Answered step by step

Verified Expert Solution

Question

1 Approved Answer

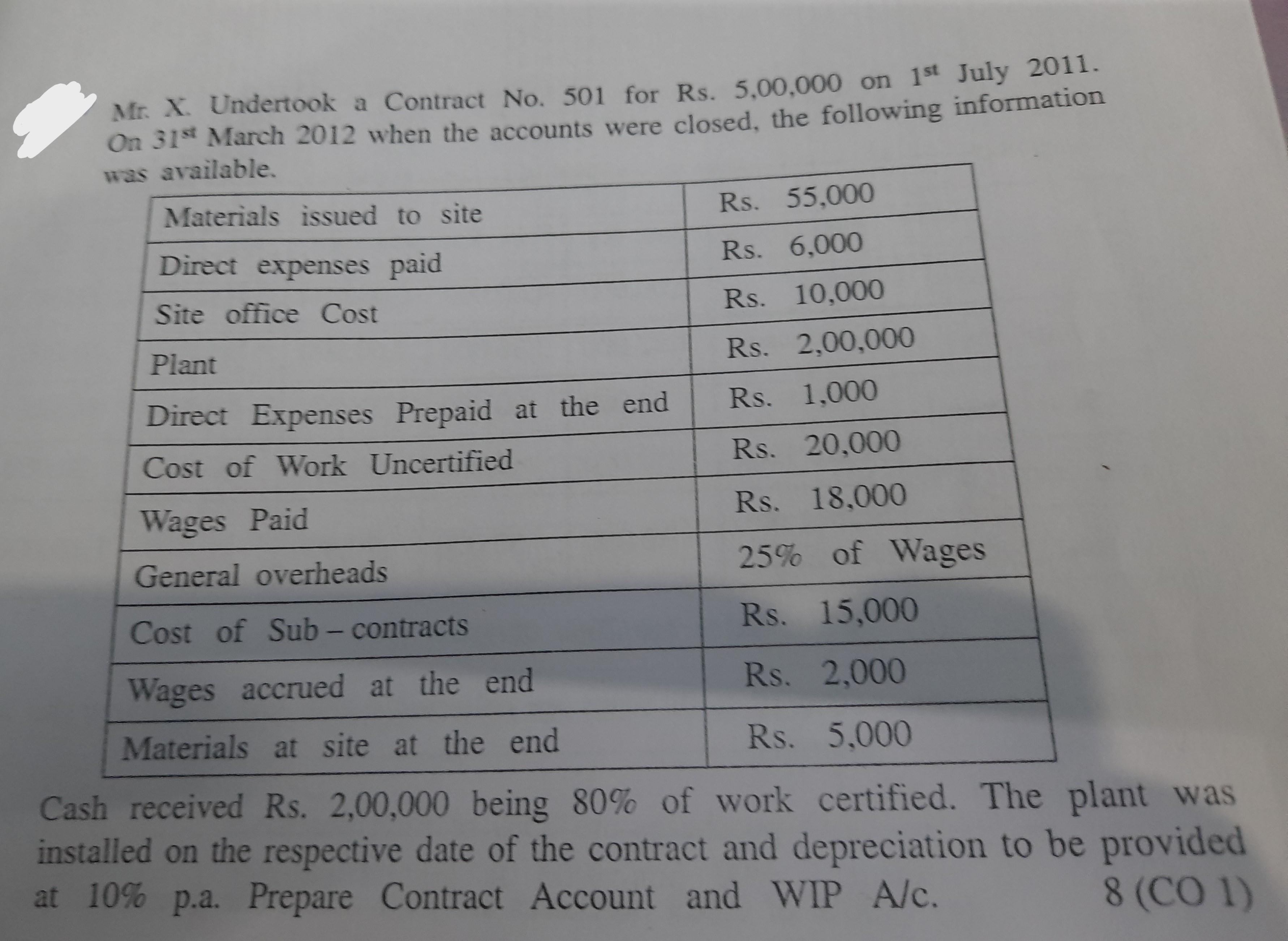

Mr. X. Undertook a Contract No. 501 for Rs. 5,00,000 on 1st July 2011. On 31st March 2012 when the accounts were closed, the

Mr. X. Undertook a Contract No. 501 for Rs. 5,00,000 on 1st July 2011. On 31st March 2012 when the accounts were closed, the following information was available. Materials issued to site Direct expenses paid Site office Cost Plant Direct Expenses Prepaid at the end Cost of Work Uncertified Wages Paid Rs. 55,000 Rs. 6,000 Rs. 10,000 Rs. 2,00,000 Rs. 1,000 Rs. 20,000 General overheads Cost of Sub-contracts Wages accrued at the end Materials at site at the end Rs. 18,000 25% of Wages Rs. 15,000 Rs. 2,000 Rs. 5,000 Cash received Rs. 2,00,000 being 80% of work certified. The plant was installed on the respective date of the contract and depreciation to be provided at 10% p.a. Prepare Contract Account and WIP A/c. 8 (CO 1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Contract account of Mr X for contract no 501 Particulars Amount Rs Particulars Amount Rs To Mat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started