Question

Mr. Rushan Perera, is the newly appointed financial analyst of the Steel Tube division of NCB Engineering PLC. Mr. Perera closed the office door and

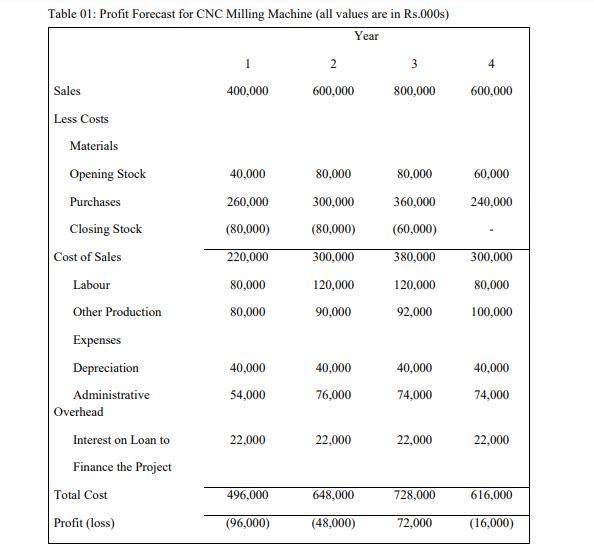

Mr. Rushan Perera, is the newly appointed financial analyst of the Steel Tube division of NCB Engineering PLC. Mr. Perera closed the office door and walk towards his desk because he has just 24 hours left to re-evaluate the profit forecasts produced by the accountant. He has been assigned with the task to provide recommendations on proposed new computer numerically controlled (CNC) milling machine. In the meeting held with the Board of Directors, Managing Director (CMD) specifically pointed out that if the project cannot give the desired results within the first three (03) years, it is useless in investing. Mr. Perera was not happy about the presentation made by the Accountant of the Company which highlighted the project as a failure. However, the MD pointed out that if Mr. Perera cannot convince him by tomorrow investing Rs.240,000,000 in this project is worthwhile, he must completely drop the investment decision. Mr. Rushan Perea's first task is therefore to re-evaluate the profit forecast produced by the Accountant (Table 01)

1. Due to the rapid technological development in the market, the lifetime of the milling machine is not more than four (04) years and scrap value would be around Rs.20,000,000. Scrap value is equal to the selling of metal that is left at the end of the project

2. The opening stock in Year 1 would be acquired at the same time as the machine. All other stock movement would occur at the year ends.

3. The machines like this are depreciated on straight line basis and lifetime considered six (06) years

4. 'Other production expenses' includes apportioned fixed overheads equal to 20% of labour costs. As far as could be seen, none of these overheads were incurred because of the proposal.

5. The administration charge was an apportionment of central fixed overheads.

Is this project profitable. can u give me an explanation using NPV and other justifications?

Table 01: Profit Forecast for CNC Milling Machine (all values are in Rs.000s) Year Sales Less Costs Materials Opening Stock Purchases Closing Stock Cost of Sales Labour Other Production Expenses Depreciation Administrative Overhead Interest on Loan to Finance the Project Total Cost Profit (loss) 1 400,000 40,000 260,000 (80,000) 220,000 80,000 80,000 40,000 54,000 22,000 496,000 (96,000) 2 600,000 80,000 300,000 (80,000) 300,000 120,000 90,000 40,000 76,000 22,000 648,000 (48,000) 3 800,000 80,000 360,000 (60,000) 380,000 120,000 92,000 40,000 74,000 22,000 728,000 72,000 4 600,000 60,000 240,000 300,000 80,000 100,000 40,000 74,000 22,000 616,000 (16,000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine whether the project is profitable we can calculate its net present value NPV and compare it to the initial investment of Rs240000000 To calculate the NPV we need to estimate the cash infl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started