Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Mr Van Rooyen is 41 years of age. He resigned from his present employer on 31 May of the current year. An amount

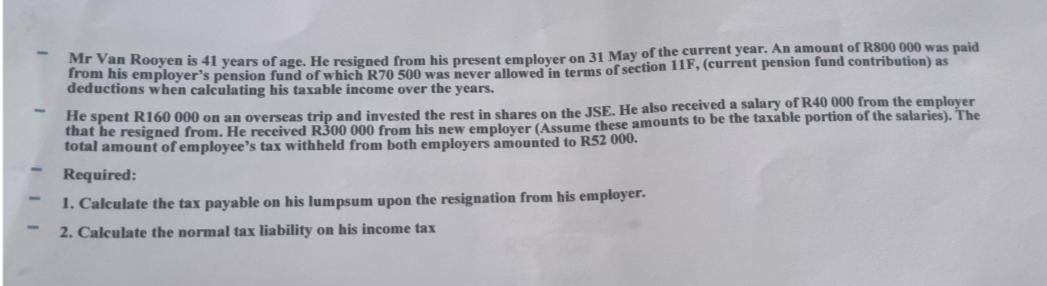

- Mr Van Rooyen is 41 years of age. He resigned from his present employer on 31 May of the current year. An amount of R800 000 was paid from his employer's pension fund of which R70 500 was never allowed in terms of section 11F, (current pension fund contribution) as deductions when calculating his taxable income over the years. He spent R160 000 on an overseas trip and invested the rest in shares on the JSE. He also received a salary of R40 000 from the employer that he resigned from. He received R300 000 from his new employer (Assume these amounts to be the taxable portion of the salaries). The total amount of employee's tax withheld from both employers amounted to R52 000. Required: 1. Calculate the tax payable on his lumpsum upon the resignation from his employer. 2. Calculate the normal tax liability on his income tax

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Tax Payable on Lumpsum upon Resignation The total lumpsum received by Mr Van Rooyen upon resignation was R800 000 Since the amount of R70 500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started