Question

Mr. Wilson started tax services Wilson Tax Consultants with a capital investment of $50,000 on January 1, 2019 in the city of Buffalo. He provides

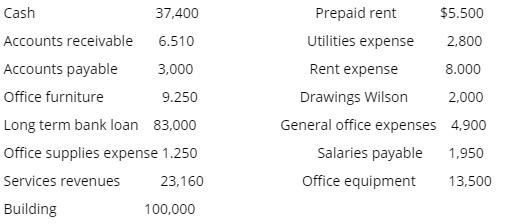

Mr. Wilson started tax services Wilson Tax Consultants with a capital investment of $50,000 on January 1, 2019 in the city of Buffalo. He provides you with the following accounting information for the year ended 31 December 2019.

Required

Using the above given information, prepare following financial statements for the Wilson Tax Consultants for the year ended December 31, 2019

a) Income Statement

b) Owner's Equity Statement

c) Classified Balance Sheet.

Cash 37,400 Prepaid rent $5.500 Accounts receivable 6.510 Utilities expense 2,800 Accounts payable 3,000 Rent expense 8.000 Office furniture 9.250 Drawings Wilson 2,000 Long term bank loan 83,000 General office expenses 4,900 Office supplies expense 1.250 Salaries payable 1,950 Services revenues 23,160 Office equipment 13,500 Building 100,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

15th edition

132554909, 978-0132554909

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App