Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Tiwari a young and upcoming professional decided to open a franchised supermarket after completing his various education. After 30 years of being in

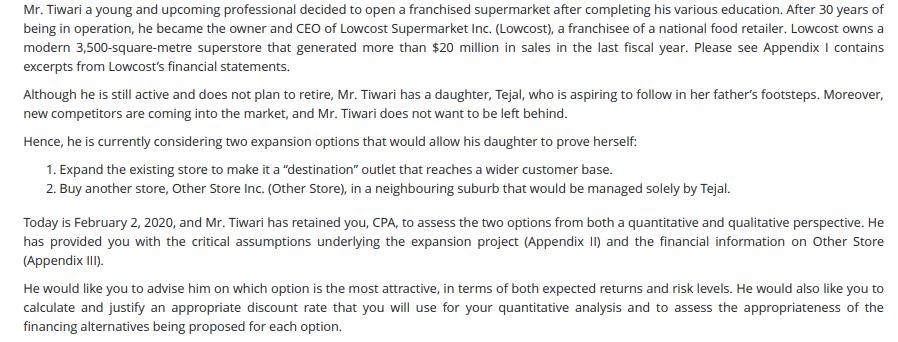

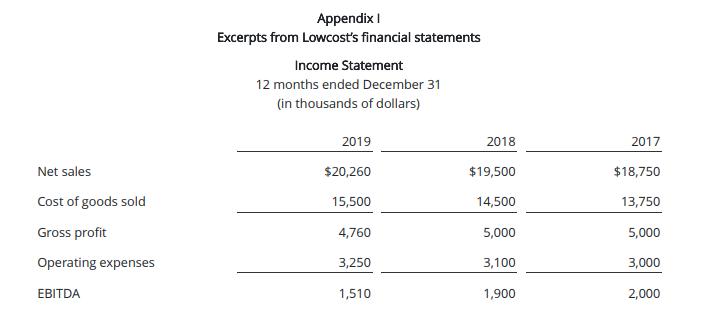

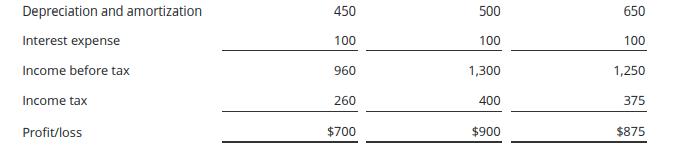

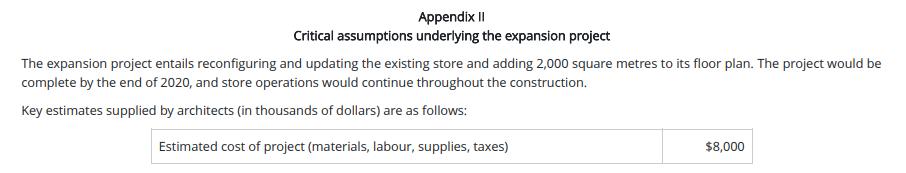

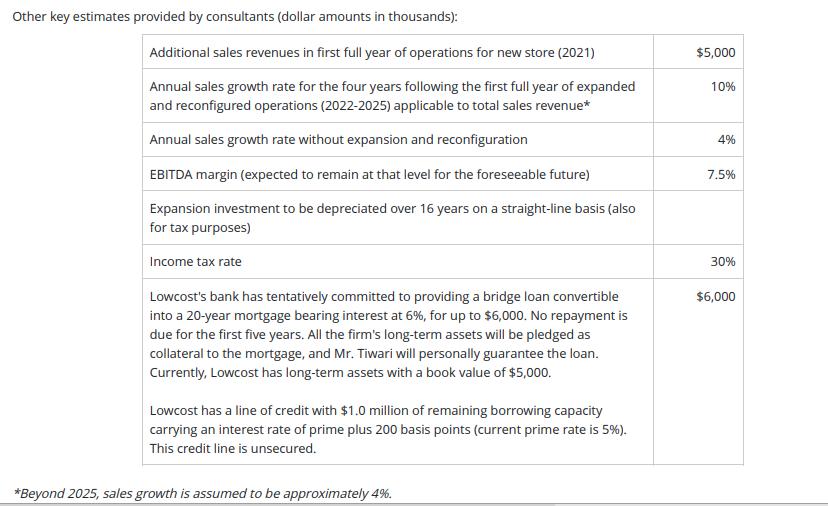

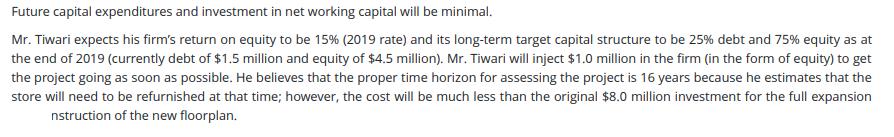

Mr. Tiwari a young and upcoming professional decided to open a franchised supermarket after completing his various education. After 30 years of being in operation, he became the owner and CEO of Lowcost Supermarket Inc. (Lowcost), a franchisee of a national food retailer. Lowcost owns a modern 3,500-square-metre superstore that generated more than $20 million in sales in the last fiscal year. Please see Appendix I contains excerpts from Lowcost's financial statements. Although he is still active and does not plan to retire, Mr. Tiwari has a daughter, Tejal, who is aspiring to follow in her father's footsteps. Moreover, new competitors are coming into the market, and Mr. Tiwari does not want to be left behind. Hence, he is currently considering two expansion options that would allow his daughter to prove herself: 1. Expand the existing store to make it a "destination" outlet that reaches a wider customer base. 2. Buy another store, Other Store Inc. (Other Store), in a neighbouring suburb that would be managed solely by Tejal. Today is February 2, 2020, and Mr. Tiwari has retained you, CPA, to assess the two options from both a quantitative and qualitative perspective. He has provided you with the critical assumptions underlying the expansion project (Appendix II) and the financial information on Other Store (Appendix III). He would like you to advise him on which option is the most attractive, in terms of both expected returns and risk levels. He would also like you to calculate and justify an appropriate discount rate that you will use for your quantitative analysis and to assess the appropriateness of the financing alternatives being proposed for each option. Appendix I Excerpts from Lowcost's financial statements Income Statement 12 months ended December 31 (in thousands of dollars) 2019 2018 2017 Net sales $20,260 $19,500 $18,750 Cost of goods sold 15,500 14,500 13,750 Gross profit 4,760 5,000 5,000 Operating expenses 3,250 3,100 3,000 EBITDA 1,510 1,900 2,000 Depreciation and amortization 450 500 650 Interest expense 100 100 100 Income before tax 960 1,300 1,250 Income tax 260 400 375 Profit/loss $700 $900 $875 Cash Flow Statement 12 months ended December 31 (in thousands of dollars) 2019 2018 2017 Operations: Cash flow from operations $1,150 $1,400 $1,525 Changes in non-cash working capital (75) (50) (125) Total cash from operating activities 1,075 1,350 1,400 Total cash from investing activities (250) (300) (250) Total cash from financing activities (100) (100) (100) Dividends (475) (850) (1,400) Change in cash 250 100 (350) Cash at beginning of period 100 350 Cash at end of period $350 $100 $0 Appendix II Critical assumptions underlying the expansion project The expansion project entails reconfiguring and updating the existing store and adding 2,000 square metres to its floor plan. The project would be complete by the end of 2020, and store operations would continue throughout the construction. Key estimates supplied by architects (in thousands of dollars) are as follows: Estimated cost of project (materials, labour, supplies, taxes) $8,000 Other key estimates provided by consultants (dollar amounts in thousands): Additional sales revenues in first full year of operations for new store (2021) $5,000 Annual sales growth rate for the four years following the first full year of expanded and reconfigured operations (2022-2025) applicable to total sales revenue* 10% Annual sales growth rate without expansion and reconfiguration 4% EBITDA margin (expected to remain at that level for the foreseeable future) 7,5% Expansion investment to be depreciated over 16 years