Question

Mr. XYZ is negotiating to buy a parcel of property for his business. The seller of the property is asking for P1,700,000 for the property.

Mr. XYZ is negotiating to buy a parcel of property for his business. The seller of the property is asking for P1,700,000 for the property. The assessed value of the property for tax purposes of P 1,250,000. The property is presently insured by the owner for P 1,350,000. Mr. XYZ, originally offered the seller P 1,300,000 for the property. Mr. XYZ and the seller have agreed on a purchase price of P 1,500,000. Shortly after the purchase is made by Mr. XYZ, he is offered P 1,750,000 for the same property. At what price would Mr. XYZ record the property on the books of his business?

Ms. QWE began a business on April 1, 2021, contributing to the business the following assets: Cash, P 3,000,000; Office Supplies, P 275,000; Office Equipment, P 700,000; Furniture and Fixtures, P 2,100,000.

What is the total value of the assets that Ms. QWE contributed to the business?

Determine the value of Ms. QWE's ownership of the business.

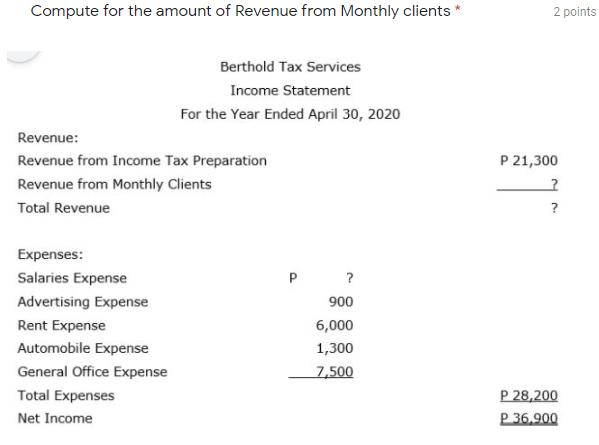

Compute for the amount of Revenue from Monthly clients * Berthold Tax Services Income Statement For the Year Ended April 30, 2020 Revenue: Revenue from Income Tax Preparation Revenue from Monthly Clients Total Revenue Expenses: Salaries Expense Advertising Expense Rent Expense Automobile Expense General Office Expense Total Expenses Net Income P ? 900 6,000 1,300 7,500 2 points P 21,300 2 ? P 28,200 P.36.900

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started