Answered step by step

Verified Expert Solution

Question

1 Approved Answer

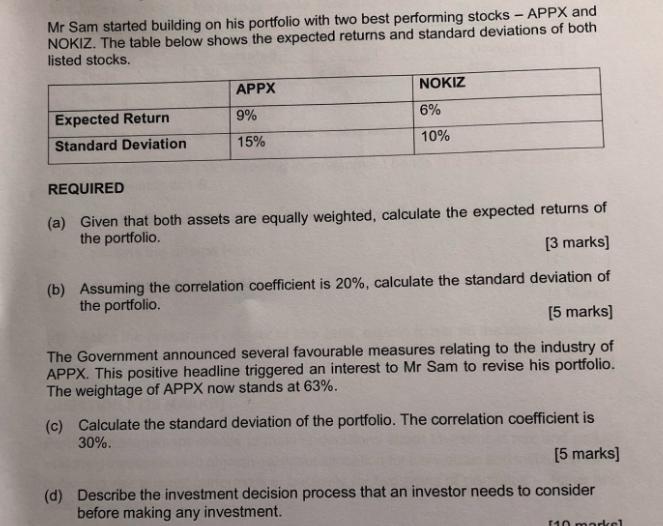

Mr Sam started building on his portfolio with two best performing stocks - APPX and NOKIZ. The table below shows the expected returns and

Mr Sam started building on his portfolio with two best performing stocks - APPX and NOKIZ. The table below shows the expected returns and standard deviations of both listed stocks. Expected Return Standard Deviation APPX 9% 15% NOKIZ 6% 10% REQUIRED (a) Given that both assets are equally weighted, calculate the expected returns of the portfolio. [3 marks] (b) Assuming the correlation coefficient is 20%, calculate the standard deviation of the portfolio. [5 marks] The Government announced several favourable measures relating to the industry of APPX. This positive headline triggered an interest to Mr Sam to revise his portfolio. The weightage of APPX now stands at 63%. (c) Calculate the standard deviation of the portfolio. The correlation coefficient is 30%. [5 marks] (d) Describe the investment decision process that an investor needs to consider before making any investment. 110 markel (e) Explain the importance of portfolio diversification with reference to systematic and unsystematic risks. [10 marks] (f) How far does the assumptions of the Capital Asset Pricing Model (CAPM) hold in reality? [10 marks] (g) Discuss the importance of investment philosophy and list down 3 investment philosophies that investors tend to adopt. Mr Sam started building on his portfolio with two best performing stocks - APPX and NOKIZ. The table below shows the expected returns and standard deviations of both listed stocks. Expected Return Standard Deviation APPX 9% 15% NOKIZ 6% 10% REQUIRED (a) Given that both assets are equally weighted, calculate the expected returns of the portfolio. [3 marks] (b) Assuming the correlation coefficient is 20%, calculate the standard deviation of the portfolio. [5 marks] The Government announced several favourable measures relating to the industry of APPX. This positive headline triggered an interest to Mr Sam to revise his portfolio. The weightage of APPX now stands at 63%. (c) Calculate the standard deviation of the portfolio. The correlation coefficient is 30%. [5 marks] (d) Describe the investment decision process that an investor needs to consider before making any investment. 110 markel (e) Explain the importance of portfolio diversification with reference to systematic and unsystematic risks. [10 marks] (f) How far does the assumptions of the Capital Asset Pricing Model (CAPM) hold in reality? [10 marks] (g) Discuss the importance of investment philosophy and list down 3 investment philosophies that investors tend to adopt.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected return of the portfolio we need to consider the weighted average of the expected returns of the individual stocks Given APPX Expected Return APPX 9 Standard Deviation APPX ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started