Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr. Wu has been employed by Animation Movie Limited as an art director in movie production for five years and his income has been

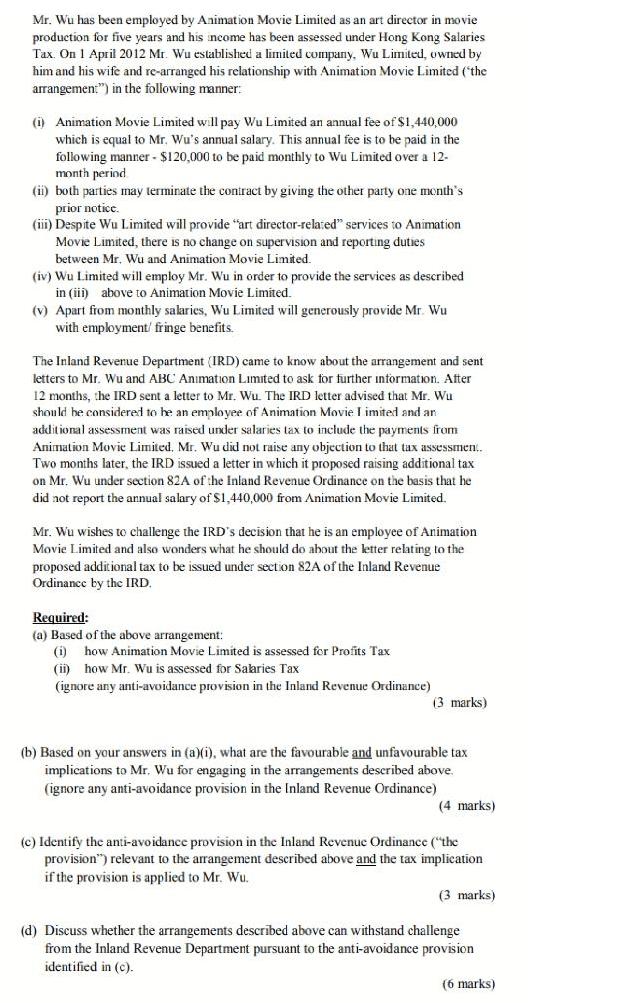

Mr. Wu has been employed by Animation Movie Limited as an art director in movie production for five years and his income has been assessed under Hong Kong Salaries Tax. On 1 April 2012 Mr. Wu established a limited company. Wu Limited, owned by him and his wife and re-arranged his relationship with Animation Movie Limited ("the arrangement") in the following manner: (i) Animation Movie Limited will pay Wu Limited an annual fee of $1,440,000 which is equal to Mr. Wu's annual salary. This annual fee is to be paid in the following manner - $120,000 to be paid monthly to Wu Limited over a 12- month period (ii) both parties may terminate the contract by giving the other party one month's prior notice. (iii) Despite Wu Limited will provide "art director-related" services to Animation Movie Limited, there is no change on supervision and reporting duties between Mr. Wu and Animation Movie Limited. (iv) Wu Limited will employ Mr. Wu in order to provide the services as described in (iii) above to Animation Movie Limited. (v) Apart from monthly salaries, Wu Limited will generously provide Mr. Wu with employment/ fringe benefits. The Inland Revenue Department (IRD) came to know about the arrangement and sent letters to Mr. Wu and ABC Animation Limited to ask for further information. After 12 months, the IRD sent a letter to Mr. Wu. The IRD letter advised that Mr. Wut should be considered to be an employee of Animation Movie I imited and an additional assessment was raised under salaries tax to include the payments from Animation Movie Limited. Mr. Wu did not raise any objection to that tax assessmen.. months later, the IRD issued a letter in which it proposed raising additional tax on Mr. Wu under section 82A of the Inland Revenue Ordinance on the basis that he did not report the annual salary of $1,440,000 from Animation Movie Limited. Mr. Wu wishes to challenge the IRD's decision that he is an employee of Animation Movie Limited and also wonders what he should do about the letter relating to the proposed additional tax to be issued under section 82A of the Inland Revenue Ordinance by the IRD. Required: (a) Based of the above arrangement: (i) how Animation Movie Limited is assessed for Profits Tax (ii) how Mr. Wu is assessed for Salaries Tax (ignore any anti-avoidance provision in the Inland Revenue Ordinance) (3 marks) (b) Based on your answers in (a)(i), what are the favourable and unfavourable tax implications to Mr. Wu for engaging in the arrangements described above. (ignore any anti-avoidance provision in the Inland Revenue Ordinance) (4 marks) (c) Identify the anti-avoidance provision in the Inland Revenue Ordinance ("the provision") relevant to the arrangement described above and the tax implication if the provision is applied to Mr. Wu. (3 marks) (d) Discuss whether the arrangements described above can withstand challenge from the Inland Revenue Department pursuant to the anti-avoidance provision identified in (c). (6 marks)

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

ai Animation Movie Limited is assessed for Profits Tax based on its income from the services it rece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started