on a straight-line basis (also for tax purposes) Income tax rate 30% Lowcost's bank has tentatively committed to providing a bridge loan convertible into a 20-year mortgage bearing interest at 6%, for up to $6,000. No repayment is due for the first five years. All the firm's long-term assets will be pledged as collateral to the mortgage, and Mr. Tiwari will personally guarantee the loan. $6,000 Currently, Lowcost has long-term assets with a book value of $5,000. Lowcost has a line of credit with $1.0 million of remaining borrowing capacity carrying an interest rate of prime plus 200 basis points (current prime rate is 5%). This credit line is unsecured. *Beyond 2025, sales growth is assumed to be approximately 4%. Future capital expenditures and investment in net working capital will be minimal. Mr. Tiwari expects his firm's return on equity to be 15% (2019 rate) and its long-term target capital structure to be 25% debt and 75% equity as at the end of 2019 (currently debt of $1.5 million and equity of $4.5 million). Mr. Tiwari will inject $1.0 million in the firm (in the form of equity) to get the project going as soon as possible. He believes that the proper time horizon for assessing the project is 16 years because he estimates that the store will need to be refurnished at that time; however, the cost will be much less than the original $8.0 million investment for the full expansion nstruction of the new floorplan. Appendix III Other Store Inc. Financial highlights Fiscal year ended December 31 (in thousands of dollars) 2019 2018 2017 Sales $10,000 $10,250 $10,500 Gross margin 2,000 2,100 2,200 Operating expenses 1,300 1,250 1,200 Depreciation 200 250 300 Earnings before income taxes 500 600 700 Income taxes 150 230 260 Net earnings $350 $370 $440 Cash from operations $600 $650 $750 Working capital $200 $250 $300 Long-term assets $0 $100 $200 Equity $200 $350 $500 The store occupies a wholly owned building of 2,250 square metres. The firm has no long-term debt. With an aging owner seeking to sell and retire, the firm has underinvested in recent years, paying out a significant portion of its cash flow as dividends. The existing assets are fully depreciated for tax and accounting purposes as at December 31, 2019. To update the store, bring it to the standards of the franchisor, and expand it to around 3,000 square metres, Mr. Tiwari estimates an investment of $4.0 million will be needed, which would be depreciated over 20 years for both tax and accounting purposes. Results for 2020 would be affected negatively by the rebranding, construction, and expansion, with sales going down to $9.0 million. However, annual sales growth of 25% is expected for 2021, 2022, and 2023, stabilizing at the long-term rate of economic growth of 3% afterward. Capital expenditures and investment in net working capital are expected to be minimal over the period. Bank financing terms would be similar to those of the store expansion project, with both stores being pledged. The investment's time horizon is 20 years, at which point the store will need to be updated but at a much lower cost than the original investment. Mr. Tiwari expects the store's EBITDA margin to be around 7.5% once the renovation and expansion is complete by the start of 2021. Food retail stores are typically sold for prices that range between five and seven times EBITDA. The owner is willing to sell the company for $3.3 million. Mr. Tiwari wonders if this price is in line with industry norms. The owner is also willing to finance the purchase, requiring 20% down with the balance due over 10 years in equal instalments. The interest rate would be 12% and would be secured by the underlying store assets and a personal guarantee from Mr. Tiwari.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

With Expansion Appendix I Excerpts from Lowcosts financial statements Income Statement 12 months ended December 31 in thousands of dollars 2025 2024 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6102a98a7a60a_84061.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started