Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Wong bought an apartment at a price of $7,000,000 on January 1, 2020. He borrowed 70% of the property value from Hang Seng

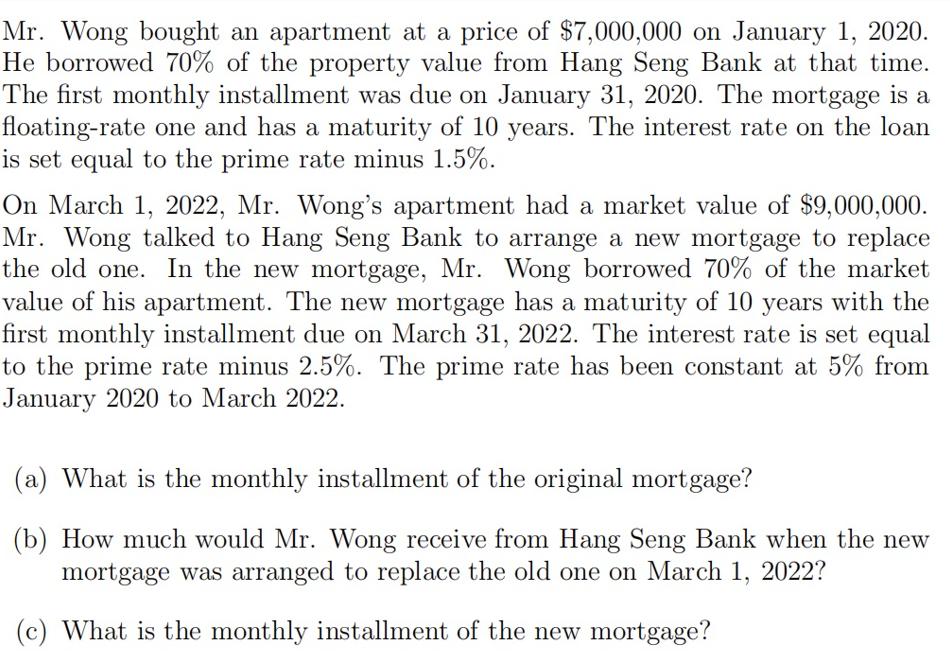

Mr. Wong bought an apartment at a price of $7,000,000 on January 1, 2020. He borrowed 70% of the property value from Hang Seng Bank at that time. The first monthly installment was due on January 31, 2020. The mortgage is a floating-rate one and has a maturity of 10 years. The interest rate on the loan is set equal to the prime rate minus 1.5%. On March 1, 2022, Mr. Wong's apartment had a market value of $9,000,000. Mr. Wong talked to Hang Seng Bank to arrange a new mortgage to replace the old one. In the new mortgage, Mr. Wong borrowed 70% of the market value of his apartment. The new mortgage has a maturity of 10 years with the first monthly installment due on March 31, 2022. The interest rate is set equal to the prime rate minus 2.5%. The prime rate has been constant at 5% from January 2020 to March 2022. (a) What is the monthly installment of the original mortgage? (b) How much would Mr. Wong receive from Hang Seng Bank when the new mortgage was arranged to replace the old one on March 1, 2022? (c) What is the monthly installment of the new mortgage?

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

SALARY INCOME MONTHLY ALARY 3800012 456000 LESS DEDUCTION OF MPF 5 22...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started