Question: Mr. Thompson is a businessman. He started a business five years ago and it has increased in size gradually for its continuous success. Thompson Inc.

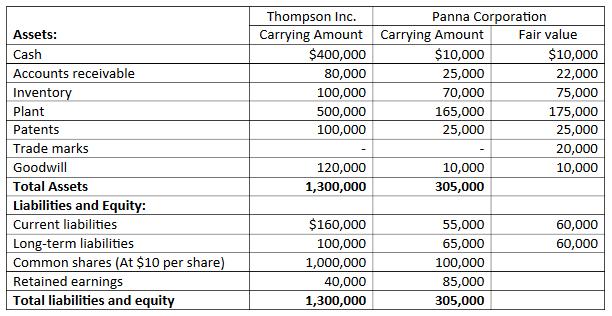

Mr. Thompson is a businessman. He started a business five years ago and it has increased in size gradually for its continuous success. Thompson Inc. is a private company and it uses ASPE for preparing its financial statements. It has completed accounting year on December 31, 2017. At the end of 2017, the financial position statement shows that there is huge amount of surplus cash and Thompson has shown interest in investing a part of the surplus amount to the equity securities of Panna Corporation. It is also a growing company in the same industry. The balance sheets of Thompson Inc. and Panna Corporation as on December 31, 2017 with fair values of assets and liabilities of Panna Corporation are presented below:

You, a CPA, CGA, the CFO of Thompson Inc., were asked by Mr. Thompson to give your opinion on the following different situations regarding the –

• Accounting requirements for the following investment proposals; and

• Presentation of Financial statement for each independent investment proposals of Mr. Thompson.

Situations:

1. Suppose Thompson purchased 1,000 shares of Panna Corporation at $ 1,100 on January 1, 2018. Show the journal entry for this transaction in the book of Thompson and present the balance sheet of Thompson Inc. aCer this investment on January 1, 2018.

2. Suppose Thompson purchased 4,000 shares of Panna Corporation at $ 4,500 on January 1, 2018. These shares are traded in Toronto Stock Exchange. Thompson Inc. gained significant in Euence over the investee (Panna Corporation) by this investment. Explain to Mr. Thompson what will be the appropriate accounting method for this transaction. Show the journal entry for this transaction in the book of Thompson on January 1, 2018.

Thompson Inc. Carrying Amount Carrying Amount Panna Corporation Assets: Fair value Cash $400,000 $10,000 $10,000 Accounts receivable 80,000 25,000 22,000 Inventory 100,000 70,000 75,000 Plant 500,000 165,000 175,000 Patents 100,000 25,000 25,000 Trade marks 20,000 Goodwill 120,000 10,000 10,000 Total Assets 1,300,000 305,000 Liabilities and Equity: Current liabilities $160,000 55,000 60,000 Long-term liabilities Common shares (At $10 per share) Retained earnings Total liabilities and equity 100,000 65,000 60,000 1,000,000 100,000 40,000 85,000 305,000 1,300,000

Step by Step Solution

3.36 Rating (174 Votes )

There are 3 Steps involved in it

To address Mr Thompsons inquiries about the investment proposals in Panna Corporation lets tackle each situation step by step Thompson Inc uses ASPE A... View full answer

Get step-by-step solutions from verified subject matter experts