Answered step by step

Verified Expert Solution

Question

1 Approved Answer

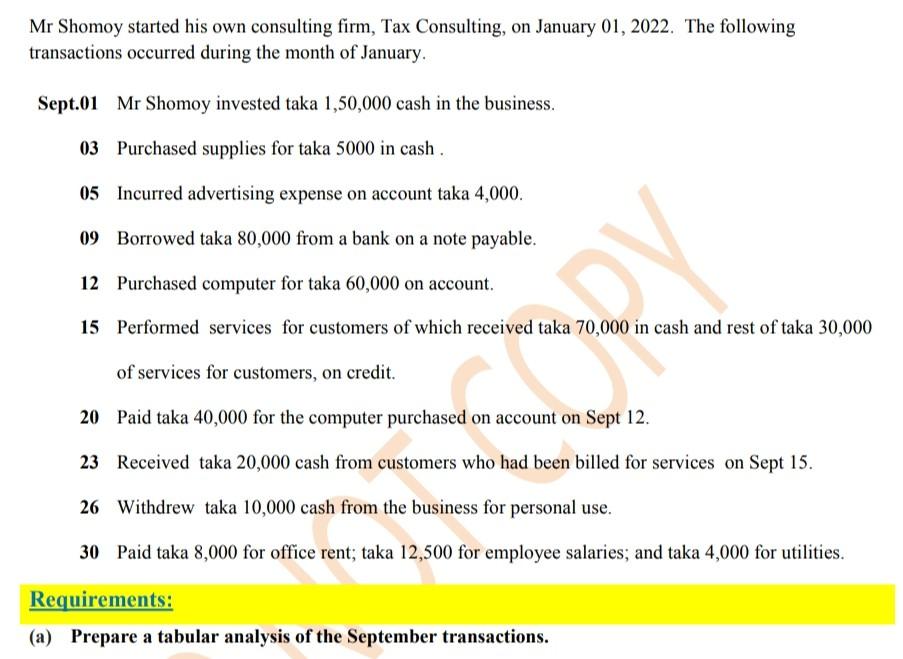

Mr Shomoy started his own consulting firm, Tax Consulting, on January 01, 2022. The following transactions occurred during the month of January. Sept.01 Mr

Mr Shomoy started his own consulting firm, Tax Consulting, on January 01, 2022. The following transactions occurred during the month of January. Sept.01 Mr Shomoy invested taka 1,50,000 cash in the business. 03 Purchased supplies for taka 5000 in cash. 05 Incurred advertising expense on account taka 4,000. 09 Borrowed taka 80,000 from a bank on a note payable. 12 Purchased computer for taka 60,000 on account. 15 Performed services for customers of which received taka 70,000 in cash and rest of taka 30,000 of services for customers, on credit. 20 Paid taka 40,000 for the computer purchased on account on Sept 12. 23 Received taka 20,000 cash from customers who had been billed for services on Sept 15. 26 Withdrew taka 10,000 cash from the business for personal use. 30 Paid taka 8,000 for office rent; taka 12,500 for employee salaries; and taka 4,000 for utilities. Requirements: (a) Prepare a tabular analysis of the September transactions. CORY

Step by Step Solution

★★★★★

3.36 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Explanation Date Sep01 Sep03 Sep05 Sep09 Sep12 Sep15 Sep20 Sep23 Sep26 Sep30 Final Bal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started