Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Siegfried Karson is employed by a publicly traded Canadian corporation. His 2023 salary was $92,500. In addition, he earned and received a bonus

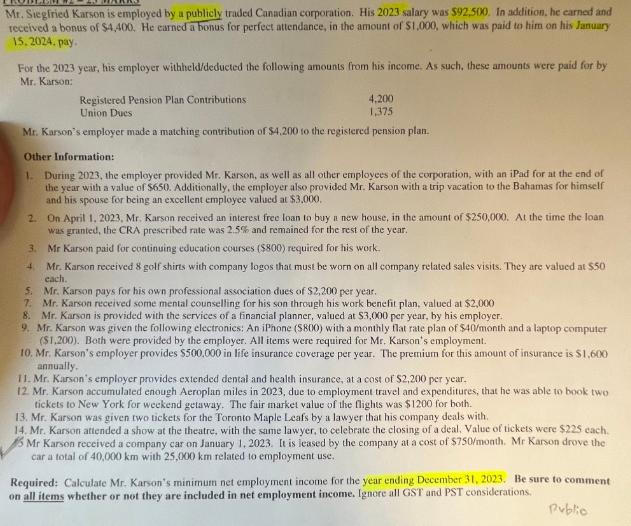

Mr. Siegfried Karson is employed by a publicly traded Canadian corporation. His 2023 salary was $92,500. In addition, he earned and received a bonus of $4,400. He earned a bonus for perfect attendance, in the amount of $1,000, which was paid to him on his January 15.2024, pay. For the 2023 year, his employer withheld/deducted the following amounts from his income. As such, these amounts were paid for by Mr. Karson: Registered Pension Plan Contributions Union Dues 4,200 1,375 Mr. Karson's employer made a matching contribution of $4,200 to the registered pension plan. Other Information: 1. During 2023, the employer provided Mr. Karson, as well as all other employees of the corporation, with an iPad for at the end of the year with a value of $650. Additionally, the employer also provided Mr. Karson with a trip vacation to the Bahamas for himself and his spouse for being an excellent employee valued at $3,000. 2. On April 1, 2023, Mr. Karson received an interest free loan to buy a new house, in the amount of $250,000. At the time the loan was granted, the CRA prescribed rate was 2.5% and remained for the rest of the year. 3. Mr Karson paid for continuing education courses ($800) required for his work. 4 Mr. Karson received 8 golf shirts with company logos that must be worn on all company related sales visits. They are valued at $50 cch. 5. Mr. Karson pays for his own professional association dues of $2,200 per year. 7. Mr. Karson received some mental counselling for his son through his work benefit plan, valued at $2,000 8. Mr. Karson is provided with the services of a financial planner, valued at $3,000 per year, by his employer. 9. Mr. Karson was given the following electronics: An iPhone ($800) with a monthly flat rate plan of $40/month and a laptop computer ($1,200). Both were provided by the employer. All items were required for Mr. Karson's employment. 10. Mr. Karson's employer provides $500,000 in life insurance coverage per year. The premium for this amount of insurance is $1,600 annually. 11. Mr. Karson's employer provides extended dental and health insurance, at a cost of $2,200 per year. 12. Mr. Karson accumulated enough Aeroplan miles in 2023, due to employment travel and expenditures, that he was able to book two tickets to New York for weekend getaway. The fair market value of the flights was $1200 for both. 13. Mr. Karson was given two tickets for the Toronto Maple Leafs by a lawyer that his company deals with. 14. Mr. Karson attended a show at the theatre, with the same lawyer, to celebrate the closing of a deal. Value of tickets were $225 each. 5 Mr Karson received a company car on January 1, 2023. It is leased by the company at a cost of $750/month. Mr Karson drove the car a total of 40,000 km with 25,000 km related to employment use. Required: Calculate Mr. Karson's minimum net employment income for the year ending December 31, 2023. Be sure to comment on all items whether or not they are included in net employment income. Ignore all GST and PST considerations. Public

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started