Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Ventura was on his way to deliver merchandise ordered by his customer when another driver lost control over his truck and rammed it

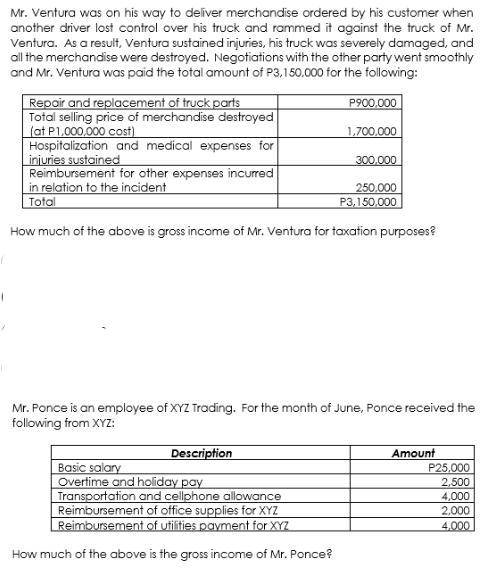

Mr. Ventura was on his way to deliver merchandise ordered by his customer when another driver lost control over his truck and rammed it against the truck of Mr. Ventura. As a result, Ventura sustained injuries, his truck was severely damaged, and all the merchandise were destroyed. Negotiations with the other party went smoothly and Mr. Ventura was paid the total amount of P3,150,000 for the following: Repair and replacement of truck parts Total selling price of merchandise destroyed (at P1,000,000 cost) Hospitalization and medical expenses for injuries sustained Reimbursement for other expenses incurred in relation to the incident Total P900,000 1,700,000 Description 300,000 How much of the above is gross income of Mr. Ventura for taxation purposes? Basic salary Overtime and holiday pay Transportation and cellphone allowance Reimbursement of office supplies for XYZ Reimbursement of utilities payment for XYZ How much of the above is the gross income of Mr. Ponce? 250,000 P3,150,000 Mr. Ponce is an employee of XYZ Trading. For the month of June, Ponce received the following from XYZ: Amount P25,000 2,500 4,000 2,000 4.000

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The gross income of Mr Ventura is Gross income Repair and replacemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started