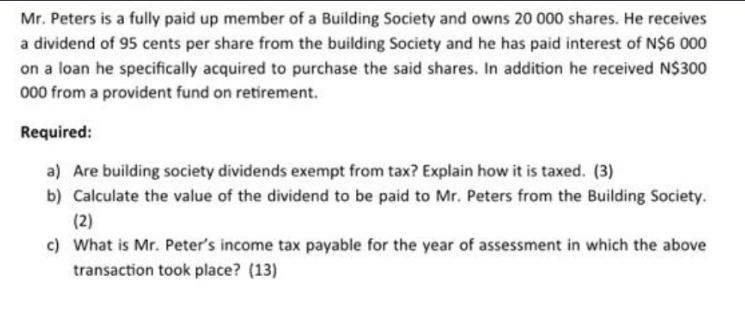

Mr. Peters is a fully paid up member of a Building Society and owns 20 000 shares. He receives a dividend of 95 cents per share from the building Society and he has paid interest of N$6 000 on a loan he specifically acquired to purchase the said shares. In addition he received N$300 000 from a provident fund on retirement. Required: a) Are building society dividends exempt from tax? Explain how it is taxed. (3) b) Calculate the value of the dividend to be paid to Mr. Peters from the Building Society. (2) c) What is Mr. Peter's income tax payable for the year of assessment in which the above transaction took place? (13)

Step by Step Solution

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

23rd Edition

978-0324662962

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App