Question

Mr. X, a Certified Public Accountant, renders tax and accounting services to ABC Corp. He was paid by the company the amount of P

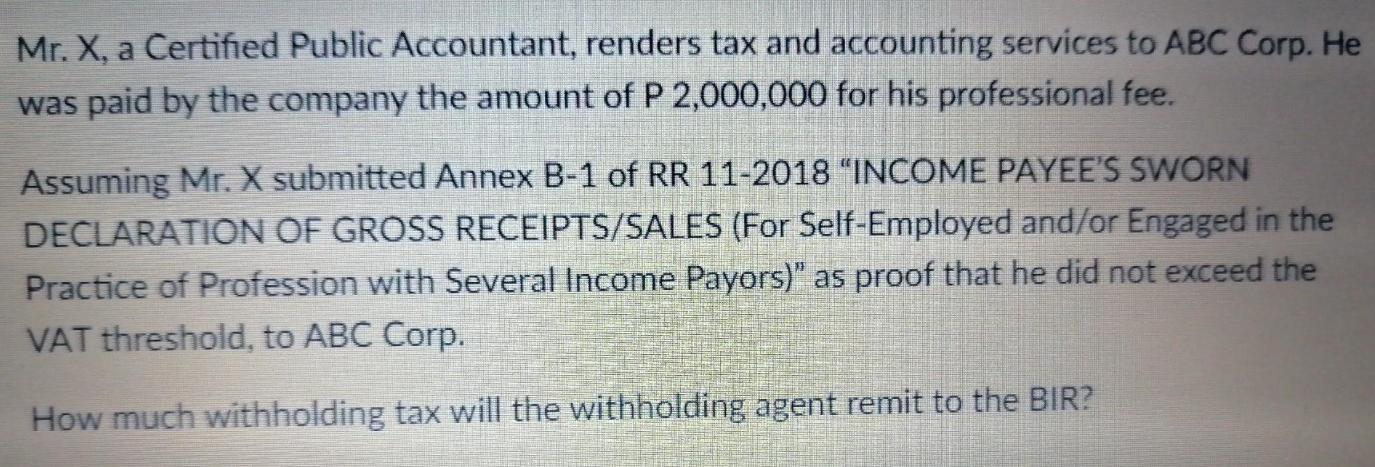

Mr. X, a Certified Public Accountant, renders tax and accounting services to ABC Corp. He was paid by the company the amount of P 2,000,000 for his professional fee. Assuming Mr. X submitted Annex B-1 of RR 11-2018 "INCOME PAYEE'S SWORN DECLARATION OF GROSS RECEIPTS/SALES (For Self-Employed and/or Engaged in the Practice of Profession with Several Income Payors)" as proof that he did not exceed the VAT threshold, to ABC Corp. How much withholding tax will the withholding agent remit to the BIR?

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Withholding Tax 30 Withholding tax amount P 200000030 P ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

16th edition

1118742974, 978-1118743201, 1118743202, 978-1118742976

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App