Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr . Tan was the President of a highly profitable corporation which was engage in the marketing of Mercedes Benz. When Mr . Tan's daughter

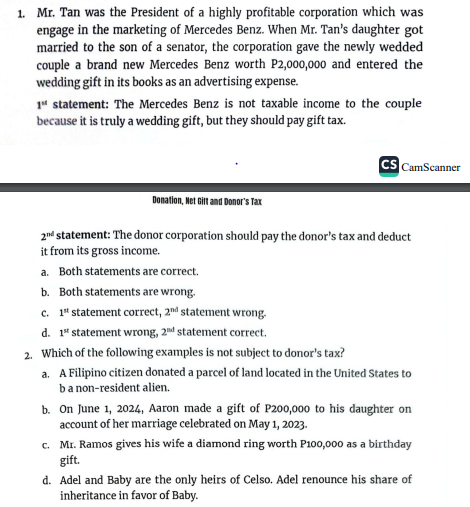

Mr Tan was the President of a highly profitable corporation which was

engage in the marketing of Mercedes Benz. When Mr Tan's daughter got

married to the son of a senator the corporation gave the newly wedded

couple a brand new Mercedes Benz worth P and entered the

wedding gift in its books as an advertising expense.

statement: The Mercedes Benz is not taxable income to the couple

because it is truly a wedding gift, but they should pay gift tax.

Donation, Met Gitt and Donor's Jax

statement: The donor corporation should pay the donor's tax and deduct

it from its gross income.

a Both statements are correct.

b Both statements are wrong.

c statement correct, statement wrong.

d statement wrong, statement correct.

Which of the following examples is not subject to donor's tax?

a A Filipino citizen donated a parcel of land located in the United States to

b a nonresident alien.

b On June Aaron made a gift of P to his daughter on

account of her marriage celebrated on May

c Mr Ramos gives his wife a diamond ring worth P as a birthday

gift.

d Adel and Baby are the only heirs of Celso. Adel renounce his share of

inheritance in favor of Baby.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started