Answered step by step

Verified Expert Solution

Question

1 Approved Answer

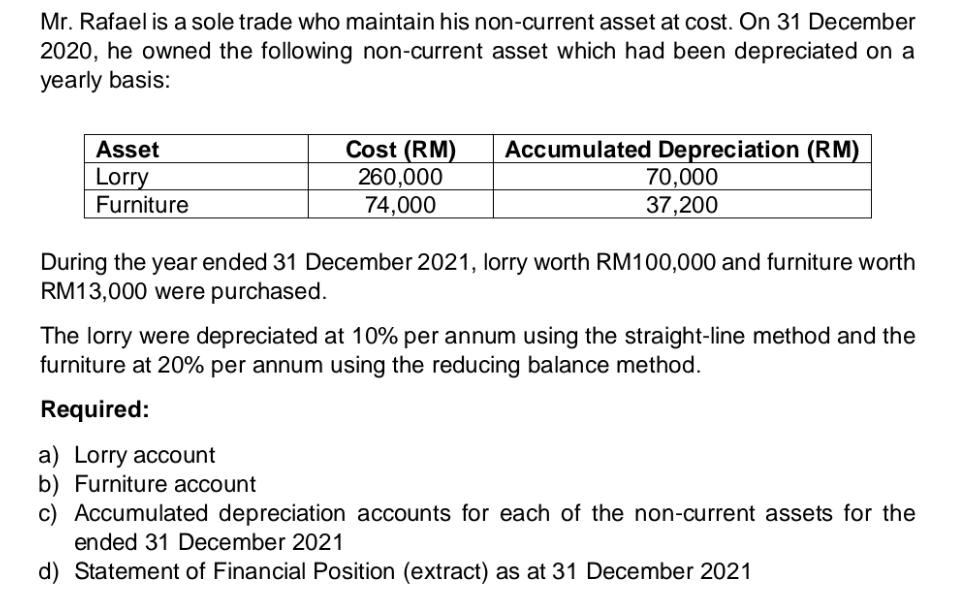

Mr. Rafael is a sole trade who maintain his non-current asset at cost. On 31 December 2020, he owned the following non-current asset which

Mr. Rafael is a sole trade who maintain his non-current asset at cost. On 31 December 2020, he owned the following non-current asset which had been depreciated on a yearly basis: Asset Lorry Furniture Cost (RM) 260,000 74,000 Accumulated Depreciation (RM) 70,000 37,200 During the year ended 31 December 2021, lorry worth RM100,000 and furniture worth RM13,000 were purchased. The lorry were depreciated at 10% per annum using the straight-line method and the furniture at 20% per annum using the reducing balance method. Required: a) Lorry account b) Furniture account c) Accumulated depreciation accounts for each of the non-current assets for the ended 31 December 2021 d) Statement of Financial Position (extract) as at 31 December 2021

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem lets go through each requirement stepbystep a Lorry account Opening balance Co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started