Answered step by step

Verified Expert Solution

Question

1 Approved Answer

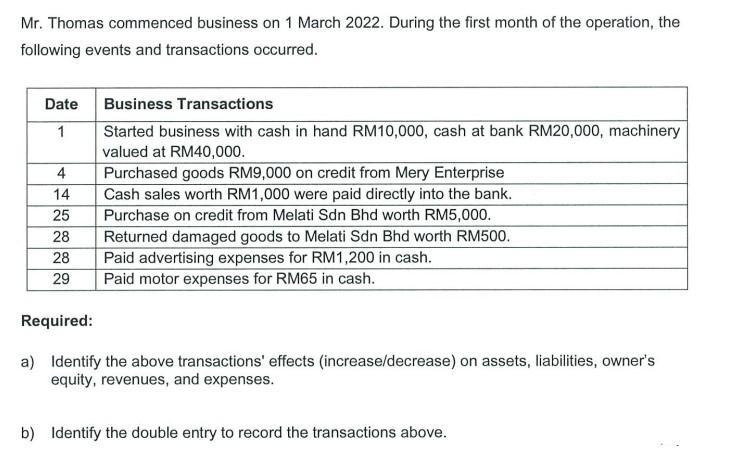

Mr. Thomas commenced business on 1 March 2022. During the first month of the operation, the following events and transactions occurred. Date 1 4

Mr. Thomas commenced business on 1 March 2022. During the first month of the operation, the following events and transactions occurred. Date 1 4 14 25 28 28 29 Business Transactions Started business with cash in hand RM10,000, cash at bank RM20,000, machinery valued at RM40,000. Purchased goods RM9,000 on credit from Mery Enterprise Cash sales worth RM1,000 were paid directly into the bank. Purchase on credit from Melati Sdn Bhd worth RM5,000. Returned damaged goods to Melati Sdn Bhd worth RM500. Paid advertising expenses for RM1,200 in cash. Paid motor expenses for RM65 in cash. Required: a) Identify the above transactions' effects (increase/decrease) on assets, liabilities, owner's equity, revenues, and expenses. b) Identify the double entry to record the transactions above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To identify the effects of the transactions on assets liabilities owners equity revenues and expenses well analyze each transaction and categorize its ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started