Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Willem Malherbe is a South African resident. He is 55 years old. His wife passed away two years ago. All his children are

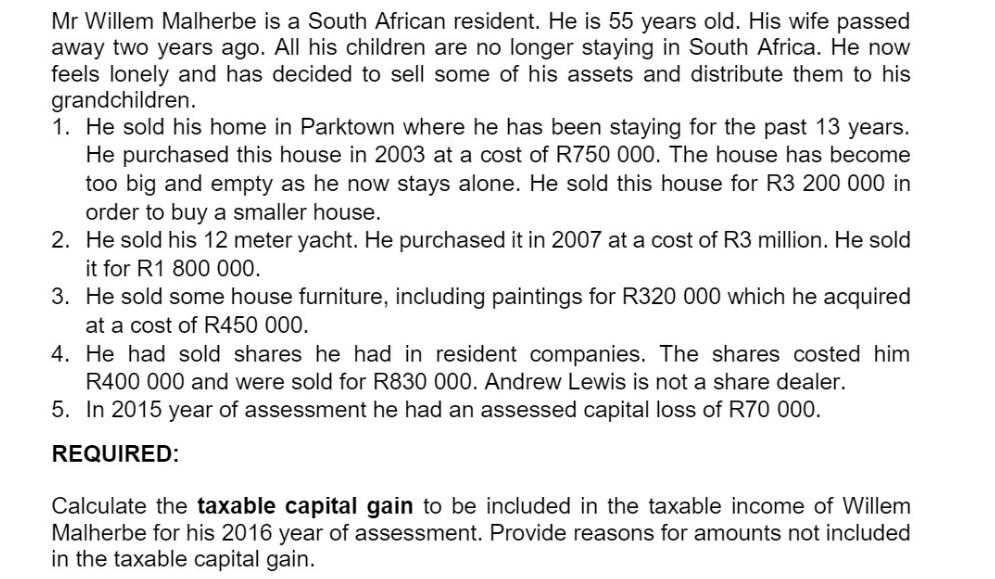

Mr Willem Malherbe is a South African resident. He is 55 years old. His wife passed away two years ago. All his children are no longer staying in South Africa. He now feels lonely and has decided to sell some of his assets and distribute them to his grandchildren. 1. He sold his home in Parktown where he has been staying for the past 13 years. He purchased this house in 2003 at a cost of R750 000. The house has become too big and empty as he now stays alone. He sold this house for R3 200 000 in order to buy a smaller house. 2. He sold his 12 meter yacht. He purchased it in 2007 at a cost of R3 million. He sold it for R1 800 000. 3. He sold some house furniture, including paintings for R320 000 which he acquired at a cost of R450 000. 4. He had sold shares he had in resident companies. The shares costed him R400 000 and were sold for R830 000. Andrew Lewis is not a share dealer. 5. In 2015 year of assessment he had an assessed capital loss of R70 000. REQUIRED: Calculate the taxable capital gain to be included in the taxable income of Willem Malherbe for his 2016 year of assessment. Provide reasons for amounts not included in the taxable capital gain.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the taxable capital gain for Willem Malherbe for his 2016 year of assessment we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started